– Following the pandemic, the number of visitors plummeted compared to the previous year due to sanctions on Ukraine

– Russia will accelerate import substitution by strengthening international sanctions against Russia

Svyaz-2022 Overview

The SVIAZ exhibition is a strategic event for the Russian information and communication technology industry and the main event of Russia's high-tech (high-tech) week RNVT. The exhibition was an international event in which Eastern European countries usually participate in large numbers, but the scale of participation by foreign companies has significantly decreased after the outbreak of COVID-19. After that, it seemed to show a recovery for a while in 2021, but the scale was reduced again as sanctions against Russia increased due to the outbreak of the Ukraine crisis in 2022. 2021 companies from 8 countries and 197 government agencies and enterprises of the Russian Federation participated in the 5 SVIAZ exhibition.

Participation status

The number of companies participating in 2022 was 5 companies from 136 countries, of which 131 were Russian companies. The national pavilion was canceled, and it was found that about one foreign company per country (Taiwan, Kazakhstan, Italy, Iran, etc.) participated. Two companies participated in Taiwan alone, and one company each from other countries (Kazakhstan, Italy, Iran). There were a total of 1 types of exhibition items for companies, and more than 2 visitors were recorded during the 1 days of the exhibition. The main event of this year's exhibition was the opening ceremony of Russian High-Tech Week. In addition, discussions on further digitization of the Russian economy and import substitution were held as major forum events.

Sviaz 2022Main Exhibition Themes

Sviaz 2022 major exhibition themes were as follows with a total of 27. However, due to the scale of the exhibition, exhibitors were grouped by industry, without distinction by subject or theme, and conducted the exhibition. Visitors to the Sviaz 2022 exhibition could purchase exhibition tickets through the online website, and tickets for exhibitors were free.

main theme

· Smart City

· IoT – Digital Future

5G

· Communication equipment

· technology

· Solutions and services

· Data network

· Communication and network infrastructure

· Satellite communication

· wireless communication

· mobile

· communication

· Fiber optic cable

· Data center

· Power supply

· Smart device

· Russian software

· IP technology

· TV and radio broadcasts

· AR and VR

・AI

· IT service

· mobile pay

· Internet-based technologies and services

· Startup

· Navitech

· Electronic parts

[Source: KOTRA Moscow Trade Center data collection]

2022/4/26

9:00 - 18:00

15th International Navigation Conference

11:00 - 11:45

Opening Ceremony of Russian High-Tech Week 2022

11:00 - 15:00

IOT Market Related Session: Import Substitution and Strategic Export Possibilities

10:00 - 13:00

Workshop on the application of EVPN/VXLAN-based L2VPN technology in data centers: VRF-LITE functionality

13:00 - 16:00

Workshop: Building a high-capacity call center based on ECSS-10 hardware and software systems

12:30 - 14:30

SVIAZ 2022 Forum: Russia's Sovereign Development of Basic Technology to Build Communication Infrastructure

12:00 - 16:00

Practical forum for telecommunications in Russia: realities, opportunities and prospects

14:30 - 16:00

SVIAZ 2022 Forum Related Topic Session: NO.1 Possibility of working with foreign partners

14:30 - 15:45

Strategic Session on Digital Sovereignty: Priorities, Human Resources, and Law

2022/4/27

10:00 - 13:00

New Panels in 2022, Production and Development Prospects, Imported Substitutes

10:00 - 13:00

Workshop: WI-FI and IOT as Business Infrastructure – Management and Security

11:00 - 12:30

Russian Software Forum: Congress on Effective Solutions – Russian IT Industry in a New Reality

11:00 - 12:30

SVIAZ 2022 Forum Related Topics Session: NO.2 Cloud Technologies and Solutions

11:00 - 15:00

Technical Workshop: Russian Software Solutions for Transforming Telecommunication Structures

12:00 - 14:00

Panel Discussion: Progress in the Radio Electronics Industry and Engineering

12:00 - 14:15

Russian Software Forum: Thematic sessions on effective solutions – NO.1 replacement of imports of engineering software in industry and education

13:30 - 15:00

SVIAZ 2022 Forum Related Topic Session: NO.3 Building Strategic Skills to Protect the Telecommunications and IT Industry

14:30 - 17:30

Russian Software Forum: Effective Solutions Topic Session – NO.2 Development of Artificial Intelligence Utilizing New Platforms for Securing National Critical Infrastructure

15:00 - 16:30

SVIAZ 2022 Forum Related Topic Session: NO.4 Data Center Industry Development Status and Prospect

2022/4/28

11:00 - 16:00

2022th Russian Research and Working Conference on Telecommunication Infrastructure in 13 – The Future of Telecommunication Networks and Infrastructures in Russia

11:00 - 16:00

Fiber Optic Conference for Digital Transformation: 'New Time, New Challenge, New Opportunity'

11:00 - 16:00

Panel Prospect: 'Could it be possible to increase the profitability of Russian telecom operators by providing high-quality service packages?'

11:00 - 16:00

Conference on CLUB-COM's new growth drivers: 'How will telecom operators find a way to survive in the post-coronavirus future?'

11:00 - 17:00

IT & Digital Sector Board of SVIAZ 2022

May 4

10:00 - 18:00

The 26th International Communication Academy (MAC) Digital Transformation Forum: Seeking Sustainability

11:00 - 14:00

HR Forum: How to Grow Your Business with Teamwork

[Source: www.sviaz-expo.ru]

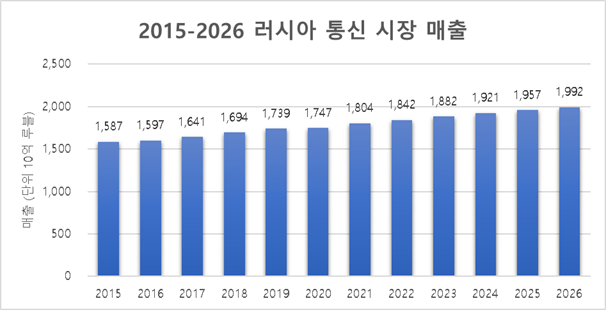

Russian Telecommunications Market Status

Since 2015, sales in the Russian telecommunication market have shown steady growth. In 2015, it recorded 1 trillion rubles (US$5,870 billion), and in 244 it increased to 2020 trillion rubles (US$1 billion). Despite the outbreak of COVID-7,470 (268), the growth rate has been maintained steadily. In 19, the size of the Russian telecommunication market recorded more than 2020 trillion rubles (US$2021 billion), an increase of 3.2% from the previous year.

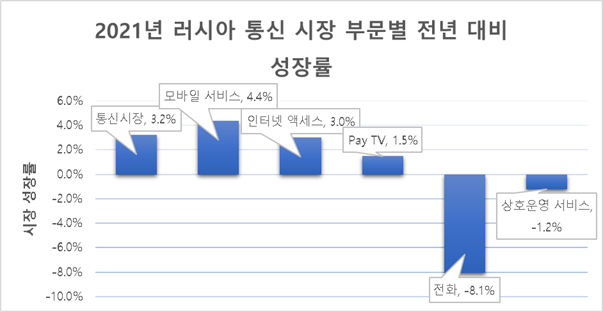

[Source: www.statista.com] *2021 is an estimate

According to TMT Consulting analysts, the growth of the Russian telecommunication service market in 2021 was unparalleled. Substantial growth in Russian telecommunications was driven by the mobile telecommunications market. However, growth slowed somewhat in the fixed broadband Internet access and pay TV segments. The growth of subscribers from telecommunication companies in 2021 seems to have slowed somewhat due to the base phenomenon that greatly increased during the self-quarantine period due to the COVID-2020 pandemic in 19. Although the rate of increase in billing costs differs by region, on average, during 2021, the mobile service, Internet access, and pay TV sectors showed an increase of 4.4%, 3.0%, and 1.5%, respectively, compared to the previous year. Telephone service and internal (mutual) operation service recorded -8.1% and -1.2% compared to the previous year.

[Source: www.statista.com]

Since the Ukrainian crisis began in earnest on February 2022, 2, Russian local supply and demand for IT, software, and electronic components has sharply deteriorated due to the withdrawal or suspension of foreign companies that have entered the country, and the application of the US FDPR (Foreign Direct Production Regulations). In this regard, Denis Manturov, Minister of Industry and Trade of the Russian Federation, said in March: “The task of strengthening technological sovereignty by strengthening the substitution of foreign software and electronic components in industrial enterprises remains a priority task of the Ministry of Industry and Trade of the Russian Federation.” said.

In March 2022, the Russian government introduced a full-fledged government support plan to make up for the negative growth trend in the telecommunications market. The Ministry of Digital Development has significantly improved the development program initiative already ordered, and announced a program plan to mass-build provincial balanced communication facilities to the provinces in cooperation with the Russian Federation Health Supervisory Service (Rospotrebnadzor). The Telecommunications Industry Infrastructure Construction Program of the Ministry of Digital Development of the Russian Federation, announced in March 3, has set various targets, including a 2022% increase in information capacity and a one-year moratorium on the "Yarovaya Law" regulating the storage of video traffic. Meanwhile, considering the rise in consumer prices, it urged telecommunications operators to introduce a fair rate interlocking mechanism, and announced that any violations that may occur in the rate setting of individual operators will be closely monitored. Specifically, the key point is to provide significant support for import substitution in each sector.

Exhibitor interview

<Questions>

1) Opinion about the exhibition

2) Interview target company information

3) Opportunities for cooperation with Korea

4) Impact of the Ukraine crisis on businesses

ㅇ Artem Barabashev, Sales Manager at Rigol (Measuring Equipment Distributor)

1. The exhibition proceeded smoothly with more visitors than expected.

2. As an official distributor of RIGOL, a Chinese measuring equipment manufacturer, the company's portfolio includes supplies from Western companies, but its proportion is small.

3. As a distributor, we are always looking for companies we can work with.

4. The size of the transaction has been drastically reduced due to a significant reduction in supply from Western partners, and cooperation with China is expected to greatly expand in the short term as alternative suppliers are currently being sought in Asia, including China. However, as the logistics difficulties continue, we are constantly monitoring the global logistics status.

ㅇ Vadim Selgin, Managing Director of Skard-Electronics (Radio and Communication Equipment Manufacturer)

1. The positivity that we can overcome even if there are few visitors this year is maintained because experience has been accumulated while participating in the exhibition for many years.

2. Since the company started manufacturing in 2000 and has a differentiated raw material and technology base, it is expected that the company will be able to participate in the import substitution program proposed by the Russian government.

3. However, since the supply and demand of parts has deteriorated since the Ukraine crisis, cooperation with China will be strengthened in the short term, and cooperation with Korea is still unclear.

4. Since the manufacturing line is already localized, there is no major problem in productivity, but problems such as market recognition, introduction of innovative technology, and procurement of key parts still remain.

ㅇ Lyudmila Yakovleva CCO of Satis (satellite equipment manufacturer)

1. It is true that the number of visitors this year has decreased significantly as we are participating in the exhibition every year.

2. Comprehensive business promotion including participation in satellite communication operators, satellite earth station equipment manufacturers, Internet service providers, and complex communication projects

3. There are products manufactured in-house, but they are highly dependent on imports of parts, so business with Korean companies is hopeful, but political stability should be given priority

4. Although it was not significantly affected by the Ukraine crisis, it is believed that it is easy to find an alternative supplier if there is a disruption in the supply and demand of parts caused by some transactions. Many local companies are looking for parts from the company due to disruptions in the supply and demand of parts.

ㅇ Konstantin Sozansky, Head of Department at Trialink (manufacturing and servicing emergency systems)

1. It is difficult to compare with existing events because it is the first time participating in the exhibition.

2. Our main business area is providing emergency system and detector installation services, and we are mainly importing parts from China and Israel.

3. If the product specifications and price are satisfied, we will consider importing from Korea.

4. It is true that the business environment has deteriorated due to the Ukraine incident, and as the import of Motorola solutions has recently been suspended, it is urgent to find an alternative import site such as Korea or develop local technology.

COVID-19 quarantine situation

Located between WTC and Moscow City, the business center located in Moscow Trade Center, EXPOCENTER is the most traditional exhibition hall among conventions in the center of Moscow city. The convention complies with the guidelines (The Chief State Sanitary Doctor of Russia MP 3.1/2.1.0198-20) of Rospotrebnadzor (Russian Federal Health Supervisory Service, Pandemic Prevention Office) of Russia, but the recent Moscow Municipal Government policy (voluntary mask wearing) , it was found that the majority of visitors were not wearing masks. Masks and gloves were always provided in the exhibition hall, and a personal protective equipment (PPE) vending machine and disinfectant pump were provided in each corner at the central entrance of the exhibition hall.

Notes and implications of visits by trade officials

The Svyaz2022 exhibition has been significantly reduced in size compared to the previous year. In particular, the number of visitors fell sharply, recording more than 2021 in 16,000 and 2022 in 7,620. This appears to be due to the aftermath of the COVID-19 pandemic and strong sanctions against Russia. Accordingly, it was observed that exhibitors in the exhibition, which consisted of 27 themed sections, were grouped by industry rather than by theme.

The main event of this year's exhibition was the fact that it coincided with the Russian High-Tech Week. As international sanctions against Russia expand, signs of Russia significantly expanding import substitution in the telecommunication industry were also confirmed in the contents of the exhibition program. If the Russian telecommunication market sales growth from 2015 to 2021 showed positive dynamics, there were opinions from participating companies that it would show modest growth in the future as an import substitution method through technology development and localization. As an international exhibition, this exhibition did not have an international event, but Russian companies participating in each region showed great interest in import substitution policies and programs, technology development projects and seminars such as government support. On the other hand, some opinions were suggested that products of local small and medium-sized manufacturers are replacing the market due to the decrease in imports due to sanctions, and there were voices of concern that government support is urgently needed to prepare for deterioration in quality and service quality.

related pictures

[Source: KOTRA Moscow Trade Center directly photographed, www.sviaz-expo.ru]

Source: Data collection through exhibition visits at KOTRA Moscow Trade Center, exhibition site (www.sviaz-expo.ru), Statista (www.statista.com)