– The size of the electric vehicle market in Mexico has doubled compared to the previous year

Global companies are increasing their investment in the production of electric vehicles and related parts

Mexico Eco-friendly Vehicle Market Status

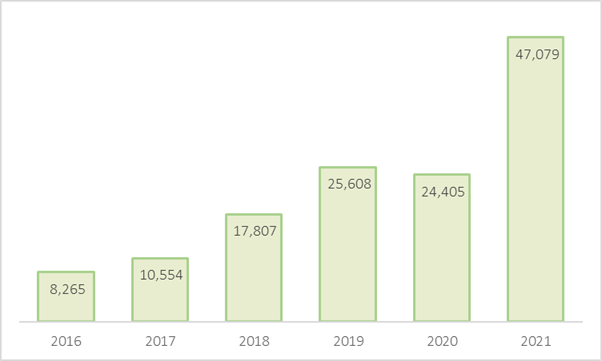

Mexican EV/Hybrid vehicle sales in 2021 were 47,079 units, an increase of 93% compared to the previous year. Considering that the total new car sales in 2021 is at the level of 101 million units, the proportion is very low, but the fact that the sales volume of eco-friendly vehicles has doubled is unusual. It seems that the perception of eco-friendly cars among local consumers is also changing. It is analyzed that the increase in oil prices was a major factor in the increase in the number of eco-friendly vehicles sold. Gasoline prices, from an average of 2020 pesos per liter in 18, will rise by 2021% to 20.06 pesos (about $1) per liter in 10, suggesting an increase in preference for electric and hybrid vehicles.

< 2016-2021 Electric/Hybrid Vehicle Sales Scale>

(Unit: unit)

[Source: Mexico Statistics Korea (INEGI)]

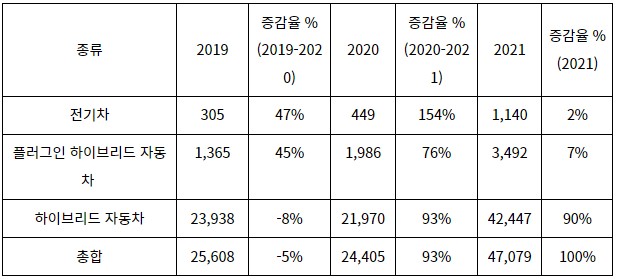

In 2021, the year-on-year increase in sales of eco-friendly vehicles was followed by hybrid vehicles (90%), plug-in hybrid vehicles (7%) and electric vehicles (2%).

< 2019-2021, sales volume by electric/hybrid vehicle model>

(Unit: unit)

[Source: Mexico Statistics Korea (INEGI)]

Reasonable price seems to be the biggest factor in increasing sales volume. The price of eco-friendly vehicles recently released is 44 pesos (about $2) for hybrid cars and 2,000 pesos (about $60) for electric vehicles, which is believed to be much lower than in the past. In particular, the recently released Chinese electric vehicle model is being sold for 3 pesos (about 43 dollars), increasing accessibility to electric vehicles.

Electric Vehicle (EV) Production Status

Global OEMs and Tier 1 companies are expected to expand EV production in Mexico. The factory structure is changing from the existing internal combustion vehicle production structure to an electric vehicle production structure, or a new electric vehicle production line is being built. This appears to have largely contributed to the increase in regional production and sourcing demand following the entry into force of the USMCA Agreement, as well as low logistics costs and minimization of logistics risks.

Ford

Ford Motor has been producing its own model, the Mustang Mach-E, since 2020, and is operating the first electric vehicle production plant in Mexico. Starting in 2020, it produces about 305 cars every day, and as of April 2022, a total of 4 Mustang Mach-E models were produced and exported to more than 60,988 countries. Ford remodeled 20% of its production line to produce the Mustang Mach-E model and applied the 80th industry method.

Giant Motors

The electric vehicle plant in Sahagún, Hidalgo, operated by Giant Motors Latinoameria (GML) has an annual production capacity of 4 units, and JAC's E SEI1 CARGO, E Sunray, and E X350 three electric vehicle models are available. are producing

BMW

The BMW Group established the first plug-in hybrid vehicle assembly plant in Mexico at its San Luis Potosi plant in 2020, where it produces the 330e model for the Australian market. As of 2022, the annual production scale is 5 units.

Zacua

Zacua was founded in 2018 with 100% Mexican capital. By establishing a factory in Puebla, the production scale is still small, but it plans to increase the production scale. Mexico is providing support in various ways to promote and attract investment for its first electric vehicle producer.

Investment Trends in Electric Vehicle Manufacturing Plants in Mexico

General Motors

In April 2021, the General Motors group announced plans to invest $4 billion in Ramos Arizpe to establish a plant in Mexico for the production of electric vehicles. GM's main production models are Chevrolet's Blazer and Equinox, and it aims to produce its first electric vehicle (EV) in 10.

Volvo Buses

Volvo Buses Mexico Corporation plans to produce electric buses using the recently developed BZL chassis at the Tultitlán plant in Mexico from the second quarter of 2022. Focusing on Mexico's zero carbon project, it is considering the possibility of expanding to Mexico, Guadalajara and Monterrey, starting with a metro bus in Mexico City, the capital city.

Although tax incentives related to the introduction of new technologies are lacking, he said that additional negotiations will be conducted with the federal government and state authorities on these incentives to secure investment incentives.

Link EV electric vehicle

In January 2022, Link EV announced plans to invest $1 million in Puebla State to build an electric vehicle assembly plant. It plans to supply mainly to Volkswagen and Audi. This plant is Link EV's first plant in the Americas. It plans to produce transport trucks and passenger cars and export them to South American countries such as Peru, Ecuador and Colombia.

Electric vehicle parts investment trend

LG Magna

In July 2021, the LG Magna e-Powertrain corporation was established, and in April 7, a plant to produce GM's electric vehicle parts was started in Mexico. This plant is the first overseas plant after the establishment of a joint venture between LG and Magna, and is expected to serve as an opportunity for LG Magna to establish itself as a key partner for electric vehicle parts in the North American finished car industry.

By 2023, a production plant with a total floor area of 2 (㎡) will be established in Ramos Arizpe to produce key parts such as drive motors and inverters for GM's next-generation electric vehicles.

POSCO International

POSCO International announced in December 2021 that the local production plant for drive motor cores in Mexico will begin construction in June 2022 in Ramos Arizpe, Coahuila, Mexico, with the goal of starting operation in the second half of 6. It will mainly be supplied to GM, Ford and Stellantis, and the initial production scale is 2023 units per year, and it is planned to gradually expand to 30 million units by 2030.

Grupo Industrial Satillo (GIS) GIS has announced that it will invest $3,000 million to expand its foundry production facility with Draxton of San Luis Potosi, Mexico. The production line is targeted for delivery in the fourth quarter of 2022, and it is expected to produce parts such as safety devices and key parts such as brackets and calipers for brake systems for electric and hybrid vehicles. Draxton currently has plants in six countries in Europe, Asia and North America.

Rassini Rassini is a Tier 1 company that supplies to leading OEMs such as Tesla, GM, Ford, Toyota, VW, Daimler, and Audi, and has been supplying brake discs to Tesla since 2016. It is investing 13 billion pesos (about $6,500 million) in the development and production of electric vehicle parts.

Next.e.GO Mobile SE

As a European electric vehicle and small mobile device producer, in May 2021, it announced its intention to establish a factory in Mexico. It is planned to be promoted as a cooperative project with the Quimmco Group located in Monterrey, and its main business model is the supply of e.GO vehicle parts in the Americas.

implication

Considering the advantages of USMCA and the strengths that can be utilized in the production of electric vehicles in North America, experts believe that investment in eco-friendly car production and related parts production will increase further in the future. The US investment in the Mexican auto parts industry in 2021 will total $23 billion, which is nearly three times higher than the previous year. Although there may be a base effect from COVID-2,500, it is analyzed that investment from major countries such as Germany, Japan, and Canada is also increasing.

As predicted before the USMCA took effect, industry insiders are of the opinion that an increase in sourcing demand for North American-based products is being realized, and that the proportion of overseas imports will gradually decrease. It is considered that it is time to review the strategic transition to local delivery by conducting preliminary research on areas where import items are expected to be reduced by local OEMs and Tier 1/2 buyers in Mexico in the future. According to an industry insider, inquiries about the establishment of new factories in Mexico, such as major industrial complexes, labor costs, electricity, logistics costs, and construction costs, are increasing significantly compared to the previous year.

KOTRA will hold a webinar to analyze trends in the automotive parts industry on May 5.19 (Korean time) to meet such demand for local expansion, and in parallel with this, it will hold an E/V Pinpoint Consultation from May 5 to 17. In addition to this, various webinars and offline events are being held by the Mexico Automobile Parts Industry Association and the Mexican Industrial Complex Association to attract local investment. It is recommended to obtain related information by utilizing various local events and use them to establish strategies for entering the local market.

Source: KOTRA Mexico City Trade Center (see attachment)

Source: Mexico Statistics Korea, BMW Group, Mexican daily El Universal, La Jornada, PT Mexico, Grupo T21, El Financiero, Solo Autos, Axis Negocios, El CEO, Expansión, Forbes, El Economista, Korean daily newspaper Korea Economic Daily, The Economist, etc. KOTRA Comprehensive data held by Mexico City Trade Center