Goal to complete the relocation of the Presidential Palace by August 2024, plan to build an eco-friendly city

Government Announces Various Incentives According to New Water-Related Investments

There are many investors who expressed their intention to invest, but no investment has yet been realized amid concerns

After launching the Nusantara Authority (IKN) in March 2022, the Indonesian government is promoting the relocation project in earnest. The new capital Nusantara, which is being promoted with the goal of final completion in 3, has an area of 2045 hectares, four times larger than Jakarta, about three times larger than Singapore, and about 25 times larger than Seoul. The capital relocation project, which began to solve problems such as overpopulation (6000%) in Java Island, concentration of GDP (4%), and ground flooding, is now ambitious to secure new growth engines by attracting foreign investment from Indonesia and realize carbon neutral policy. It is being reborn as a cold plan.

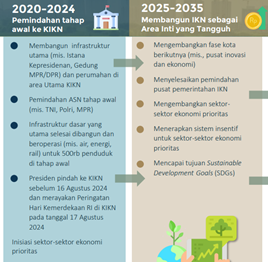

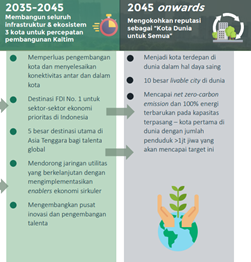

New capital relocation project timeline

The new capital relocation project is largely divided into four detailed plans.

<Four-step plan for relocation project to new capital in Indonesia (picture)>

[Source: Indonesia National Development Planning Department]

The Indonesian Ministry of National Development and Planning announced in a briefing on April 2023, 4 that the construction progress rate for major government administrative agencies (Presidential Palace, government ministries, etc.) is reaching 12%. However, considering the plan to complete the relocation of the Presidential Palace in time for Indonesia's Independence Day on August 26 next year, there are many evaluations that the schedule is very tight.

New capital is built as a future forest city

The concept of Indonesia's new capital is 'Future Smart Forest City'. Recently, the New Capital Authority of Indonesia announced through SNS of the Ministry of Public Housing that the new capital will become a carbon-neutral city in 21 with the concept of a sustainable smart rainforest city in the 2045st century.

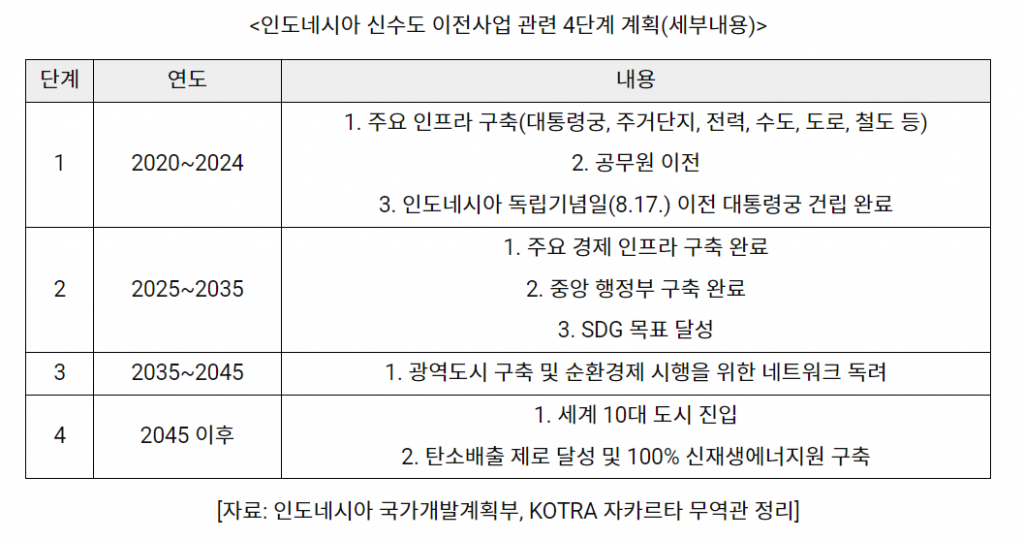

Provide incentives to attract foreign investment

Indonesia's new capital relocation project is a large-scale project costing about 340 billion dollars. It is noteworthy that the Indonesian government budget only accounts for about 20% of the total cost, and the remaining 80% is made up of private investment. Here, private investment includes foreign investment, and by 2045, cooperation with major countries will be expanded and foreign investment will be attracted to build a new engine for economic growth.

In March 2023, the Indonesian government announced incentives for investment in new water through Government Regulation No.3 of 2023. Incentives include tax benefits for corporate and personal income taxes, as well as benefits for foreign workers' residence and land.

First, if you invest more than 100 billion rupiah (approximately 9 million won, based on the exchange rate on May 1500, 2023) in Shinsudo, you can receive 5% corporate tax exemption, and the benefit period varies depending on the investment field and details. In particular, if you invest between 2 and 100 in infrastructure and public services designated as priority investment sectors, you will be eligible for corporate tax exemption for up to 2023 years. In addition, corporate tax exemption for up to 2030 years for investments in hotels and shopping malls and up to 30 years for investments in agriculture and fisheries is provided. In addition, if insurance companies, banks, and Islamic finance companies enter Shinsudo between 20 and 10, they can receive corporate tax exemption for up to 2023 years, and if they enter Shinsudo between 2035 and 25, they can receive corporate tax exemption for up to 2036 years. Other financial service providers will also be able to receive corporate tax reductions of up to 2045%. Even if a multinational company relocates its regional headquarters to the new capital, corporate tax exemption is provided for 20 years and a 85% reduction for an additional 10 years. Various R&D expenses can also be deducted, and customs duties can be waived if capital goods deemed necessary by the Indonesian government are imported.

In order to achieve the target of 190 million people, income tax for individuals working at businesses located in Shinsudo can be exempted for up to 30 years. In addition, a 10-year residence permit will be provided to attract foreign workers, while the obligation to pay a monthly fee of $100 to the Indonesian Ministry of Labor will be waived. The right to use land acquired for agricultural purposes in the new capital is granted for up to 95 years, and for commercial and residential buildings, the right to use can be obtained for up to 80 years.

A summary of the main points related to incentives is as follows.

The Indonesian government is committed to making progress on the capital relocation within the current President Joko Widodo's tenure (until November 2024). According to the recent government announcement, the progress rate has reached 26%, but the completion of the relocation of the presidential palace in August next year is very tight. According to CNN Indonesia's report on May 8, 2023, the Indonesian government announced that it had received letters of intent from 5 domestic and foreign investors by February, but none of the investments were realized yet.

The government believes that it is still experiencing difficulties because it has not yet prepared in detail how to acquire land when investing. On the corporate side, after the presidential election next year, there are concerns that the relocation project will be carried out as planned in the next government, so the actual investment is still insignificant. If you are considering investing in the relocation of the new capital, you should always pay attention to local trends and conduct a careful preliminary review as schedules and detailed plans may change due to local circumstances in Indonesia.