India's drone parts industry attracting new attention

India Drone (Unmanned Aerial Vehicle) Market Trend

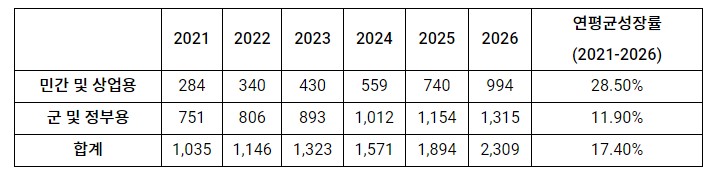

In 2014, India completely banned the use of civil drones (UAV: Unmanned Aerial Vehicle), slowing the development of the unmanned aerial vehicle market. However, it is emerging as a promising field as it was enacted in 2018 to institutionally enable the use of drones for private use, institutional maintenance in 2021, announcement of government support measures, and the recent February 2022 government budget proposal to apply drones to agriculture / land. . According to MarketsandMarkets data, the drone market in India is projected to reach $2 billion in 2022, with an average growth rate of 11% between 2021 and 2026. In particular, the private and commercial sectors are expected to grow by 17.4%. The Indian drone market is worth $28.5 billion worldwide by 2022, accounting for 11% of the total $249 billion.

<The size of the unmanned aerial vehicle (UAV) market in India>

(Unit: million dollars)

[Source: MarketsandMarkets]

Drones are being used not only for military purposes but also in various fields. Its use has increased in India in recent years, especially due to its wide range of functions, from simple photography to surveillance, road and rail route monitoring, and delivery of necessities/food to customers. In addition, as the COVID-19 outbreak spread, drones played various roles such as monitoring, disinfection, temperature measurement, and announcements. This has helped minimize the risk of spreading the virus, as well as helping to ensure the safety of medical staff and police personnel. As the Indian government expands drone-related infrastructure, drones are expected to be used in various fields such as agriculture, logistics (courier service, food delivery, etc.), and safety (criminal suppression, fire suppression, traffic accident detection, etc.), and related companies are rapidly increasing.

Main contents of government announcement “Drone Regulation 2021”

– Reduced licensing costs regardless of drone size

(Large drone license was 3,000 rupees (48,000 won), but all drone license costs were unified to 100 rupees (1,600 won))

– Revocation of pilot license for non-commercial micro/nano drones

– Relaxation of various approvals and certificates related to drone suitability, manufacturing, airworthiness, maintenance, import clearance, acquisition of existing drones, operator permits, R&D organization approvals and student remote control licenses

– Revocation of approvals such as unique authentication number, unique prototype identification number, etc.

– A type certificate and unique identification number are required only for drones operated in India, and drones imported or manufactured for export are exempted.

– Designate a separate corridor for cargo transportation

– Formation of drone promotion council for sound corporate communication

– Revocation of flight permit requirements of up to 400 feet in ‘green zones’ and up to 8 feet in areas ranging from 12 to 200 km around airports (green zones are airspace with a maximum vertical distance of 400 feet)

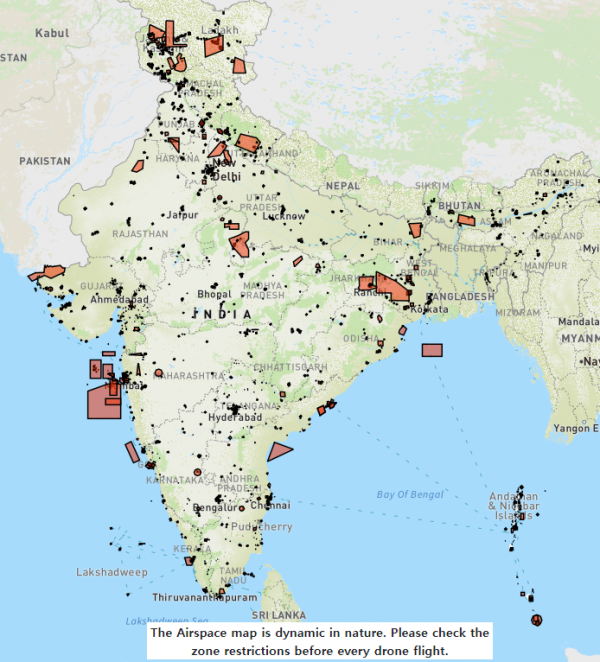

– Scheduled to launch a single digital sky platform related to drone operation. Operate interactive airspace maps on this platform and display red, green and yellow areas

– Easy transfer and deregistration of drones

– The maximum fine for violating laws/regulations has been lowered to 100,000 rupees (1,600,000 won)

– Improving the business environment for foreign companies to facilitate drone operation business in India

Indian Drone Market Opportunities

India's drone industry is relatively in its infancy, but the government is approaching it from an infrastructure point of view. The value chain of the drone industry is largely divided into hardware, software and services. As it is an early stage, there are many opportunities in the hardware field. However, as the Indian government decided to ban the import of finished products, it is necessary to focus on the parts sector. Major parts markets such as drone frames, sensors, engines, communications, batteries, and attachments are promising. Currently, India imports major parts from the US, Europe and China and assembles the final product in-house.

The Indian government is building and operating the Digital Sky Platform for drone use. It can be seen as a kind of highway in the sky.

[Source: digitalsky.dgca.gov.in direct capture (drone no-fly zone)]

According to local media (Business Standard) in February last year, drone-related start-ups increased by 2% after the announcement of new guidelines by the Indian government in August of last year, which is a much faster growth than the United States (8%) or Germany (34%) during the same period. seemed (9.7 drone startups in February 6.7, compared to 21 drone startups in August 8) except for dragons). And in August of last year, the Indian government announced PLI (Product Linked Incentive) support of 157 billion rupees (about 22 million dollars) for domestic production, predicting that more than 2 jobs will be created and investments of 211 billion rupees will occur.

Key drivers for the Indian drone market

The promising areas in India for the service sector are agriculture, logistics and safety. In particular, in the case of agriculture, it is included in the 2022 government budget under the project name Kisan Drone. Kisan Drone is a drone that can spray agricultural nutrients and pesticides in 5kg to 10kg unmanned tanks in 1 minutes on a 15-acre field. In addition, the basic gist is that drones transport vegetables, fruits, etc. from farms to markets, increasing profits for farmers. Garuda Aerospace said it would produce domestically produced drones at the level of 2 rupees (about 10,000 won) within the next two years, and predicted that it would contribute to the creation of new jobs. Government support covers up to 16% of the cost of agricultural drones. The government expects that it will be as active as tractors and cultivators on farms. The Directorate General of Civil Aviation (DGCA), a drone management agency, announced that as of February 75, 22, 2 drones were registered, and Omni Agri 9 (558kg) and Agribot UAV (01kg) drones are currently being used for agricultural purposes.

Tulasi Ram, co-founder of Aries Solutions Pvt, said that he mainly manufactures drones for agriculture and also deals with drones for mining and construction. It is receiving support from the Indian government's production-linked incentives (PLI) and various other government tax benefits. Currently, it procures major parts from China, Japan, Germany and the United States, but it aims to produce high-quality in-house drones in the future.

In addition, Pravin Prajapati, president of India's Indrones Solutions, is a provider of drone solutions for due diligence, mapping, inspection and monitoring. Currently, it is manufacturing drones for inspection and mapping of industrial sites, and it is said that it is receiving government support. He is very interested in a JV with a Korean company in India, and is currently importing motors, controllers, and batteries for drones.

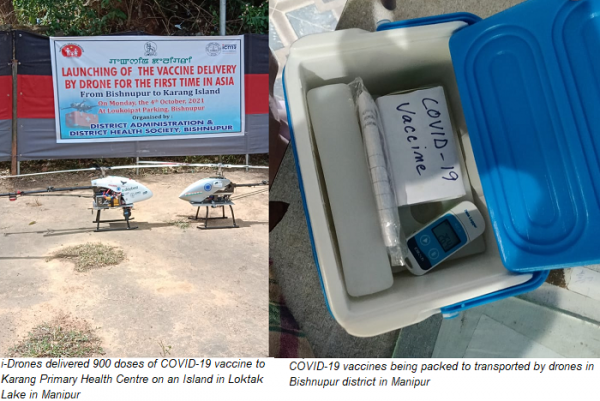

Drones are also expected to be actively used for food delivery, drug delivery, and crime-fighting. Indian food delivery company Swiggy said in collaboration with ANRA Technologies that it has successfully conducted more than 352 hours of flight time and more than 100 km of local test flights using 1,100 drones. It was conducted through ANRA's SmartSkies CTR and SmartSkies Delivery platform, and test flights were conducted in Punjab and Uttar Pradesh.

[Source: The Indian Talks]

WHO announced that it has succeeded in delivering a coronavirus vaccine to the islands and mountainous regions of India using drones in October of '21

[Source: WHO]

Gujarat state police announced in January that they had used drones to uncover nine illegal liquor distilleries and arrested 1 people. Illegal liquor makers are mainly located in rough mountains and near rivers, so it is not easy to move and find them. The National Police Agency said drones will be used in other crime-fighting activities as well. Gujarat, India is an alcohol-forbidden state.

[Source: The Indian Express]

Import Trends and Tariff Rates

Income Trend

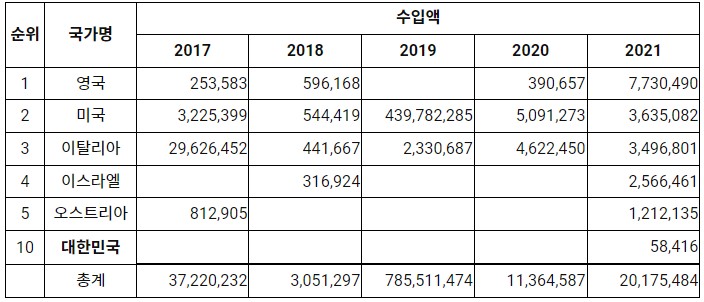

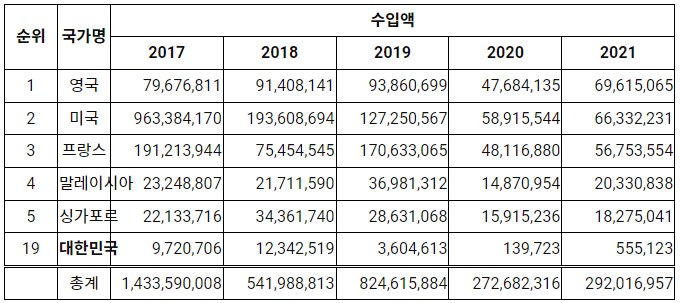

<Indian drone (HS Code 880220) import trend>

(Unit: US$)

[Source: Global Trade Atlas]

<Trend of import of drone parts (HS Code 8803) in India>

(Unit: US$)

[Source: Global Trade Atlas]

The Indian government has banned the import of finished drones, including CBU/CKD/SKD forms (Notification No. 54/2015-2020-DGFT, February 22, 2). However, drones for research and defense/security purposes can be imported. It also announced that parts related to drones can be freely imported. Tariffs for each part need to be individually confirmed.

marketing plan

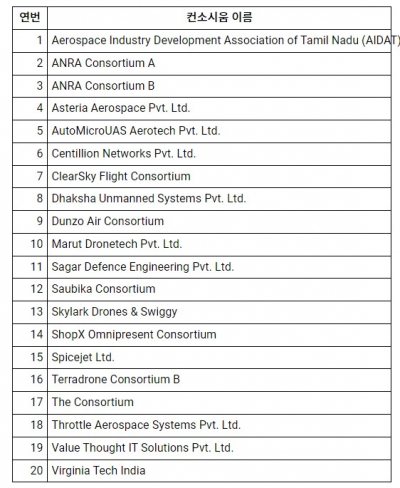

India's drone sector is focusing on domestic production following a series of government measures. The 5 BVLOS (Beyond Visual Line of Sight) drone operating consortiums approved by the government in May of last year are as follows, and one way to develop the Indian market is to cooperate with the companies.

[Source: Ministry of Civil Aviation (https://pib.gov.in/PressReleasePage.aspx?PRID=1716085)]

implication

The drone industry in India is still in its infancy but is showing strong growth. In particular, as the application field of drones enters daily life in the defense/security field, the ripple effect is expected to be greater. One of the sectors to focus on in India is agriculture. In 2021, the agricultural industry accounted for 18.8% of India's national gross value added (GVA). In addition, agriculture is always included in the national budget as an inclusive policy. This is because the government decided that it was important to nurture the industry while blocking the import of finished drones in an exceptional way. Due to the corona virus, the use of drones has become very diverse. From logistics such as delivery to police support for the safety of citizens, and use for fire suppression in high-rise buildings, the fields of application in the future are endless. This is a good opportunity for Korean companies to start from the hardware field of drones in India and go all the way to the service field.

Source: Comprehensive trade office data including MarketsandMarkets, IBEF, CNBC, DGCA, Business Standard, Live Mint, The Indian Talks, WHO, Indian Express, GTA and in-person interviews