– In the United States, large cargo trucks are a key means of logistics and transportation

– Self-driving trucks will bring changes in logistics and distribution

In the United States, the race to develop autonomous truck technology is in full swing. The U.S. has a large land area, so large cargo trucks are a key means of logistics and transportation. With the rapid growth of e-commerce, the market can place orders regardless of physical limitations such as cargo handling capacity, traffic problems, human permissible driving time, and logistics disturbances. They demand faster service from to delivery. If a truck equipped with fully autonomous driving technology that can operate XNUMX/XNUMX without a driver appears, it is expected to bring about a major change in logistics and distribution in the future.

major American trucking companies

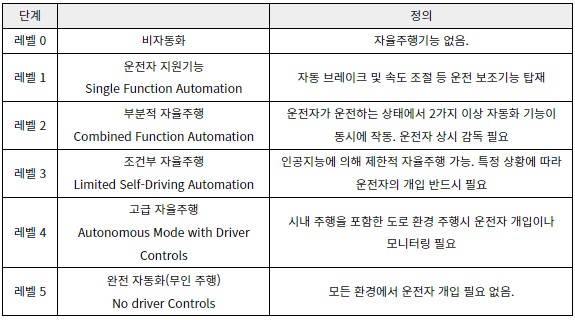

To use autonomous trucks in cities, accurate recognition and analysis of geographic, static, and dynamic traffic environment information is required. Currently, the autonomous driving truck technology in the United States corresponds to Level 4 of the International Society of Automotive Engineers (SAE) standards. Level 4 is the stage where fully autonomous driving is possible, and the system takes full control of all functions of the vehicle. However, it cannot operate in an environment in which the system is not designed to work. Currently, autonomous driving is possible only in controlled environments, such as highways, industrial roads, and low-traffic areas.

Due to the nature of the vast territory, the proportion of straight sections of highways is high in the United States. Therefore, the highway driving environment is generally more monotonous than city driving. If the data of the logistics base located on the highway is completely systematized, the logistics truck will be able to do a significant part of Level 4 autonomous driving without driver intervention. Currently, major US autonomous driving technology companies include TuSimple, Waymo, Aurora, Plus, Torc Robotics, Embark Trucks, Kodiak Robotics and Locomotion.

[Source: SAE]

Main company 1: TuSimple

TuSimple is a San Diego-based Chinese autonomous truck technology company founded in 2015 with initial investments from Nvidia, UPS and Navistar. It is also the first self-driving startup to be listed on the NASDAQ in the US. TuSimple is working to realize Level 4 long-distance autonomous cargo transportation between logistics bases. It has already tested more than 8500 million miles along 460 mapped routes and holds 318 patents on autonomous truck technology.

TuSimple is also a company that has attracted many collaborations with companies based on strong technology and capital. TuSimple's position in the development of autonomous trucks is quite large, and it is well positioned to secure significant market share in the US market in the future. It has partnerships with heavy truck manufacturers such as Navistar and Traton. It also has partnerships with auto parts suppliers such as Wabco and Knorr-Bremse, and also has partnerships with the US Postal Service, US Postal Service, including logistics companies UPS, DHL, and Ryder. In December 2021, it signed a contract to supply 4 autonomous driving (level 100) trucks with DHL.

In December 2021, it succeeded in autonomous driving of a Class 8 truck without human intervention for the first time in the industry. TuSimple's unmanned Class 8 truck is said to be in mass production by 2025.

<American Truck Classification>

(Unit: Lbs)

[Source: US Department of Energy]

Key Companies 2: Waymo

Founded in 2009, Waymo is a California-based self-driving vehicle developer and subsidiary of Alphabet (Google's parent company). Waymo started as a self-driving venture for passenger cars and expanded its business to include autonomous driving for cargo transportation. Waymo's self-driving truck program focuses on the final destination portion of long-haul trucking.

Waymo's autonomous driving software solution, Waymo Driver, has conducted more than 150 billion miles of simulated driving tests and more than 8 million miles of real-world driving tests, including Class 13 trucks, in more than 2000 states. Waymo's autonomous driving system, which includes lidar, radar, cameras, inertial measurement devices, and auxiliary sensor systems, can perceive the environment 300 meters ahead. All data collected while driving is stored in the Waymo cloud so that the system can continuously learn and apply. Recently, Waymo was reported to have conducted a six-week test drive service between Dallas and Houston UPS facilities with a Class 8 heavy-duty truck equipped with an autonomous driving system.

Waymo has partnered with Ryder for fleet management services, including maintenance, inspection and escort, and more recently with Daimler. We made initial plans for autonomous testing on Freightliner's trucks. It also has a partnership with logistics company JB Hunt.

[Source: Waymo website]

Key Companies 3: Aurora

Founded in 2017, Aurora is one of Pennsylvania-based autonomous driving technology companies. The Aurora has so far been tested with 450 million real miles and 60 billion virtual miles. The core of Aurora's autonomous driving technology consists of three main parts. Autonomous driving software, Aurora Computer that connects hardware and software, and sensors. The sensors include radar, camera and lidar for 3D implementation, and the vehicle's driving condition is monitored using Aurora Atlas HD software.

Aurora has partnered with more than half of U.S. truck manufacturers. It has signed contracts with major truck manufacturers such as Paccar, Toyota, and Volvo, as well as dealers such as Denso. In addition, it plans to conduct a pilot autonomous driving test with logistics company FedEx, and will apply Aurora's autonomous driving technology to a logistics truck equipped with Paccar's Autonomous Vehicle Platform (AVP).

Aurora has established a five-phase commercialization plan, in the order of laying the groundwork (5-2017), development and improvement (2020-2021), verification (2022-2022), release (2023-2023), and expansion (after 2024).

[Source: Aurora homepage]

Key Companies 4: Plus

Plus is a California-based autonomous truck technology company founded in 2016. It has received investments from US investment firm Sequoia Capital, Chinese automakers SAIC and FAW, etc. Plus is developing autonomous driving software for long-distance trucks with the goal of fully autonomous driving (level 2024) between logistics bases by 4.

Plus conducted its first tests of autonomous driving software along the US coast in 2019, and signed a contract to supply 2021 autonomous driving platforms to Amazon in 1000. The core technology of Plus is hardware such as sensors, actuators, and computing platforms, and AI algorithm software that makes decisions based on data collected through actual driving.

Currently, Plus holds more than 200 patents related to autonomous driving technology, and has technical partnerships with automobile manufacturers such as China's FAW and Europe's IVECO. Technical partnerships with American manufacturers have not yet been secured.

[Source: Plus website]

Key Player 5: Torc Robotics

Founded in 2005, Torc Robotics is a Virginia-based autonomous truck technology company. The company was acquired by Daimler in 2019, making it an independent subsidiary of Daimler. Torc Robotics exclusively provides Level 4 truck technology to Daimler.

Torc Robotics' autonomous driving system is divided into See (sensor), Think (prediction), and Action (safe driving). It started its first road tests in 2019, and is currently working with American truck maker Freightliner to test Gen4, a level 2 autonomous driving technology from Torc Robotics.

[Source: Torc Robotics]

Key Companies 6: Embark Trucks

Founded in 2016, Embark Trucks is a San Francisco-based autonomous trucking technology company. As of June 2021, Embark has developed 6 of the 16 key technologies essential to developing and commercializing fully autonomous trucks, with the remaining five due to be completed by 11. Embark's self-driving system consists of lidar, radar, and GPS systems, including control cameras capable of predicting situations up to 5 seconds later, reviewing simulations of up to 2023 scenarios per second, and with accuracy to within 60 cm.

Currently, Embark has partnerships with logistics companies such as Werner Enterprises, Mesilla Valley Transportation, Bison Transport and Anheuser Busch InBev.

[Source: Embark Trucks website]

Key Player 7: Kodiak Robotics

Founded in 2018, Kodiak Robotics is a Silicon Valley-based autonomous truck technology company. Kodiak Robotics has received investments from BMW i Ventures and Bridgestone. SK Group also invested in Kodiak Robotics.

Kodiak Robotics uses radar from ZF (Germany), lidar from Hesai (China), smart tire system technology from Bridgestone (Japan), and autonomous driving solution platform from Nvidia (USA). Here, the autonomous driving system is collectively managed through a self-recognition system called Kodiak Robotics.

Currently, Kodiak Robotics has no partnerships. In order to catch up with the commercialization progress of other autonomous driving technology companies, it is evaluated that the development speed must be increased and partnerships with logistics companies must be secured.

[Source: Kodiak Robotics website]

Key Companies 8: Locomotion

Founded in 2018, Locomotion is a Pittsburgh-based autonomous truck platooning technology company. Unlike other Level 4 autonomous driving technology companies, Locomotion is focused on developing platooning systems that can drive multiple vehicles simultaneously. Locomotion was founded by the Carnegie Mellon National Robotics Engineering Center and has expertise in autonomous vehicles, robotics, and AI. It also has a cooperative relationship with the Transportation Research Center.

Locomotion's main technology, Autonomous Relay Convoy, is a method in which a driver controls one truck, and the remaining 1-2 trucks use an autonomous driving system to move according to the operation of the driver's truck. However, platooning is still considered a level 3 level of technology, and it is known that a driver must be placed on all trucks for platooning.

Locomotion has partnered with diesel engine specialist Cummins to test, integrate and commercialize the technology. Locomotion has also partnered with logistics provider Wilson Logistics and will launch its first platooning logistics service this year.

[Source: Locomotion website]

implication

Until Level 5 trucks, which are in the fully autonomous driving stage, are commercialized, the demand for Level 4 autonomous driving trucks is expected to be high. Frost & Sullivan, an industry-specialized research firm, predicts that by 2030, Level 4 autonomous trucks will account for about 6.4% of U.S. general cargo volume, saving $47 billion in freight costs per year.

An official from a Chicago-based consulting firm said in an interview with KOTRA's Chicago Trade Office, "It is expected that level 4 or higher self-driving trucks will help build new logistics business models, such as usage-based on-demand services, in the cargo transportation industry."

Korean companies may consider establishing partnerships with major US autonomous driving technology companies. One of the reasons why American venture companies related to autonomous driving hardware were able to grow was because automakers such as Ford, BMW, and GM made bold investments and collaborations in autonomous driving companies.

In the autonomous driving field, both hardware and software technologies are evaluated as not lagging behind in technological prowess compared to foreign companies. Self-driving truck technology is also developing in Korea. Kakao Mobility introduced autonomous platooning technology under the supervision of the Korea Expressway Corporation, and Hyundai Motors successfully led the autonomous driving of cargo trucks on highways in 2018.