– The U.S. bio industry is blurring the boundaries between industries, the digital health era brought about by COVID-19

– Digitalization is essential in the bio industry, and attention to digital biomarkers, which is key data, is needed.

When talking about changes in the US bio industry, it is impossible to ignore COVID-19. The damage caused by COVID-19 swept the world is undeniable, and it is still ongoing. Almost all countries are helpless in the face of the new disease, and the bioindustry is taking a more radical response than ever to combat it.

The situation close to the collapse of the existing healthcare system due to COVID-19 has forced rapid changes in the medical field, one of the most conservative fields, and the representative result is the mRNA vaccine, which everyone is benefiting from. The existing vaccine development process takes almost 10 years or more from the start of clinical trials to approval, but in the case of mRNA vaccines, the entire process from substance development to approval for use was completed within one year. The government improved related regulations, the US FDA granted an unusually wide immunity for side effects along with an Emergency Use Authorization (EUA), the academia quickly shared important data such as the relevant Corona 1 gene sequence, and the pharmaceutical industry has also made bold investments. New technologies were introduced to respond to new diseases.

Digital acceleration brought about by COVID-19

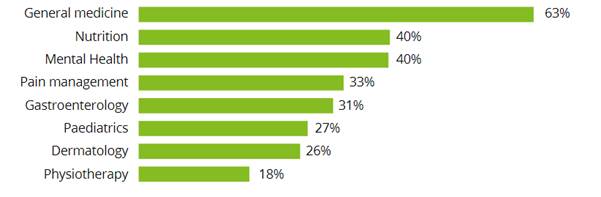

Starting with the development of the vaccine mentioned at the beginning, COVID-19 has brought about great changes in various fields of the bio industry. One of the most notable changes is the case of telemedicine, which has spread amid the situation where the existing face-to-face treatment has reached its limit. According to a report (2022) conducted by the American Medical Association (AMA) on doctors who are health care providers, about 60% of doctors have a positive opinion that telemedicine helps their patients, Although there are differences according to the field of consumer survey in Korea, the acceptance of digital health is increasing in society as a whole, with more than half of the respondents wishing to use telemedicine in general medical care.

<Result of questionnaire on whether patient medical experience is improved through telemedicine>

(Unit: person)

[Source: American Medical Association]

<Despite consumption of telemedicine by sector>

[Source: Deloitte]

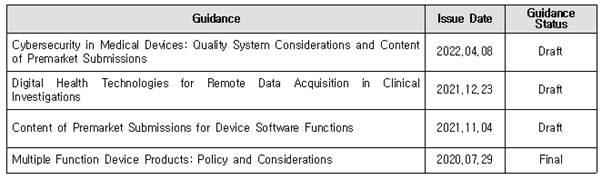

In addition, the FDA is preparing various policies for the spread and stable settlement of the digital health field, and is laying the foundation for overcoming the ongoing COVID-19 crisis by presenting related guidelines.

[Source: FDA, KOTRA Silicon Valley Trade Center Reconstruction]

digital health market

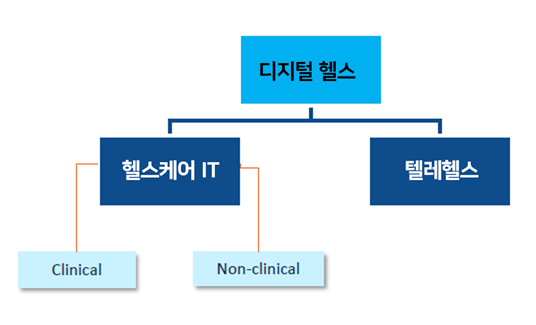

The industry following the digitization of the US bio industry can be divided into the digital health industry by separating it from the existing fields.

<Digital health market segmentation>

[Source: Frost & Sullivan, KOTRA Silicon Valley Trade Center Reconstruction]

Here, healthcare IT ranges from fields that support medical professionals using IT infrastructure or solutions including it (Clinical: chart management, drug development, treatment, clinical trials, etc.) to products or services that support health in individuals’ daily lives (Non- Clinical: wearables that measure heart rate, exercise volume, sleep state, etc.) are included.

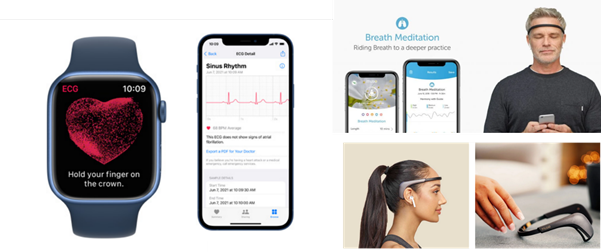

GE Healthcare, a subsidiary of General Electric, provides various solutions such as medical imaging, information, diagnosis, and monitoring systems. Oracle recently acquired Cerner, the world's second largest HER (electronic health record) vendor, entered into 3M has entered the healthcare RCM (Revenue cycle management) market to provide IT solutions for the entire medical process. Gritstone Oncology, which has been funded by Google, develops an immunotherapy vaccine based on AI machine learning. In particular, in the case of Clinical Healthcare IT, with the FDA approval of electronic therapy products, local large companies are also responding quickly by setting up related business headquarters. According to a representative of a Korean startup preparing to enter the local market, “As the FDA standards are being revised in the US, new technologies, including digital therapeutics, are gradually entering the digital health field. Companies that do this will take the lead,” he said. In addition, in the US market, various products are currently on the market, from basal metabolism measuring devices using wearable devices such as Apple Watch and Fitbit to devices that help meditation or sleep by measuring brain waves.

<Healthcare IT products in the US market>

[Source: apple, Choosemuse website, KOTRA Silicon Valley Trade Center reprocessed]

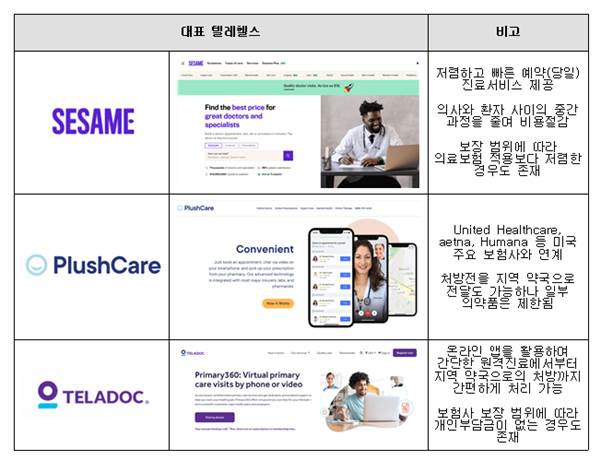

Telehealth refers to a service market in which telemedicine, as described above, connects officials in the medical industry (doctors, patients, insurance companies, etc.), typically using network-based solutions. In the US, various telemedicine platforms, including TELADOC and SESAME, are in operation, and they are actively approaching patients in connection with the existing US health insurance system.

<A major telehealth company in the United States>

[Source: website of each company, KOTRA Silicon Valley Trade Center reprocessed]

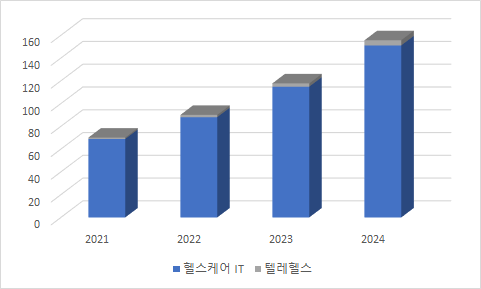

US digital health market size

The U.S. digital health market accounts for about 2021% of the global digital health market as of 39.4 and is worth $700 billion.

<US Digital Health Market Size>

(Unit: US$ billion)

[Source: statista, KOTRA Silicon Valley Trade Center reconstruction]

The US government is supporting various policies for digitalization and innovation in the medical field as a means of responding to COVID-19, and the expansion of investment in the digital health field by the private sector is also expected to support the continued growth of the related market. According to data from Silicon Valley Bank, venture capital investment in the bio sector in 2021 is $724 billion, of which 59%, or $426 billion, is invested in healthcare IT fields such as health tech and Dx, which is an increase of 20% compared to 186 years.

The core of the digital health industry – digital biomarkers

From management systems in hospitals to platforms that remotely connect patients and consumers, IT devices that help consumers check their health status, and mobile apps that provide various medical information and help, the digital health market has a wide range of applications. It is extensive and the market is very large.

So, what is the most important thing in the digital health industry? Excellent doctors or engineers, abundant capital, hardware infrastructure such as research facilities, and excellent AI technology will all be important elements in digital healthcare. However, data is an important element that lies at the foundation of digital health-related solutions, products, and services. In digital health, data expressed as digital biomarkers among numerous data is the basic unit that supports the industry.

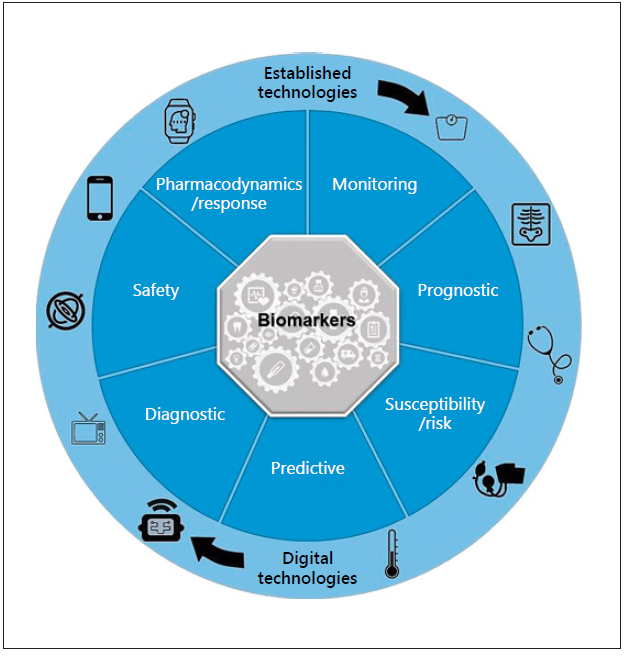

<Digital Biomarker>

What is a digital biomarker? As defined by the National Institutes of Health (NIH), 'biomarkers: indicators or surrogate markers (ex. blood pressure, body temperature, blood sugar, recent extends to DNA, RNA, protein, bacteria, and viruses), and refers to biomarkers collected based on digital technology.

[Source: Traditional and Digital Biomarkers: Two Worlds Apart?]

With the spread of IT devices and the advent of new biotechnology, it is now possible to collect, measure, and evaluate numerous biomarkers. Frost & Sullivan, a research institute specializing in digital biomarkers, selected digital biomarkers as one of the 2022 promising technologies in 50, and the related market is expected to grow from $2022 billion in 26 to $2026 billion in 90, growing at a CAGR of 35.1%.

Currently, about 70% of the global digital biomarker market is headquartered in the United States, and 316 patents (24% of worldwide related patents) have been registered in the United States so far.

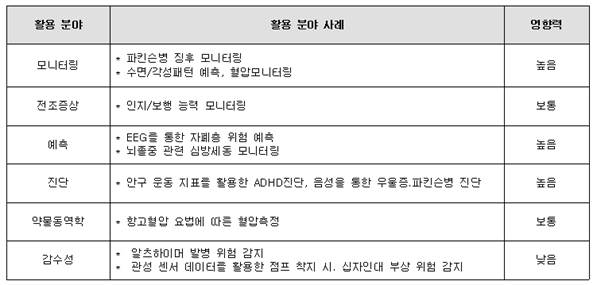

<The impact of digital biomarker application into fields>

[Source: Frost & Sullivan, KOTRA Silicon Valley Trade Center Reconstruction]

implication

As the digitization of the bio industry progresses, the introduction and application of new technologies such as cloud and AI in all fields, such as pharmaceuticals and medical care, is expected to play an important role in the market. As a topic to be addressed, inter-industry linkages are more important than ever.

Gartner, a technology consulting firm, has presented Data Fabric, Cybersecurity Mesh, Privacy-Enhancing Computation, Cloud-Native Platforms, and Decision Intelligence as representative technology trends for 2022. It can be seen that the boundaries between the two countries are blurring and that the industry needs to be viewed from a broader perspective.

<Emerging Strategic Technology Trends in 2022>

[Source: Gartner]

In a situation where there are currently no clear standards for leading companies or unified standards in the digital health market, companies that preferentially build a platform that collects and manages data located at the foundation of the digital health industry such as digital biomarkers It is expected to exert a strong influence in the bio industry in the future.

To this end, it is necessary to increase the understanding of the US standards, which play a leading role in related policies, and furthermore, to strategically participate in the establishment of the standards through cooperation or cooperation with US policy research institutes, if possible.

Source: American Medical Association, Deloitte, FAD, Frost&Sullivan, apple, Choosemuse, SESAME, PlushCare, TELADOC, statista, Karger, Gartner, KOTRA Silicon Valley Trade Center