Chile, located on the opposite side of Korea, has a wide range of climates, from the Atacama Desert, the world's driest desert in the north, to the Patagonia Glacier in the south, as its territory stretches about 4,300 km from north to south between the Pacific Ocean and the Andes Mountains. It enjoys optimal conditions for development. In Chile, where we are familiar with copper, wine, and long territories, green hydrogen has recently been receiving a lot of attention.

The Chilean government has set a goal of being carbon neutral by 2050 in response to climate change, a global issue. With an ambitious plan to close all coal power plants by 2040 and achieve 2050% of the installed capacity of renewable power by 98, the vision is to emerge as a country that produces and exports green hydrogen, a clean fuel, based on vast renewable energy resources. was announced.

1. Chile’s Green Hydrogen Strategy

Chile's Ministry of Energy announced the “National Green Hydrogen Strategy” in November 2020 and is actively promoting it to attract investment. Minister of Energy and Ministry of Mining, Juan Carlos Jobet, attended the Korea-Pacific Alliance Green Economy Forum held in Korea on November 2021, 10 to explain the potential of Chilean green hydrogen, while also explaining the potential of Chilean low carbon It was also successful in signing a memorandum of understanding (MOU) for hydrogen cooperation.

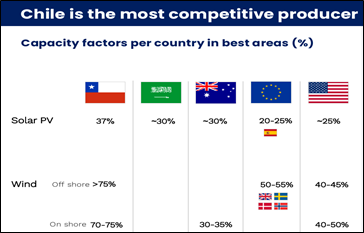

At the heart of Chile's green hydrogen strategy is its renewable energy production potential. The capacity factor of solar power generation facilities in the northern desert region of Chile is 37%, and the facility usage rate of onshore wind power generation in the south is 70~75%, which is similar to that of other countries with good renewable energy environments (Saudi, Australia, and the United States). etc.) is higher than

Comparison of Renewable Energy Usage Rate (Capacity Factor) by Country

Based on this, the unit cost of renewable energy is steadily decreasing. In the National Energy Commission (CNE) energy auction (auction) conducted this year, the average electricity purchase price was $23.78 per MWh, which is 2017% lower than the previous auction conducted in 27. In addition, after 2030, it is predicted that the Levelized Cost of Energy (LCOE) in northern Chile will be lower than $15 per MWh. The Ministry of Energy predicts that the Levelized Cost of Hydrogen (LCOH) will reach $2030, the lowest in the world, by 0.95 based on the competitive renewable energy generation cost.

Equalized cost of generation (LCOE) (left) and equalized cost of hydrogen (LCOH) (right)

In addition, the main goals of the national green hydrogen strategy are to attract USD 2025 billion in green hydrogen business investment by 50, install 5GW of water electrolysis facility capacity, produce 20 tons of hydrogen per year, and export USD 2030 billion in green hydrogen by 25. .

2. Chilean government's efforts to promote hydrogen business

As part of a specific action plan to achieve the goal after the establishment of the hydrogen strategy, the Chilean government raised a $5000 million fund by the Production Promotion Agency (CORFO) to promote investment and proposed a plan to utilize the state land for the hydrogen business. .

2.1 Execution of bidding for funding support from the Chilean Production Promotion Agency (Corfo)

On April 2021, 4, the Chilean Production Promotion Agency and the Ministry of Energy announced a tender for hydrogen business operators to revitalize the green hydrogen industry. Total funding is $21 million (up to $5 million per project). The main conditions for participating in the bidding are to have a water electrolysis facility of at least 3 MW or more, and to achieve COD (Commercial Operation Date) by December 10 at the latest along with hydrogen production.

The above bidding started accepting applications on September 2021, 9, and a total of 6 companies (Air Liquide, CAP, ENEL, ENGIE, GNL Quintero, etc.) submitted a bid proposal, and the evaluation is currently underway.

2.2 Hydrogen business development using state land

It is essential to secure a large-scale site for the installation of renewable energy facilities required at the first stage in the hydrogen business value chain. Whether solar or wind power, depending on the electrolysis capacity of the water, as little as a few thousand hectares to tens of thousands of hectares are required. Southern Chile has a favorable location for wind power and although there are large sites, most of them are privately owned.

On the other hand, the northern part of the desert is mostly state land, and the Chilean Ministry of National Assets is managing (lease/sale). You can participate in the bidding for the land lease announced by the Ministry of National Assets periodically, and if there is a site desired by a business operator, you can apply through the process of checking whether the lease is possible with the Ministry of State Assets. This is not possible and can only be secured through bidding participation.

However, on November 23rd, the Ministry of State Assets and Energy and the Ministry of Energy announced a resolution to make a direct concession without a bid except for the promotion of investment in the hydrogen business. The lease period is up to 40 years, and it is a requirement to install a water electrolysis facility of at least 20MW. On the other hand, it is possible to separately apply for a site for the installation of renewable energy production facilities, but it must be a site dedicated to supplying electricity necessary for the hydrogen project.

The Ministry of State Assets will accept applications for direct leasing agreements from operators from January 2022, 1 to January 3, 2022.

3. Chile Green Hydrogen Project Status

In Chile, various green hydrogen-related projects are being promoted mainly by private power generation companies. In order to reduce risks, most business operators divide their business into phase 1 (demonstration project) and phase 2 (commercialization project). According to a recent announcement by the Ministry of Energy, more than 40 projects are under development in Chile, and the list of major projects is as follows.

Chile Green Hydrogen Project Status

Currently, the Haru Oni phase 1 project is the only project connected to the start of construction. In addition, various types of hydrogen projects are being reviewed, such as a project for exporting green hydrogen and a project using hydrogen as truck fuel in the mining industry.

4. Implications

Despite the Chilean government's active publicity, related companies need to materialize Chile's green hydrogen-related policies before participating in the project. have to watch

In addition, it will not be easy to secure domestic demand in the short term at the level of Chile's industry. A number of projects currently under development are focusing on the production of green ammonia for export, and the Haru Oni Phase 1 project (Haru Oni PJT), which has begun construction, also produces eco-friendly gasoline (eGasoline) and imports it from Germany's Porche. . In order to secure price competitiveness of hydrogen, it is necessary to promote a business on a commercial scale, and finding a source outside Chile will be one of the challenges.

Nevertheless, Chile is the most politically, economically and socially stable country among Latin American countries, and the natural conditions for renewable energy development at competitive prices alone are enough for Korean companies to enter Chile for hydrogen production. I think.

Source: Ministry of Energy “National Green Hydrogen Strategy”, Ministry of Energy “Chile's Green Hydrogen Strategy and Investment Opportunities”, Ministry of National Assets “Resolution No. 595810”, the magazine “La revista Energética de Chile”.

※ Please note that this manuscript is information prepared by an external expert and is not an official opinion of KOTRA.