– As the installation of electric vehicle chargers increases, the charger parts market is also growing

– Expansion of overseas brand entry due to expansion of high-voltage and fast-charging chargers

As sales of electric vehicles in China increase, the number of electric vehicle chargers installed is also increasing. Recently, high-voltage fast chargers that can compensate for the long charging time of electric vehicles have begun to spread. As the proportion of fast chargers is increasing, the market size of charging modules and relays, which are core parts of chargers, is also increasing. Domestic companies need to pay attention to the Chinese charger parts market, which is highly dependent on imports for major parts of electric vehicle chargers.

Expansion of New Energy Vehicle Sales

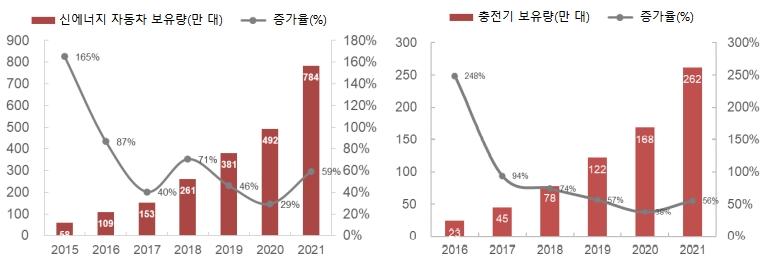

As sales of new energy vehicles expand, the number of electric vehicle chargers installed is also increasing. According to the China Automobile Manufacturers Association (Chinese Automobile Manufacturers Association), by 2021, there will be 784 million new energy vehicles in China, an increase of 2020% compared to 59.3, and the sales of new energy vehicles in 2022 are expected to reach 500 million. According to the China Electric Vehicle Charging Infrastructure Promotion Federation (Chinese Electric Vehicle Charging Infrastructure Promotion Federation) predicted to do

<Trends of New Energy Vehicles and Chargers in China>

[Source: China Automobile Manufacturers Association, China Charging Federation]

By region, Guangdong, Jiangsu, and Sichuan provinces have the highest level of supply of electric vehicles and electric vehicle chargers. These regions have the largest number of EVs in China, with more than 40 EVs in each province. In major cities in the province, such as Guangzhou, Nanjing, and Chengdu, the proportion of electric buses among all buses exceeded 2021% in 90. Guangzhou and Chengdu announced that they would expand the supply of electric taxis, and they also announced plans to completely convert taxis to electric vehicles by 2022 and 2023, respectively.

In addition, as the penetration level of electric vehicles is high, the amount of electric vehicle charging in the region is also the highest in China. According to the statistics of the China Charging Federation, the provinces with the highest electric vehicle charging capacity by 2021 are Guangdong, Jiangsu, and Sichuan.

<Charging capacity of electric vehicles by provinces and cities in China in 2021>

(Unit: XNUMX kWh)

[Source: China Charging Federation]

Expansion of electric vehicle charging stations and growth of the parts market

As electric vehicle sales increase, the number of electric vehicle charging stations is also increasing. According to the China Charging Federation, the number of electric vehicle charging stations is expected to increase to 2021 million in 114 to 2022 million in 168, a 47% increase from the previous year. With the proliferation of electric vehicle charging stations operated by various entities such as the national power grid, private companies, and automobile companies, the installation of public charging stations is expected to exceed that of household chargers. Dongguan Securities Co. predicts that the share of public charging stations, which charge faster than home chargers, in the Chinese charger market will exceed 2021% by the end of 43 from 2022% in 50.

<Example of home charger and public charger>

[Source: Cha Cher Zija (汽车之家), Zhongxin King (中新网)]

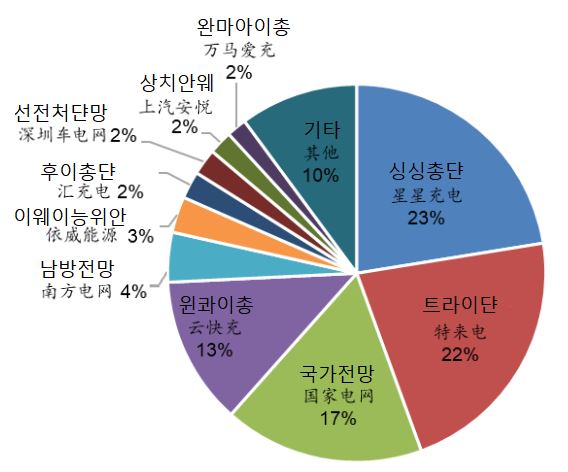

Public charging stations for electric vehicles were mainly operated by state-owned companies, but recently, privately operated charging stations are changing. Prior to 2013, when public charging stations began to spread, charging stations were installed led by state-owned companies such as National Outlook and Southern View. Since 2014, private electric vehicle charging station companies such as Trinul (特来电) and Xingxingchongnyi (星星充电) have appeared. There are a total of 2021 companies operating more than 1 charging stations in China in 13, with the top 10 companies operating 90% of the total. Three of the top three Chinese companies in the Chinese market, Tri-Niat (特来电), Xingxing Chong-Ni (星星充电), and National Outlook (National Perspective) are operating a total of 3 chargers, accounting for more than 60% of the total market.

<Market share of public charger operators>

[Source: China Charging Federation]

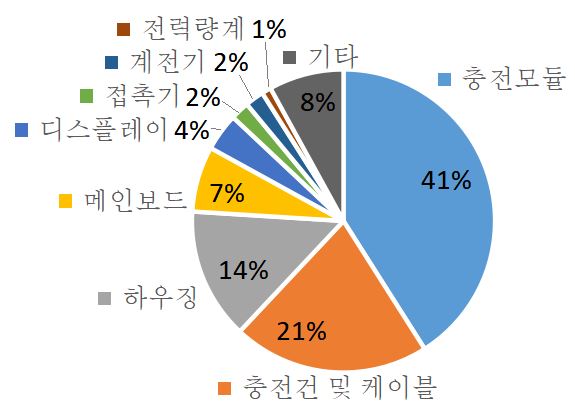

Although the size of the charger market is expanding, the dependence on imports for major parts of the charger is still high. Dongguan Securities Co., Ltd. predicted that the market size of the charger market in 2022 will double from the previous year to reach 1,241 billion yuan and reach 2025 billion yuan by 2045. On the other hand, more than 40% of the IGBT (transistor), a core component of the charging module, which accounts for 90% of the charger cost, is still dependent on the US, Europe, Japan, and Korea. In China, only a few companies such as Shida Bandao (斯达半导) and BYD (比亚迪) are producing. In addition, electrode foil, which is a key material for chargers, is also highly dependent on imports from Japanese and Korean products for high-performance chargers. Products made in China have the disadvantages of low power storage capacity, high leakage current, and short lifespan.

<Cost Proportion by Charger Parts>

[Source: Minister Zhao Chung, Guolian Securities Co.]

Advances in electric vehicle fast charging technology

As the technology of electric vehicle chargers develops, the demand for high-performance parts is also increasing. Initially, electric vehicles had a small charging capacity, but recently, the charging capacity has increased due to the expansion of production of high-voltage electric vehicles. As the installation of high-voltage chargers increases, the demand for high-performance components such as high-voltage charging modules and high-voltage relays is also increasing.

In 2021, high-voltage charging electric vehicles with fast charging rates were launched. BYD (比亚迪) and Xiaofeng (小鹏) produced cars equipped with 400V batteries capable of high-voltage charging instead of the existing 800V batteries. BYD has launched the EA800 model with an 1V high-voltage battery and can travel up to 5km with a 150-minute charge. In addition, Xiaofeng (小鹏) released the G5, which can travel up to 200 km with a 9-minute charge, and also introduced a self-developed 480kW high-power fast charger.

<Electric vehicle model capable of fast charging>

[Source: Dungcheoji (懂车帝)]

The high-voltage charger market is also growing as the production of high-voltage charging vehicles over 800v is expanding. High-voltage charging can more than double the charging speed and reduce power loss in the circuit by 2%, improving the efficiency of using electrical energy. Starting in 60, state-owned companies, private companies and automakers will all start installing only high-voltage chargers at charging stations. The voltage of chargers used at public charging stations such as National Outlook and Trinium is mainly between 2021V and 750V. Automaker Xiaofeng is also installing a 1000㎾, 480V fast charging public charging station, and when using the fast charger, the Xiaofeng electric vehicle can travel up to 800km with a five-minute charge.

<Xiaofeng's 480㎾ fast charger>

[Source: Xiaofeng Motors]

With the proliferation of high-voltage chargers, the demand for parts for high-voltage chargers, such as high-voltage charging modules and high-voltage relays, is also increasing. The charging module is a necessary component to maintain the stability of the circuit even at the high voltage of the electric vehicle and to improve the efficiency of electric energy conversion. The 20kW/30kW charging module is mainly used for the high voltage charger, not the 40kW charging module used previously. In 2021, the market size of 30kW/40kW has expanded to 40%. In recent years, various companies such as Tonghe, Yeongliai, and BorgWarner have launched high-voltage charging module products of 30kW or more, and the dependence on imports of major parts including transistors reaches more than 90%. .

<Charging module power generation>

[Source: 充电桩管家,国联证券]

As the battery voltage of electric vehicles increases, the demand for high-voltage relays is also increasing. A relay is a component used for current control and circuit protection in a charger. High-voltage electric vehicles of 800V or higher require a high-voltage relay because current control is more difficult than that of conventional electric vehicles. According to Guolian Securities, two to three high-voltage relays are used per high-voltage DC charger, and the relay market size is expected to grow from 1 billion yuan in 2 to 3 billion yuan by 2021. In addition, China's advanced relay market is currently dominated by foreign companies such as Japan's OMRON (欧姆龙) and Switzerland's TE Connectivity (泰科). did.

implication

The Chinese charger industry is highly likely to grow together with the expansion of electric vehicles. As electric vehicle sales increase, demand for chargers will also increase, and the size of the related parts market will also increase. The development of charger technology can have a positive effect on the charging speed and safety issues of electric vehicles and increase the sales volume of electric vehicles.

A local buyer said, “Korean products are more competitive in price compared to European and Japanese products, and they are safer and have longer product lifespans than Chinese products.” said. In addition, a local charger component manufacturer added, “Korean products such as IGBTs, relays, and electrode foils have successfully entered the Chinese market, and the scale of entry is expected to increase as the supply of high-voltage and high-power chargers expands.”

Recently, wireless charging technology for electric vehicles has also appeared. A wireless charger installed on the floor of the road or parking lot can be charged without connecting a charging cable. Chinese automakers and power grid operators are actively developing and commercializing the technology. Companies that want to enter China's electric vehicle charging parts market need to pay attention to the technology trends as well.

Source: Guolian Securities Co., Dongguan Securities Co., China Automobile Manufacturers Association (China Automobile Manufacturers Association), China Electric Vehicle Charging Infrastructure Promotion Federation (China Electric Vehicle Charging Infrastructure Promotion Association), Tianjin Trade Center