– Significant increase in ESS demand due to EU carbon emission reduction policy and energy price rise

– Expected to maintain a steady increase in line with the expansion of renewable energy

What is the cause of the rapid growth of the European energy storage system market?

To expand the use of green energy in accordance with the European Union's carbon emission reduction policy, EU member governments are investing in renewable energy production facilities and ESS development and installation. The ESS market is rapidly growing in line with the recent rise in energy prices due to the EU's energy policy. Gas prices soared by 2021% in less than a year from the beginning of 1 to the end of October due to the supply disruption of natural gas in Europe and the increase in energy consumption. In addition, due to the recent Russia-Ukraine crisis and the resulting European sanctions, Russian gas supply has plummeted, and a continuous price increase is inevitable. Accordingly, the demand for ESS (Energy Storage System) is increasing due to the efforts of the government and industry to stabilize energy prices by lowering the dependence on fossil fuels in the energy production field and increasing the use of green energy such as wind power and solar power generation. .

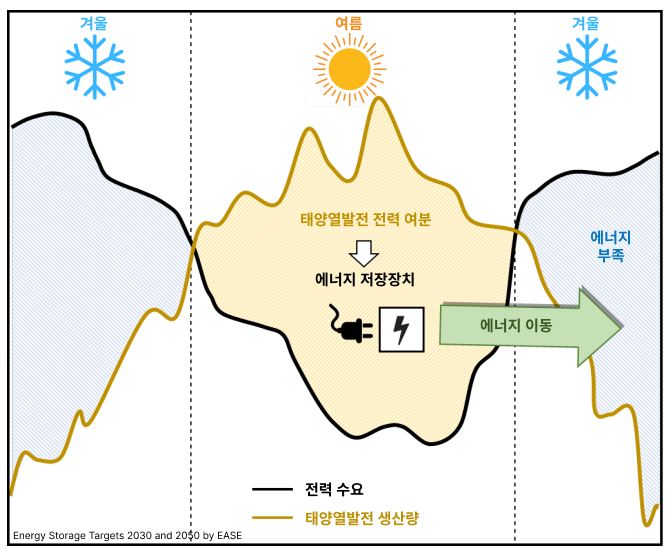

ESS is a device designed to store surplus energy for a long time when climatic conditions are good and use it when energy production falls due to unfavorable climate conditions. makes it possible One factor is that ESS facilities and installation costs have become cheaper due to the development of battery-related technology and the expansion of production facilities, and thus the interest of general companies and individual consumers in energy storage facilities has increased. The major countries leading the European ESS market, such as Germany, Italy, France, and Austria, are encouraging the installation of ESS, such as subsidizing the purchase and installation of industrial and home energy storage devices, and thus the market growth is expected to continue.

<Energy storage principle in renewable energy generation>

[Source: Energy Storage Targets 2030 and 2050 by European Association for Storage of Energy (EASE), translated by KOTRA Brussels Trade Center]

European ESS Market Trend

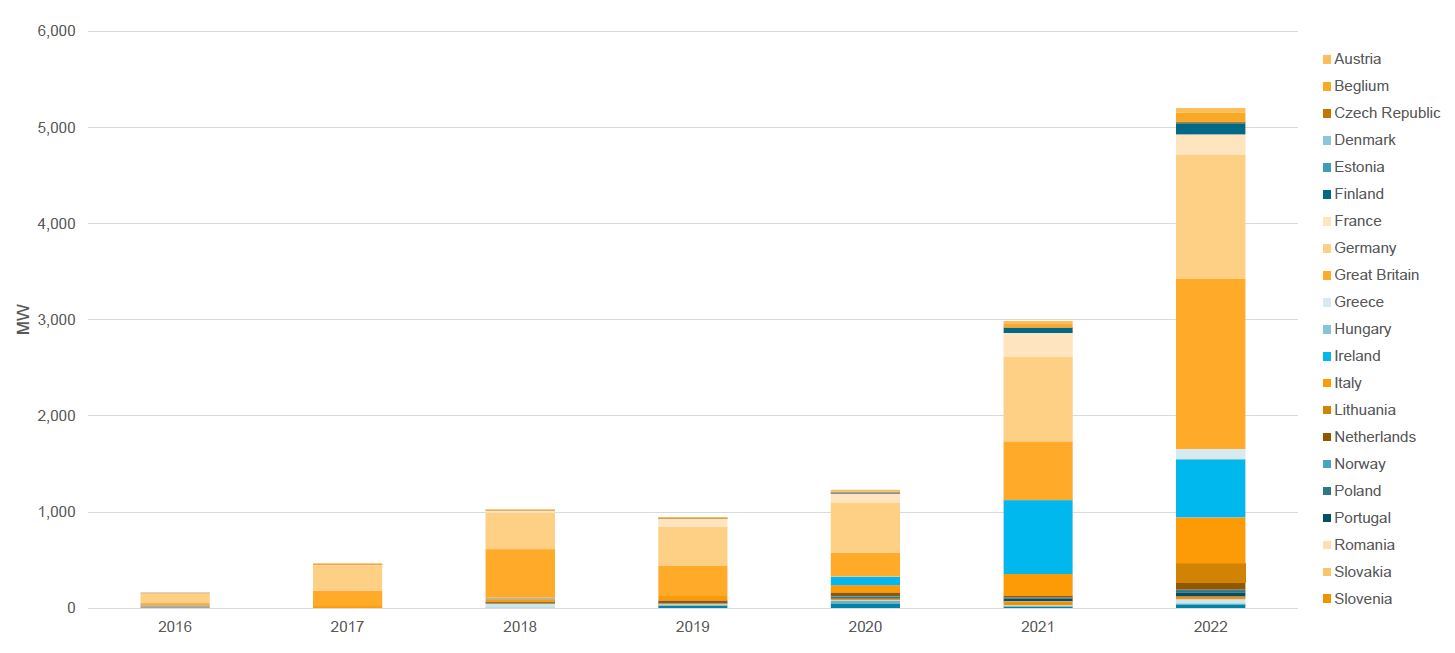

The ESS market is largely classified into power supply side and consumer side, and the consumer side can be further divided into household and industrial use. The ESS market for power supply companies to store electricity produced in renewable energy production facilities until it is sold to consumers has expanded by 2015% since 72.9, but in 2019 it suffered a temporary downturn due to delays in large projects related to renewable energy development. On the consumer side, household equipment continued to grow, growing 2015% between 2019 and 78.3, while business equipment grew 99% over the same period. According to the European Energy Storage Association (EASE) announcement in June, 6GW of new batteries were installed in 2022, and it is estimated that more than 5GW of battery capacity is in operation. By 10, the cumulative battery capacity is expected to be 2030GW. However, installation rates are expected to decline slightly in 57 and 2023 due to recent supply chain disruptions and raw material shortages.

<Annual battery installation status by European country>

(Unit: MW)

[Source: DELTA-EE (2022.6)]

The UK and Germany are the regions with the largest energy storage system market in the European market, followed by markets such as Ireland and Italy. In addition to this, the market value is high in that there are many business opportunities despite the small size as demand is rapidly increasing in the markets of other European countries such as Belgium and the Netherlands, which have small market sizes.

Current status of major companies in the European ESS market

Korean companies such as Samsung SDI and LG Chem, which are leading the European ESS market, and China's BYD are the top 3 companies, occupying 75% of the total market. Samsung SDI has a battery production base in Hungary and is in the process of expanding its production capacity by investing an additional KRW 1 trillion. LG Energy Solution is considering the construction of a second plant in Germany and Spain following the production facility in Poland. SK On (formerly SK Innovation) also has two production facilities in Hungary and has secured a site of 2 square meters to build an additional factory. As Korean companies are strengthening their position in the European market, Chinese and European companies are fiercely competing to take the lead in the market.

Future Prospects and Implications

As the recent Russia-Ukraine crisis caused major disruptions in energy supply and demand within the EU, the EU Commission announced the REPowerEU energy policy in May. The policy contains key targets for the rapid expansion of renewable energy, in particular designating a “go-to area” to increase renewable energy production and simplify facility installation permits. In this regard, Claude Chanson, general manager of RECHARGE, the European rechargeable and lithium battery industry association, told the Korea Trade Center as follows. “Given the current EU energy policy objectives and geopolitical factors, the battery market is expected to grow. However, in the current situation where the installation of renewable energy facilities is accelerating, the policy on batteries must also be considered. An expedited permitting process for battery manufacturing facilities is also needed to meet growing renewable energy projects and consumer demand.” As such, it is necessary to keep an eye on the response of the relevant EU while setting targets for energy storage devices.

It is also necessary to pay attention to the battery-related legislation. In March, the Sustainable Battery Regulations passed the Congress and the Board of Directors, and a three-way discussion is currently underway. This regulation is part of the European Green Deal, and compared to the 3 battery directive, sustainability and resource circulation elements such as eco-design, recycling and collection, and supply chain due diligence have been added. Companies seeking to enter the market can consider entering the market and collaborating by referring to the new battery regulation.

In a situation where preference for eco-friendly energy such as solar and wind power has increased, the demand for energy storage devices is also rising to provide a stable supply of energy demand, so the expansion of the ESS market is a natural step. As the demand for electric vehicles increases as well as energy generation, the reuse of batteries using used and used batteries of electric vehicles is expected to expand. ESS is in the spotlight as an example of reuse of waste batteries, and cooperation in the supply of related parts and materials and technologies and solutions can be explored. In addition, it is possible to try to enter the European market by cooperating with companies in the front and rear of the value chain through participation in local projects.

Sources: EASE (European Association for Storage of Energy), EURO BAT (European Union Battery Association), Energy Storage World Forum, EU Commission, Delta-EE