– Continued increase in the share of high-tech industries with a focus on software-related services

– The information and communication technology (ICT) industry continues to grow rapidly, while the pharmaceutical and aircraft manufacturing industries continue to decline

If industries are classified according to the degree of technology intensity, they can be broadly divided into high-tech industries, middle-high-tech industries, low-mid-high-tech industries, and low-tech industries. Israel's industry is developed mainly in high-tech industries. The high-tech industry is a pillar that has supported the national economy even in the midst of the global economic crisis and is a major driving force for economic growth.

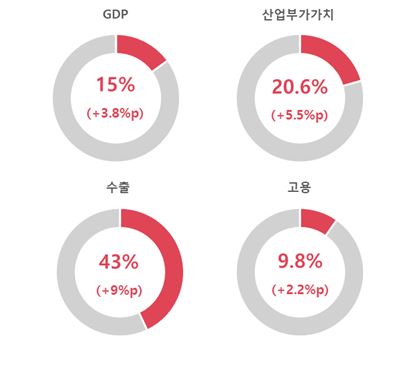

According to the Central Bank of Israel, high-tech industries accounted for 2020% of Israel's gross domestic product (GDP) in 15 and 20.6% of the total industrial value added. These figures are 2010%p and 3.8%p higher than in 5.5, respectively, indicating that the share of high-tech industries in Israel's economy is gradually increasing.

During the same period, the share of high-tech industry exports in total industry exports also increased surprisingly rapidly. As of 2020, the export share stood at 2010%, a 9%p increase from 43. Due to the narrow domestic market with a population of 940 million, most high-tech companies are export-oriented.

On the other hand, the size of employment did not increase significantly compared to the increase in added value or exports. As of 2020, the share of employment in the high-tech industry remained at 2010%, an increase of only 2.2%p from 9.8. However, the wage level has remained fairly high compared to other industries, and the rate of wage growth is steep. The average monthly wage (24,872 NIS) of workers in the high-tech industry is more than twice the average monthly wage of the industry as a whole (11,510 NIS). Also, over the past five years, the average wage in the high-tech industry has risen by 2%, while the average wage in the industry has risen by 5%. According to the Israel Innovation Agency, the total income tax of workers in the high-tech industry, which accounted for 20% of employment in 23.8, reached 2018% of the total income tax.

The share of high-tech industries in the Israeli economy as of 2020 and the rate of change compared to 2010

(Unit: %, %p)

If you look at the share of added value by industry in Israel's high-tech industry (as of 2019), you can see that the share of high-tech service industry is much higher than that of high-tech manufacturing. In particular, the software development and consulting industry, which has the largest added value, accounts for 57% of the high-tech industry, accounting for more than half. It is followed by computer, electronic, and optical device manufacturing with IBM at the top with 25%, and pure science and applied science R&D with 9%. The pharmaceutical manufacturing industry, which had driven Israel's export growth until the 2000s, recorded 2019% of the added value of the high-tech industry as of 4. Although the pharmaceutical industry has been on a downward trend in recent years, it remains one of Israel's major high-tech manufacturing industries. In addition, aircraft, spacecraft, and related parts manufacturing industries account for 3%, and data processing, storage, and related service industries account for 2%.

Looking at each business sector, it can be seen that the information and communication technology (ICT) sector occupies an absolute portion of the high-tech industry. Software development and consulting services, computer/electronic/optical device manufacturing, and data processing/storage/related services account for a whopping 84% of added value.

Share of added value by industry in high-tech industry as of 2019

(unit: %)

Looking at the distribution of startups by business sector, digital health (621 companies, 15%), smart mobility (508 companies, 12.3%), fintech (494 companies, 12%), clean tech (482 companies, 11.7%), agricultural technology Industry (431 companies, 10.4%) and cybersecurity (422 companies, 10.2%) are in order. Fintech and cybersecurity are the sectors where domestic investment is most active. It is interpreted as the effect that companies' digital transformation and digital payment received attention due to COVID-19.

Distribution of Israeli high-tech industry by sector as of 2020

(Unit: company)

Despite the COVID-19 crisis, Israel's high-tech industry recorded sound growth. The scale of added value in the high-tech industry grew by 2020% in 5.8 compared to the previous year, which is much higher than the average annual growth rate of 10% for the past 2010 years (2019-4). The size of employment in the high-tech industry also increased slightly by 0.6% compared to the previous year. As such, the growth trend of the overall high-tech industry has been strengthened, but the impact of the global economic crisis has been different for each industry. Unlike the information and communication technology industry, which has been booming due to COVID-19, the aircraft and spacecraft-related parts manufacturing industry is going through a cold season due to the rapid slowdown in demand in the aviation industry. In addition, the pharmaceutical manufacturing sector also left poor performance due to continued sluggish overseas business of Israel's largest pharmaceutical company, Teva.

Increase/decrease in value added by industry in Israel’s high-tech industry in 2020 compared to the previous year

(unit: %)

Israel's high-tech industry is driving domestic industrial production and export growth, driving national economic growth. Although there are differences by industry, overall, they showed a stable appearance in terms of employment and exports despite the global economic crisis caused by COVID-19. As the trend of introducing advanced technologies across industries is intensifying due to the corona virus, the growth of the high-tech industry, centered on the information and communication technology industry, is expected to continue. In addition, as most Israeli high-tech industry companies are export-oriented, the proportion of high-tech industry exports is expected to continue to expand in the future. This is expected to contribute significantly to the growth of Israel's foreign trade volume.

※ Please note that this manuscript is information prepared by an external expert and is not an official opinion of KOTRA.