– As of 2020, China’s share of the global surgical robot market is 5.1%, with high growth potential

– In laparoscopic surgery, which has the largest market share, foreign-funded companies were strong, but the proportion of localization is gradually increasing.

– ‘Smartization’, which combines AI technology and voice recognition technology with existing surgical robot hardware, is being introduced

A medical robot refers to a robot used for the purpose of medical assistance in medical institutions such as hospitals and clinics. Unlike simple medical devices, a medical robot refers to a robot that can be operated independently and can provide intelligent services. The medical robot operates according to the situation in the field, and through this, it assists the doctor and also helps to increase the medical capacity of the doctor. Medical robots are cutting-edge equipment that combines technologies from various disciplines such as medicine, mechanics, biomechanics, and computer engineering.

The advantage of medical robots over traditional medical personnel is that they are superior to humans in terms of patience, meticulousness, and accuracy. This is because medical robots do not accumulate fatigue and lose concentration or shake hands no matter how long they stand. As such, medical robots reduce the probability of medical accidents and sometimes reduce errors that may occur during surgery through pre-simulation surgery.

Market Status

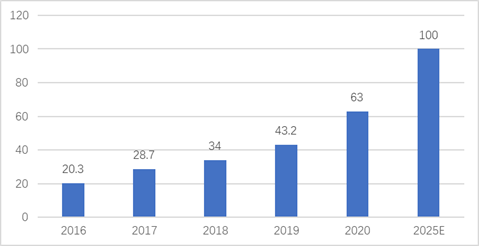

Based on these advantages of medical robots, the medical robot market is also growing rapidly in China. According to the International Robot Association (IFR), the size of China's smart medical robot market, which was 2019 billion yuan (about 43.2 billion won) in 8,287, is expected to exceed 2025 billion yuan (about 100 trillion won) by 1.9.

<China Smart Medical Robot Market Size in 2018-2025>

(Unit: billion yuan)

[Source: International Federation of Robotics (IFR), EqualOcean data synthesis]

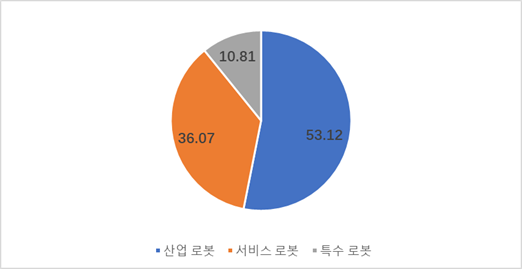

In China, robots are classified into industrial robots, service robots, and special robots according to their use and purpose. Medical robots fall into the category of dual service robots. According to data released by Zhiyan Consulting (智研咨询), as of 2021, the total robot market size in China is 839 billion yuan (about 16 trillion won), of which service robots account for 36.07% (about 302.6 billion yuan). to be. In particular, the service robot sector is expected to grow faster than other types due to the rapidly increasing demand for medical robots and logistics robots.

<Proportion by Type of China Robot Market in 2020>

[Source: Ziyen Consulting]

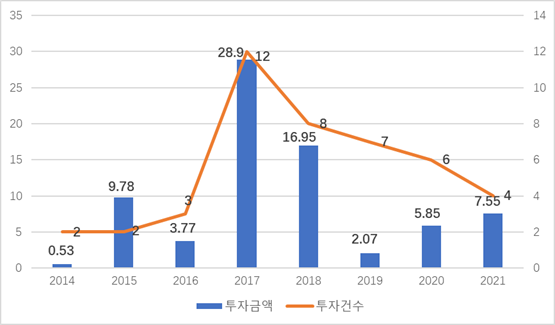

Investments in medical robots are also being made steadily. According to the Industrial Information Network, the cumulative number of investments and the amount of investment in the Chinese medical robot industry in 2014-2021 were 44 and 75.4 billion yuan (about 1.4 trillion won), respectively. In particular, in 2017, the number of investments and the amount of investments amounted to 12 and 28.9 billion yuan, respectively, making the largest number of investments during the same period. It was found that investment in the medical robot industry did not decrease significantly in 2020, when the corona virus began in earnest, and in 2021, when the corona virus was in full swing.

<Investment in China's medical robot industry in 2014-2021>

Unit: billion yuan, case)

[Source: Industrial Information Network]

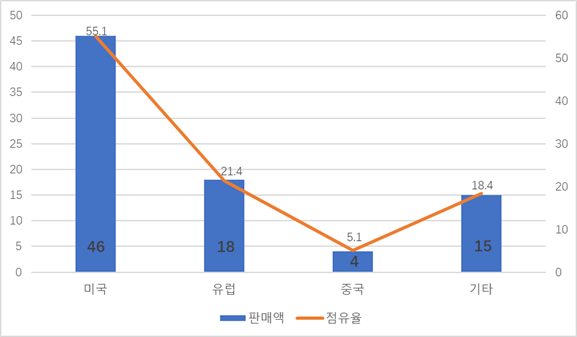

Specifically, as of September 2021, investment in surgical robots was the largest (9%), followed by rehabilitation robots (81%) and medical service robots (10%). According to cn-healthcare, a Chinese medical health research institute, the global surgical robot market size in 9 was $2020 billion, with the US, Europe, and China accounting for 8,321%, 55.1%, and 21.4% of the market, respectively. . Looking at surgical robots, laparoscopic surgery robots are the mainstay in China, as in other countries. In addition, there are bone joint surgery robots, Seldinger surgery robots, endoscopic surgery robots, and vascular surgery robots. Laparoscopic surgical robots, which are currently the most widely used surgical robots in China, have a market penetration rate of only 5.1% as of 2020. Considering that the US market penetration rate during the same period was 0.51%, the growth potential is very large.

<Global surgical robot market size and share in 2020>

(Unit: billion dollars, %)

[Source: Frost & Sullivan]

Related policies

The Chinese government, which declared the sophistication of Chinese manufacturing industry with “Made in China 2015” announced in 2025, has been steadily announcing policies for manufacturing advancement since then. The surgical robot industry is no exception. Looking at the 'Opinion on the Deep Convergence Development and Implementation of Advanced Manufacturing and Modern Service Industry' announced by the National Development and Reform Commission, which is in charge of overall planning and adjustment of the Chinese economy, the includes upgrading. Since 2015, policies for the development of medical robots have been announced almost every year. The '2021 Plan', which established the economic development plan from 2025 to 14.5, also contains the contents of smart surgical robots. As such, within the framework of the advancement of the overall manufacturing industry, China's will to develop medical robots can be seen.

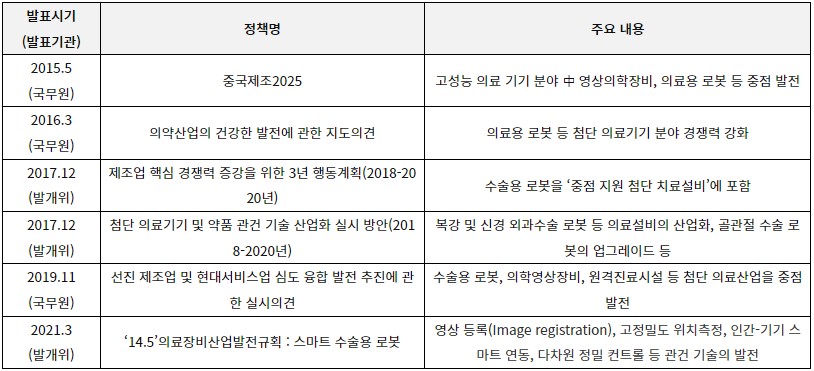

<China Medical Robot Related Policy>

[Source: Comprehensive KOTRA data such as the State Council of China and the Development Committee]

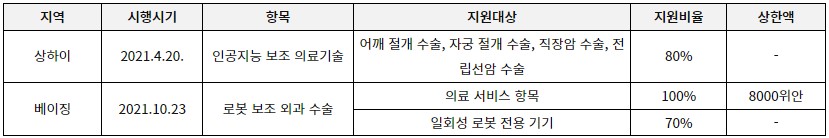

In addition, starting from Shanghai in 2021, as medical expenses for surgical robots are included in insurance, the demand for surgical robots is expected to grow further. The high price has been one of the factors that have made it difficult for surgical robots to become commonplace in China. For example, in the case of Intuitive Surgical's laparoscopic surgery robot, which is most used in China, the local price reaches 2000 million yuan (approximately 38 billion Korean won). If the operation is performed with a laparoscopic surgery robot, the patient will have to spend about 3 yuan more than the cost of traditional laparoscopic surgery. It is a burden for hospitals, but it is a bigger burden for patients who cannot be covered by medical insurance. However, from April 2021, Shanghai, from October, the cost of surgical robots in Beijing has been able to be received as insurance.

<Surgical Robot Medical Insurance Support Details>

[Source: cn-healthcare]

surgical robot market

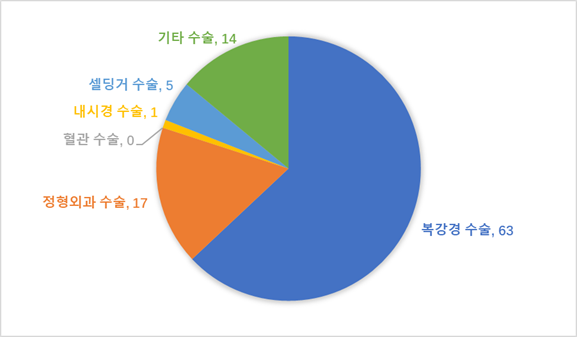

Types of medical robots are broadly divided into surgical robots, nursing robots, rehabilitation robots, service robots (transporting patients, manufacturing and delivering medicines, etc.), and medical assistants (diagnosing, prescribing, etc.) robots. Among them, the market for surgical robots is the largest. In 2020, the global surgical robot market size was $8,321 billion, of which laparoscopic surgical robots accounted for 63%. It is followed by orthopedic surgical robots (17%) and Seldinger robots/endoscopic robots/vascular robots (6%).

<Global Surgical Robot Market Size by Detailed Area in 2020>

(unit: %)

[Source: Frost & Sullivan]

China's surgical robot market penetration rate is very low compared to advanced countries such as the US and Europe. For example, in the case of laparoscopic surgical robots, the market penetration rate of the US in 2020 is 13.3%, while that of China is only 0.51%. In the case of orthopedic surgery robots, the market penetration rate of the US in 2020 is 7.6%, while that of China is only 0.03%. Therefore, the number of surgeries using surgical robots is very small compared to the number of the population. As of 2020, the number of surgeries using laparoscopic surgical robots and joint replacement surgery robots in China was only 47.4 and 234, respectively.

Looking at the Chinese market, as of 2020, laparoscopic surgical robots account for 75% of the total surgical robot market, and orthopedic surgery robots account for 10%. If you look at the purchase history of surgical robots in China in 2018-2021 on the Chinese government procurement website, laparoscopic surgery robots and orthopedic surgery robots were the main products, while neurosurgery robots were also sold little by little in 2020 and 2021.

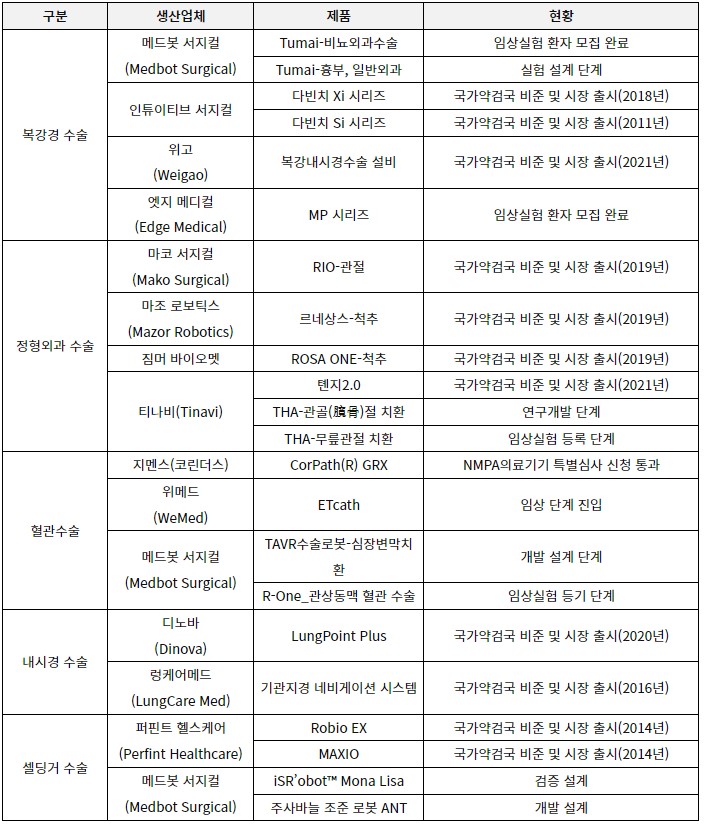

<Main surgical robot products>

[Source: cn-healthcare and each company's website]

competitive trend

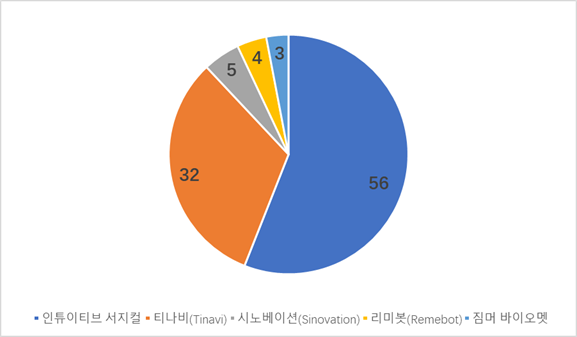

At present, laparoscopic surgery has the largest share in the surgical robot market in China. Orthopedic surgery and neurosurgery are the next largest. In the laparoscopic surgery field, Intuitive Surgical products are the most sold. As for laparoscopic surgical robots, Chinese domestic products are still in the clinical stage, so Intuitive Surgical products are almost monopolized. The price of Intuitive Surgical products is three to four times higher than those made in China, so it is far ahead of the total sales volume.

In orthopedic surgery products, Zimmer Biomet and China's Tinavi are doing well. However, recently, products from Mazor Robotics, Stryker, and MedTech are also entering the Chinese market, so fierce competition is expected. In the field of neurosurgery robots, products from Sinovation and Remebot are doing well.

Looking at the surgical robots purchased by China from 2018-2021 on the Chinese government procurement website by brand, Intuitive Surgical accounted for 56% of the total, followed by Tinabi (32%), Synovation (5%), and Remibot ( 4%), followed by Zimmer Biomet (3%).

<Share of surgical robot brands purchased in China in 2018-2021>

(unit: %)

[Source: Chinese government procurement website, cn-healthcare]

The health industry disclosed the clinical registration status of major companies as of 2021.

<Status of surgical robots in China as of 2021>

[Source: cn-healthcare]

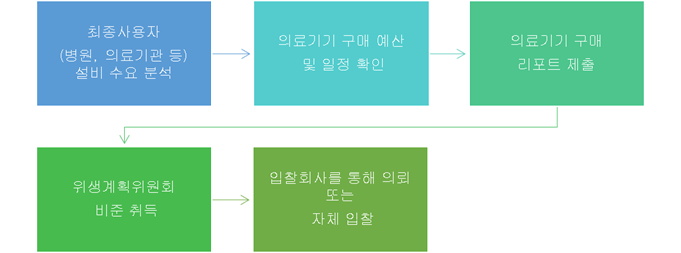

In China, the purchase of medical equipment (including surgical robots) is made through a bidding method. Hospitals, medical institutions, health examination centers, and clinics generally select the medical equipment they want to purchase through the following specialized bidding sites.

<Main bidding (procurement) sites in China>

[Source: KOTRA Dalian Trade Center]

<Chinese medical device bidding process>

[Source: KOTRA Dalian Trade Center]

Implications and Future Prospects

According to research and consulting firm Frost & Sullivan, the global market for surgical robots grew from $2015 billion in 30 to $2020 billion in 83, growing at a compound annual growth rate of 22.6%. By 2026, this figure is projected to grow to $336 billion. In the case of China, the market size from $2015 billion in 0.93 to $2020 million in 4.25 has grown at a compound annual growth rate of 35.7%. It has grown faster than the global growth rate. Frost & Sullivan predicts that the surgical robot market in China will grow to $2026 billion by 38.4, accounting for 11.4% of the global market share.

Currently, 'localization' and 'smartization' have emerged as major development directions in China's medical robot field. As capital is added to the advanced technology, many domestic products are already being sold in the fields of orthopedic surgery and neurosurgery. This trend is expected to accelerate as patents for some surgical robots expire soon. In addition, with the development of AI technology, the application fields of surgical robot products are becoming more and more diversified. For example, by applying a deep learning algorithm to an already developed surgical robot hardware platform to help surgeons remotely control it, innovations that have not been seen before are taking place.

On February 2 this year, the "19 China Medical Robot Industry Innovation Conference" was held in Shanghai. The innovation competition consisted of a total of 2022 seminars, 4 business reports, and discussions on industry-university investment research. Many doctors, professors, researchers, and investors from university hospitals, medical research institutes, medical robot centers, and investment companies from all over China attended. At the seminar, Yang Zhiwen (杨志文), an investment partner of Oriza Holdings, said, “Currently, the Chinese surgical robot market is like a blue ocean. Advanced companies will be able to grow rapidly with favorable financing conditions and localization policies.”

As such, China's surgical robot market is characterized by the rapidly developing technological prowess and thick capital of its own companies, a significantly lower market penetration rate for surgical robots compared to advanced countries, policies to encourage the development of advanced medical devices in China, medical expenditure per capita that increases every year, and a small number of medical personnel compared to the population. On the other hand, as it appears that there is a shortage of manpower and facilities in the medical field in China due to Corona 19, the demand for the medical robot market in China is expected to grow solidly in the future.

Source: International Robot Association (IFR), Qianzan Industrial Research Institute (former 瞻产业研究院), Zhiyan Consulting (智妍咨询), Industrial Information Network (产业信息网), Health Industry (健康界), Frost & Sullivan, DMK Korea), EqualOcean (亿欧网), LeiPhone and KOTRA Dalian Trade Center