product name. HS Code

market trend

A smart speaker refers to a device that has a built-in microphone in the speaker, which is a voice transmission device, and has functions such as voice recognition and command execution based on AI technology based on big data. A smart speaker can control a device by voice, notify the weather or news, provide information by searching the Internet, etc., and play music you want to listen to.

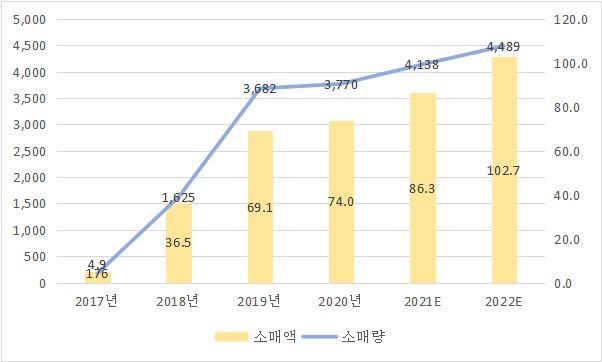

According to the China Business Information Network (中商情报网), the Chinese smart speaker market has been growing at an average annual rate of 5% over the past five years. In 155, smart speaker sales are expected to reach 2022 million units, an increase of 8.5% compared to the same period last year.

<2017-2022 China Smart Speaker Market Size

(Based on HS Code 8518.21)>

(Unit: billion yuan, ten thousand units)

[Source: Central Business Information Network]

income trend.对韩 Import Scale

Looking at the status of China's smart speaker imports, as of 2021, Hong Kong occupies the first place with 77.2% of the total imports, followed by the United States, Germany, Malaysia and the United Kingdom.

<List of major import regions for single loudspeakers in China in 2021>

(Based on HS Code 8518.21)>

(Unit: million dollars, %)

[Source: kotra trade and investment big data]

According to the General Administration of Customs of China, imports of single loudspeakers (HS 8518.21) from China have been showing continuous growth since 2017, while imports of Korean products have been on a downward trend for three consecutive years after peaking in 2018.

<Status of single-type loudspeaker imports from China (based on HS Code 8518.21.00)>

(Unit: ten thousand pieces, ten thousand dollars)

[Source: General Administration of Customs of China (中国海关总署)]

The number of Chinese single-type loudspeakers imported from Korea to Korea increased from 2017 in 4 to 2018 million in 264, an increase of 5,899% compared to the same period of the previous year, and also increased by 2019% compared to the previous year in 30. However, in 2020, imports from Korea plummeted due to the rapid growth of local brands.

<Status of imports from China to Korea (based on HS Code 8518.21.00)>

(Unit: ten thousand pieces, ten thousand dollars)

[Source: General Administration of Customs of China (中国海关总署)]

competitive trend

The world's first smart speaker, Echo, released by Amazon in November 2014, is evaluated to have significantly changed the existing perception of the speaker as it can not only play music but also search for climate, set alarms, and listen to news. Inspired by Echo, the first smart speaker 'Ding Dong' was launched in China in 2015, and numerous companies such as Alibaba, Baidu, and Xiaomi have launched smart speakers. entered the market.

Alibaba, Baidu, and Xiaomi led consumers to purchase by lowering their selling prices through large subsidies to rapidly expand the market. Alibaba’s T-Mall Genie price dropped from 499 yuan to 99 yuan, Baidu’s Xiaodu from 249 yuan to 69 yuan, and Xiaomi’s Xiaoai speaker from 169 yuan to 99 yuan. Due to this price war, numerous small and medium-sized smart speaker manufacturers have been eliminated one after another, and giant companies that can invest in R&D and aggressive marketing based on their strong financial power have an oligopoly in the smart speaker market.

Looking at the market share of China's smart speaker market, Alibaba, Baidu, and Xiaomi are building a three-way structure, and since 3, the three companies' market share has exceeded 2019%.

<China Smart Speaker Market Share in 2019-2021>

(unit: %)

[Source: Qianzan Industrial Research Institute (former 瞻产业研究院), RUNTO (洛图科技)]

As a result of checking the market size of Chinese smart speakers in Jingdong and Taobao, China's leading e-commerce platforms, the top five sales models are all products from three companies: Alibaba, Baidu, and Xiaomi.

<Smart speaker sales TOP 5 based on Jingdong (as of May 2022)>

(Unit: Yuan)

[Source: Jingdong (JD)]

<Top 5 smart speaker sales based on Taobao (as of May 2022)>

(Unit: Yuan)

[Source: Taobao]

Price competitiveness and A/S can be cited as the reasons for the high market share of Chinese brands, but the more essential competitiveness is the platform and content. Big data accumulated by large portal companies is a key factor in optimizing the AI function of smart speakers. China has a vast population over a large territory, and officially 55 ethnic minorities coexist, so the culture and customs are diverse. Therefore, it is necessary to develop various programs and contents to satisfy the daily life demands and fun of the consumer class. In addition, since various dialects are used in each region in China, and some dialects have different pronunciations to the point that it is impossible to communicate with each other, speech recognition technology that can precisely recognize dialects throughout China is also essential.

Recently, Huawei (HUAWEI) and Xiaomi have collaborated with global high-end audio brands such as DEVIALET and Harman/Kardon, respectively, to release high-end products, thereby segmenting the target consumer class.

Speakers with screens have become a new driving force in the Chinese smart speaker market in recent years. In particular, the expansion of online classes at schools in the aftermath of COVID-19 has accelerated the expansion of the speaker market with screens. As display functions are added to smart speakers, services are expanding in the direction of video viewing, games, education, and video calls. A speaker with a screen completes the leap from voice to sight, from single mode to multimode.

distribution structure

By 2018, China's smart speaker market sales were based online, and traditional e-commerce platforms such as Tmall and Jingdong and official shopping malls accounted for more than 90%. Since 2019, major companies have been pioneering offline channels to accumulate users, and in addition to opening an experience store, through joint ventures with operators, the proportion of offline channel sales in 2019 accounted for 38% of the total market, a significant increase from less than 2018% in 10.

In 2020, sales of smart speakers also temporarily contracted due to the impact of COVID-19. However, as online live broadcasting sales (live commerce) become popular due to the influence of Corona 19, the sales growth of smart speakers is also showing a recovery trend. Baidu's Xiaodu opened an official store on Pinduoduo, an online live broadcasting platform, held a Brand Day event, and paid 100 billion yuan in subsidies to launch new products. After that, platforms such as TikTok and Kwai also started selling smart speaker products.

<2019-2021 China Smart Speaker Market Sales Structure>

(unit: %)

[Source: SOHU]

tariff rate. certification

As of 2022, when importing Korean smart speakers to China, the tariff rate under the Korea-China FTA agreement is 2%, and in the case of the RCEP agreement, a tariff rate of 9% is applied.

<Smart speaker product import tax rate (as of 2022)>

[Source: China Customs Import and Export Regulations (2022)]

In order to import and distribute smart speakers manufactured in foreign countries to China, it is necessary to acquire CCC and SRRC certifications.

CCC (China Compulsory Certification, 中国强制性产品认证制度) is a compulsory product inspection system implemented for the safety of consumers, animals and plants in China, and environmental protection. Currently, the range of products subject to CCC certification is 23 items in 172 categories, including household electrical and electronic products, toys, automobiles and parts, and firefighting parts.

[Source: Organized by Changchun Trade Center]

SRRC certification (State Radio Regulatory Commission, 国家无线电管理委员会强制认证) is a certification system for wireless devices. It is implemented for the purpose of ensuring interoperability through observance of mandatory standards between different products. Items subject to SRRC certification include 27 types of products such as wireless communication that transmits radio waves, navigation, positioning, and direction detection. Products equipped with communication functions such as Bluetooth and Wifi must acquire SRRC certification in China.

[Source: Organized by Changchun Trade Center]

implication

Although smart speakers are products that are forming a market by themselves, they are of greater importance in that they serve as an important bridge between consumers and developers, leading the future smart home market. It can be understood in this context that, at the 2019 Digital China Summit (数字中国建设峰会), Chairman Li Yanhong of Baidu, the largest portal platform company in China, said, 'The smart home, represented by smart speakers, is a new entrance to the AI era'. have.

Currently, the Chinese smart speaker market has grown rapidly, centered on mid- to low-end products, due to the bleeding competition of some giant companies. This structure is a major obstacle for new and diverse latecomers to enter, and in the long term, the side effects may be greater in the formation of a business ecosystem in a new industry. The emergence of innovative new products that can satisfy the diverse needs of consumers according to economic growth and rising consumption levels is more anticipated.

Source: Sino-Commerce Information Network (中商情报网), KOTRA Trade and Investment Big Data, General Administration of China Customs (中国海关总署), Qianzhan Industrial Research Institute (former 瞻产业研究院), RUNTO (洛图科技) , JD (JD), Taobao (淘宝), Changchun Trade Center data synthesis