– The eastern region is the center of the new SOC project –

– In the field of artificial intelligence, the Beijing-Tianjin-Hebei region is strong –

Eastern region has the most new SOC projects

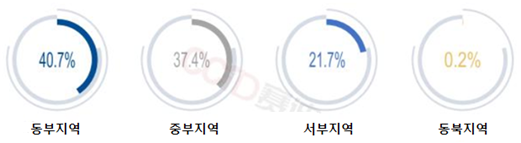

As of 2020, China's provincial-level key new infrastructure projects are distributed in 406 in the eastern region, 373 in the central region, 216 in the western region, and 2 in the northeast region. The percentage of project ownership in the eastern, central, western and northeast regions is 40.7%, 37.4%, 21.7%, and 0.2%, respectively.

Distribution of New SOC Projects in China

High-speed rail and rail transportation sales have a high share

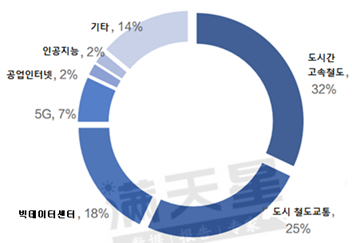

In detailed classification, intercity high-speed rail and urban rail transportation account for 57% of new SOC projects by region, and big data centers also account for 18%. Projects in this field are mainly concentrated in the central and western regions such as Guangdong, Henan, Hunan, and Sichuan, with 5G projects accounting for 7%, still in Guangdong and Zhejiang. It is concentrated in eastern regions such as Jiangsu and Jiangsu.

Types of New SOC Projects Existing in China

As for 5G base stations, the East Coast region is strong

5G is a key business of China's new SOC, and it has been announced that by 2020, Guangdong, Zhejiang and Jiangsu will build a total of more than 5 new 5G base stations. In terms of region, the eastern region has 2020 5G base stations in 28, accounting for 2000% of China's total target, taking first place. 49.8

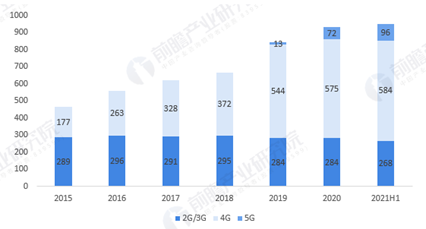

In 020, China built 5 72G base stations and 2021 in the first half of 96.

Number of mobile communication base stations in China in the first half of 2015-2021

(Unit: XNUMX pieces)

Data Centers Concentrate in 3 Cities

In September 2015, the first Big Data Comprehensive Pilot Zone was built, and Guizhou has now emerged as the most important data center base in China. As of 9, China's data centers are mainly concentrated in Jingjinji, Yangtze River Delta and Pearl River Delta cities, accounting for more than 2019% of the total market.

· Jingjin-ji (京津冀) city group: refers to the three districts of Beijing, Tianjin, and Hebei.

· Yangtze River Delta city group: 26 in total, including parts of Shanghai, Jiangsu, Zhejiang, and Anhui, located in the lower reaches of the Yangtze River in China means city.

· Pearl River Delta city group: Shenzhen and Guangzhou are located in the triangle formed by the flow of the West River, the North River, and the East River from the lower reaches of the Pearl River in China. , which means nine cities including Zhongshan.

China's data center IT investment was 2019 billion yuan in 3698 and is expected to reach 1000 billion yuan by 2025.

2018-2025 China Data Center IT Investment Size and Forecast

(Unit: billion yuan, %)

Industrial Internet construction is mainly concentrated in economically developed areas such as Beijing and Shanghai

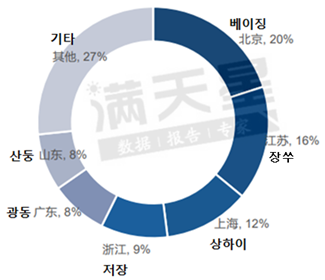

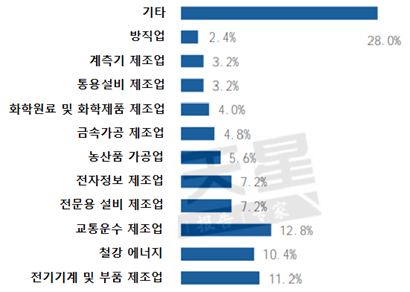

Looking at the industrial Internet platform, the provincial cities with a relatively large number of industrial Internet platforms are Beijing, Jiangsu, Shanghai, Zhejiang, Guangdong, and Shandong. Beijing has the upper hand in the development of industrial Internet platforms, with a large number of platforms, and many fields, such as construction equipment, petrochemicals, ships, and aerospace, are relatively well developed.

Industrial Internet platforms in regions such as Shandong, Shanghai, Guangdong, Zhejiang and Jiangsu are focused on the core industries of each region. For example, the platform will be nurtured based on the home appliance industry in Shandong and Guangdong, the steel industry in Shanghai, and the construction equipment industry in Jiangsu. Guangdong and Zhejiang have also built an industrial internet platform that transcends industries based on local ICT leaders.

China Industrial Internet Platform Location

Distribution of industries related to China's industrial internet platform

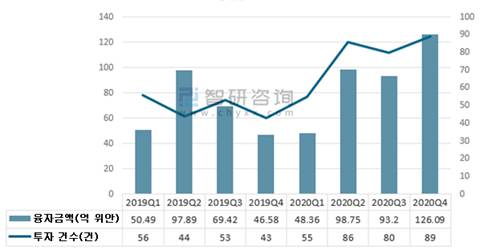

In 2020, the number of unlisted loans in China's industrial Internet industry reached 310, an increase of 58.2% over the previous year.

Amount and Number of Non-listed Loans for Industrial Internet of China in 2019-2020

(Unit: billion yuan, number of cases)

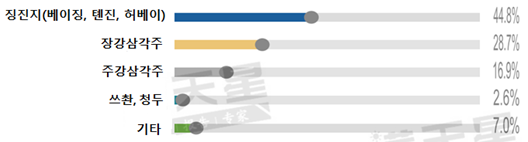

Clear comparative advantage of Beijing-Tianjin-Hebei in the field of artificial intelligence

Looking at the proportion of Chinese AI companies located in the region in 2019, AI companies in the Beijing-Tianjin-Hebei region accounted for 44.8% of the total, while those in the Yangtze River Delta region accounted for about 28.7%, and the Pearl River Delta and Sichuan-Chongqing regions each accounted for 16.9%. %, accounting for 2.6%. The reason why the AI development level of Beijing-Tianjin-Hebei is far ahead is that the related industries have been promoted relatively quickly. Beijing is the first city in China to be approved as a national next-generation artificial intelligence innovation development experimental park, and as the number of artificial intelligence enterprises and patents ranks first in the country every year, the industrial cluster of the entire Beijing-Tianjin-Hebei region has matured.

Regional Distribution Situation of Chinese AI Companies in 2019

Since 2014, the scale of Chinese AI industry loans has steadily expanded, reaching the highest level in 2018. In 2020, China's artificial intelligence industry loan scale is 1402 billion yuan.

Size of Chinese AI Industry Loans in 2014-2020

(Unit: billion yuan)

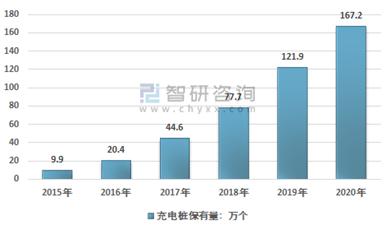

New Energy Vehicle Charger Market Rapid Growth

The scale of China's charging infrastructure construction continues to grow rapidly. In 2015, China's new energy car charger stock was only 9, but by December 9000, China's charger stock had already increased to 2020. With the development of China's new energy automobile industry, there will still be a large demand space in the future charger market.

2015-2020 China New Energy Car Charger Inventory

(Unit: XNUMX pieces)

Demand in the special high voltage equipment market is high

Electricity can be said to be the power source of the new SOC. The operation of technologies such as 5G, industrial Internet, data centers, and new energy vehicle chargers all require a power grid. The size of China's extra-high voltage equipment market increased from 2016 billion yuan in 996 to 2020 billion yuan in 1418. As investment in extra-high voltage projects increases, the size of China's extra-high voltage equipment market is expected to reach 2021 billion yuan in 1728.

2016-2021 China Extra-High Voltage Equipment Market Size

(Unit: billion yuan)

New SOC Construction that promotes digitalization of traditional industries

China's new SOC will accelerate the upgrade of traditional industries and promote productivity improvement in traditional industries such as manufacturing, agriculture, finance, energy, and logistics, thereby invoking an innovation paradigm. Such new SOC construction has great investment value. New SOCs such as 5G will be applied in fields such as social management, public service, education and medical care, and smart city, which will generate new consumption demand, promote economic growth, and expand efficient investment and information consumption.

Source: Sedi (赛迪), Ministry of Industry and Information Technology of China (中国工业及信息化部), Qianzhanwang (former 瞻网), China National Industrial Information Security Development Research Center, Jiyan Consulting (智研咨询), Sohu (搜狐) , iimedia, slander information (中商情报网) and KOTRA Qingdao Trade Center data synthesis