– Notable Dutch battery technology company

– Electric Vehicle Market

The Netherlands is one of the countries that has actively introduced electric vehicles in Europe. In terms of the size of the automobile market, it ranks 7th in the EU and has maintained an average annual sales of 10 units for the past 45 years. On the other hand, the Dutch automobile industry does not have a high contribution to economic growth, accounting for less than 1% of GDP. VDL Nedcar is the only major automobile manufacturer that has signed a third-party contract with BMW (Germany). In addition, the Tesla plant operating in the Tilburg region was closed in the summer of 3 and is currently being used for Tesla Energy.

The Dutch new car market has entered a stage of maturity or saturation. After a recovery period in 2017-2018, stability was restored in 2019, but the number of new car registrations in 19 decreased by 2020% due to the severe economic blow caused by the COVID-19.8 pandemic. Sales of newly registered passenger cars in 2020 were 35 units, the lowest level since 7996, and sales of commercial vehicles decreased 1980% from the previous year to 22.2 units, the lowest in five years.

On the other hand, in the electric vehicle market, sales of pure electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) increased remarkably in 2020. This is also the effect of the purchase subsidy policy that allows consumers to purchase electric vehicles relatively easily.

From July 2020, 7, all consumers purchasing a pure electric vehicle (BEV), whether new or used, can apply for a purchase subsidy. In addition, the subsidy system includes information on individual rental (lease) of electric vehicles. In other words, the subsidy system was designed to promote the purchase and rental (lease) of electric vehicles by individual consumers, and provides subsidies of 1 euros for new car purchases and 4000 euros for used car purchases. In 2000, the new car purchase subsidy was originally known to be 2022 euros, but was reduced to 3700 euros, and the used car purchase subsidy will be maintained at 3350 euros. Subsidies for new car purchases in 2000 and 2023 will be gradually reduced to 2024 euros and 2950 euros, respectively, and all subsidies for electric vehicles will end in 2550.

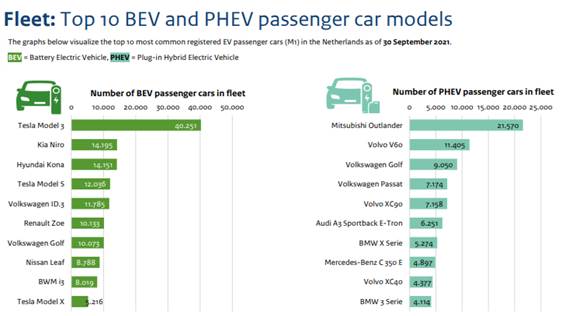

<Top 10 electric car sales in the Netherlands>

[Source: rvo.nl]

Dutch lithium-ion battery market

In Europe, there are plans for ten Giga-factories focused on lithium-ion technology, mainly for the German and French automotive industries. The European Battery Alliance has announced an Action Agenda for 'internalizing batteries' to enable battery production in Europe.

In the next few years, production facilities for lithium-ion batteries are expected to be oversupplied. However, before 2030, the supply is expected to be in short supply due to the explosive increase in the use of electric vehicles and storage devices in the power grid. This will affect the price increase of rechargeable batteries and unstable supply and demand, and will also affect emission reduction and energy conversion plans.

In the Netherlands, the use of lithium-ion batteries is expected to increase significantly in line with strict government regulations and plans to phase out fuel-burning engines. First, it plans to actively manage environmental degradation at the national level and ban the sale of gasoline and diesel fueled vehicles from 2025. This is expected to increase the number of EVs produced by 10 times, which will have a positive effect on the lithium-ion battery market as a result. In addition, wind energy requires a significant amount of lithium-ion batteries as an energy source for the national rail system.

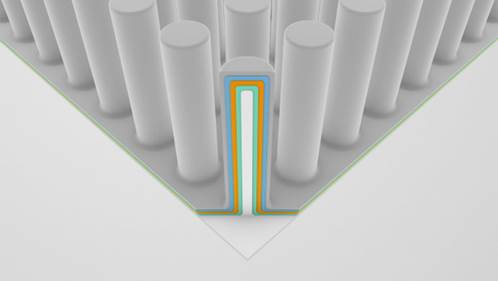

<Battery system configuration>

[Source: fic.com.tw]

The lithium-ion battery market is growing at a rapid pace due to the growing penetration of electric vehicles, the increasing demand for industrial power and sustainable fuels. Emerging markets, particularly electric vehicles and renewable energy storage systems, are driving the growth of the lithium-ion battery market. Countries such as the Netherlands, China, and Germany are promoting various plans and implementing strict regulations to support the development of advanced battery technology. The Dutch lithium-ion battery market was valued at $2020 billion in 27, and is expected to reach $7000 billion in 2021, at a CAGR of 2030% from 10.9 to 2030.

<Global Li-ion Battery Market>

[Source: mnmks.com]

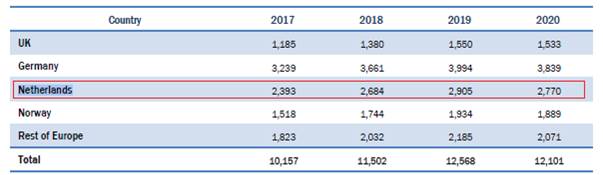

<Lithium-ion battery market size by country (2017-2020)>

(Unit: million dollars)

[Source: mnmks.com]

<Lithium-ion battery market size and forecast by country (2021-2030)>

(Unit: million dollars)

[Source: mnmks.com]

Dutch Battery Industry Status

The rapid increase in the number of future mobility such as electric vehicles, electric bicycles, electric trucks and ships is driving the need for rechargeable batteries and charging infrastructure and waste battery solutions. Rechargeable batteries are becoming increasingly important in power networks as they balance supply and demand for sustainable energy. Accordingly, the Ministry of Infrastructure and Water Resources Management and the Ministry of Economy and Climate are conducting analysis and policy making in various fields such as energy transition, sustainable transportation, circular economy, advanced manufacturing, and trade.

The value chain of the Dutch battery industry is long and complex, and it is highly dependent on other countries as it does not mine raw materials or produce batteries on its own. Asian countries are mainly responsible for the production of raw materials and battery cells, which are the first half of the value chain, while battery reuse and recycling, which is the second half of the value chain, is still in the R&D stage.

The Netherlands, on the other hand, excels in automotive parts, alternative materials and battery concepts, battery management systems, and battery reuse and recycling, creating thousands to tens of thousands of new jobs related to it.

However, due to the shortage of raw materials for batteries, the reuse of batteries is becoming more important in the future. Accordingly, the design phase requires attention to cycle design, smart maintenance and repair options, and it is important to check the battery condition during actual use and disposal.

In the Netherlands, there are many companies that replace failed batteries by replacing battery cells or upgrading battery management systems. Representative examples include Time Shift Energy Storage, Scholt Energy, VDL, Alfen, and Peter Ursem. Additionally, Spiers New Technologies (SNT) has been offering battery reuse services since November 2019. In 2019 alone, it received a total of 18 to 1,000 drive batteries from 1,500 neighboring countries, including the Netherlands.

In addition, by 2025, the reliance on cobalt raw materials is expected to decrease as more and more cathodes are used in lithium-ion batteries. Combining it with other developments in the future (eg availability of silicon graphite for anode technology) will lead to increased energy density and reduced cost. In addition, various initiatives are being pursued in the Netherlands to develop batteries made of alternative battery materials (iron and copper fluoride, silicon) and recycled materials.

At TNO, Delft, Eindhovel, and Twente Institutes of Technology, research on ① nano coatings to minimize the use of rare materials and ② alternative materials with a wide range of uses is being conducted. In addition, numerous startups and new companies such as Spiers are working to recover scarce raw materials from discarded rechargeable batteries for battery recycling.

Notable Dutch battery companies

Although the Netherlands does not excel in terms of battery manufacturing, there are companies that assemble battery modules for niche markets (Cleantron, SuperB, Eleo). VDL Nedcar is considering assembling a car battery pack to cover losses related to BMW's business, but there is no company in the Netherlands that is responsible for the battery cell and overall battery manufacturing process.

However, the seven Dutch companies listed below have innovative battery technologies to bring to market. The applications that these companies are targeting are very diverse, from materials and parts to full-fledged batteries and manufacturing equipment.

1) Battolyser

Battolyser is a spin-off company from TU Delft. The battery decomposer (Battolyser) developed here can store electricity like any other battery, but has the function of decomposing water into hydrogen and oxygen when fully charged. Although a simple combination of a regular battery and an electrolyzer can accomplish the same task, this decomposer has the advantage of better performance at a lower cost in real-world critical situations. Additionally, while conventional electrolysers cannot be turned on and off easily, Battolyser's battery decomposer can quickly switch between hydrogen production mode and battery discharge mode.

2) Delft IMP

Delft IMP has developed a battery powder coating process. Coating the cathode and anode materials has the advantage of improving durability and extending battery life. It also increases energy density and battery reliability, and allows the use of cheaper raw materials without loss of performance.

Meanwhile, Delf IMP applied an atomic layer deposition (ALD) process that can apply a 'nanoshell' of a desired thickness to the powder particles. During passage through the tubular reactor, the particles are contacted with a gaseous precursor that reacts with the surface. Accordingly, the coating is formed layer by layer, varying in thickness depending on the diameter and length of the reactor tube.

3) Elastor

Elestor's mission is to build storage systems at the lowest cost per kilowatt (kWh). Elestor developed the Redox Flow Battery technology, based on a technology developed by NASA a few decades ago. The battery stores electrons in a compound, which is responsible for determining whether there is an excess of electrons (electricity). Electrons are usually emitted in the reverse direction when needed through the same chemical reaction. Elestor's Flow Battery decomposes hydrogen bromide into hydrogen and bromine during charging. These active materials are readily available, inexpensive, and have the advantage of increasing energy and power densities.

4) E-Magy

E-Magy focuses on the anode of lithium-ion batteries. The superiority of silicon material in terms of energy density has been widely known when manufacturing an anode, but in general, graphite has been mainly used. The reason is that it is difficult to handle the mechanical stress in the process of repeatedly absorbing and releasing lithium ions when silicon is used.

However, E-magy's parent company, RGS Development, has created a Nanosponge silicone casting process that does not crack even under high pressure (entering guests?). Nano sponge has the strength to shorten charging time and reduce production cost by making 40% higher energy density than existing graphite materials.

E-Magy is currently operating one production facility with a focus on the electric vehicle market, and is preparing to expand its production facility further in the future. In addition, it aims to mass-produce 1 tons of nanoporous silicon, which can be supplied to up to 50 electric vehicles per year.

5) Leydenjar

In a similar direction to the E-magy company, Leydenjar is also focusing on the silicon anode business for lithium-ion batteries. However, the difference is that E-magy sells manufacturing equipment, not materials. Leydenjar's core technology was originally developed by ECN, a photovoltaic (PV) research institute that was trying to make solar cells with superior performance. However, nanotextured silicon fabricated according to a plasma-enhanced chemical vapor deposition (PECVD) process has been found to better produce fine anodes instead of solar cells. Leydenjar claims that the silicon anode has an energy density of up to 70% higher than that of graphite.

The company initially spent a lot of time demonstrating the practical advantages and commercial viability of the anode manufacturing process. In addition, a pilot production line has been established in the Eindhoven region, allowing customers to test the technology by ordering samples directly. The final step is to develop production-optimized roll-to-roll (a method of manufacturing electronic devices on plastic and metal foil) deposition equipment.

6) Lionvolt

The Lionvolt company aims to become the first battery cell manufacturer in the Netherlands, not just a battery cell. The company, a spin-off from the Holst Center (Technology Park), has successfully demonstrated the 3D solid-state thin-film lithium-ion battery concept. The concept consists of a foil covered with an array of micropillars, each layer of which is coated with a battery material. In addition, the lithium storage electrode has a type surrounding the electrolyte. In a nutshell, each pole can be seen as a small battery.

This design has the advantages of ① charging and discharging times faster because lithium ions travel a relatively short distance, ② long lifespan because liquid electrolyte is not required, low risk of fire and explosion, and ③ light weight in design. Taking advantage of these advantages, Lionvolt is targeting the wearable market in the short term, and in the long term plans to develop a larger 3D solid-state lithium-ion battery for the automotive and other markets.

<Lionvolt 3D solid-state lithium-ion battery on foil>

[Source: bits-chips.nl]

7) SALD

SALD is based in Eindhoven and has a similar business direction to the aforementioned Delft IMP. Both companies are developing ALD production equipment for a variety of applications. In the production of current lithium-ion batteries, the equipment of both companies is used to apply a protective coating to the electrode material, but the process is different.

The core technology of SALD is another type of ALD capable of high-throughput production, called spatial ALD. This causes the moving substrate to pass through different precursor gas regions, resulting in the formation of nanolayers step by step. Unlike Delf IMP, SALD deposits powdered electrode material onto a substrate and then applies a coating, meaning that the particle surface is not completely covered. In other words, where the particles touch, the coating can grow and, according to SALD, the principle helps electrons move easily through the electrode.

In the following article, additional trends in the Dutch battery market, related policies and regulations, and R&D trends will be explored.

Sources: rvo.nl, fic.com.tw, mnmks.com, bits-chips.nl, Whitepaper of government, ig.com, oostnl.nl, brainporteindhoven.com, fortadvocaten.nl, innovationorigins.com, groenezaken.com, Comprehensive data from KOTRA Amsterdam Trade Center including wetten.overheid.nl, bd.nl, ad.nl, klimaatakkoord.nl, batterycompetencecenter.nl, ec.europa.eu, etc.