– Expansion of mobile phone users along with improvement of communication infrastructure

– Increased mobile phone imports after COVID-19

Cambodia is a young country with 1,671% of the total population of 47.8 million people under the age of 25, and interest in electronic devices such as cell phones is high. Considering that only 25.1% of the total population resides in urban areas, the related market is expected to grow when the Internet infrastructure such as 5G in Cambodia expands in the future.

Product name and HS Code

– (HS 851712) mobile phone

Cambodia mobile phone market trend growing due to improvement of communication infrastructure

There are about 2,206 million mobile users in Cambodia (based on SIM users), which is about 130% of the total population. Although users often use different SIMs for different carriers, this is because there are many mobile phone users in Cambodia due to the low rate of landline phone penetration. There are also 1,344 million Internet users, or 78.8% of the total population. Moreover, mobile users and Internet users are continuing to grow, growing by 2021% and 2.2%, respectively, compared to 1.3.

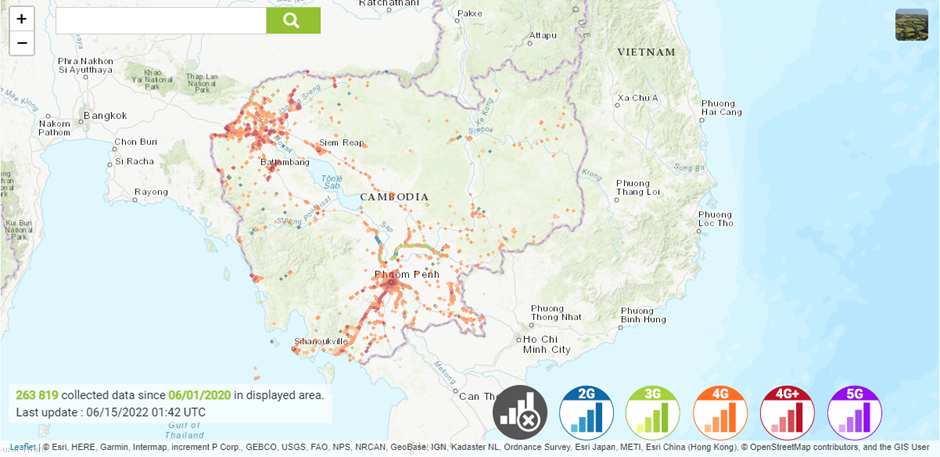

With the expansion of the mobile and Internet user markets, the communication infrastructure is also improving. The average mobile internet connection speed in 2022 is 16.51 Mbps, an increase of 2021 Mbps compared to 5.16. The cost of using data has also decreased, with data costing $2019 per gigabyte in 0.13, according to the World Bank, making it one of the lowest-cost countries for data among low- and lower-middle-income countries. The 4G penetration rate in Cambodia has reached 80% of the population through price competition and infrastructure construction competition among telecommunication companies such as cell card, Smart, Metfone, and Seatel in Cambodia.

<Cambodia Mobile Network (Metfone) Supply Status>

[Source: NPRF]

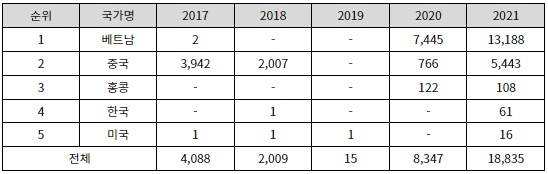

Increase in mobile phone imports after Corona 19

Cambodia's mobile phone imports (HS code 851712) were $2021 million in 1,883, an increase of 125% compared to the previous year. Cambodia's mobile phone imports were imported on a small scale, but the size of imports increased after Corona 19, and it increased significantly in 19, especially when the lockdown and Corona 2021 in Cambodia were severe. As e-commerce expands after Corona 19, it seems that the demand for mobile phones has naturally increased. The main importing countries are Vietnam, China, Hong Kong, Korea and the United States, of which Vietnam accounts for 70% of the total.

(Unit: XNUMX US$)

[Source: ITC Trade Map]

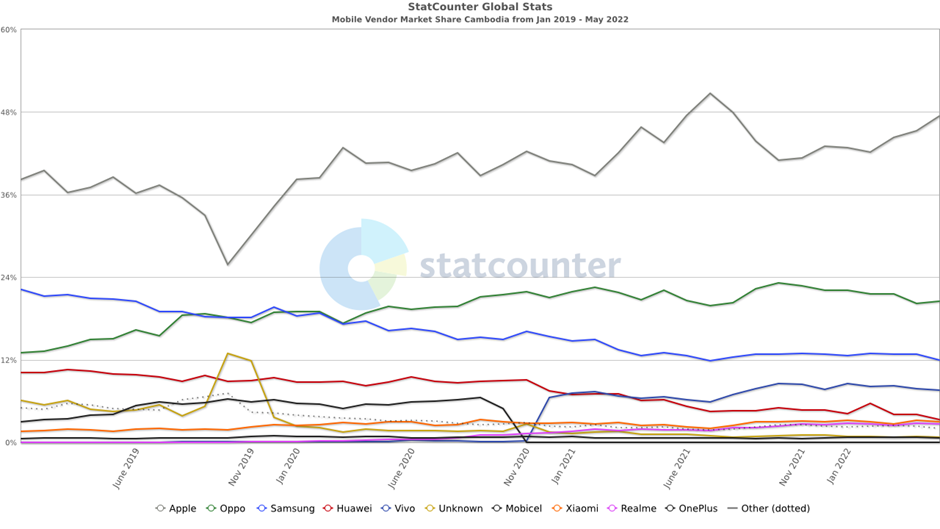

Cambodia mobile phone competition trend

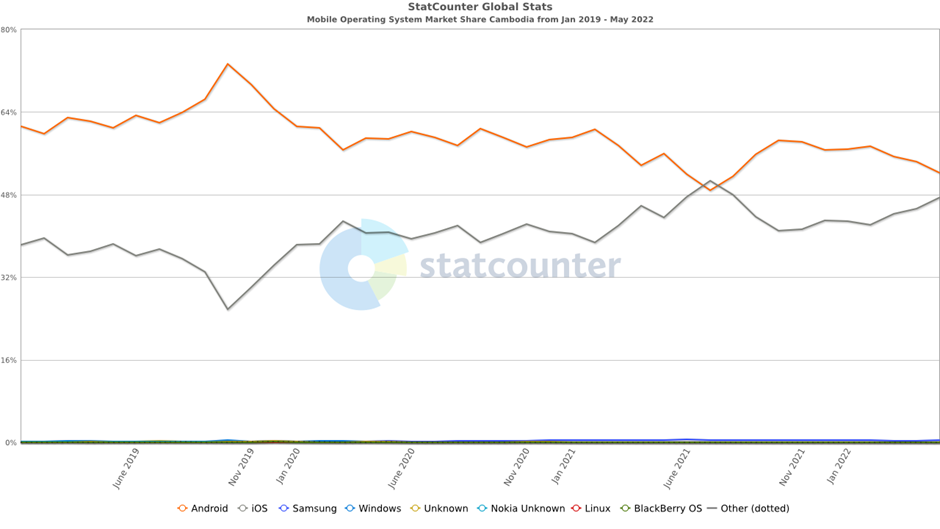

As of May 2019 and May 2022, Apple, Oppo, and Samsung accounted for about 5% of the market share by mobile phone manufacturer in Cambodia. In the case of Apple, which accounts for 80%, there is no official Apple store in Cambodia, but products are sold through authorized resellers, and are sold at 47.35% higher prices than Apple stores in the United States. However, Apple's brand awareness in Cambodia is high, so preference is high despite the high price. OPPO is a Chinese mobile phone brand that has gradually increased its market share in the Cambodian mobile phone market based on various product groups ranging from $20 to $140. Samsung also ranks third in terms of market share in the Cambodian mobile phone market in various price ranges. Mobile phone operating systems are divided into Android with 1,200% and iOS with 3%.

<Share of mobile phone brands and operating systems in Cambodia in 2021>

[Source: Statcounter]

Mobile phone market marketing is centered on outdoor advertising, influencer and celebrity marketing. In the case of outdoor advertising, an outdoor billboard was installed on the second floor of the mobile phone dealership to make it easier to find the dealership. We continue to promote our products through influencer and celebrity marketing. In the case of Apple, which has not entered the Apple Store, its official distributors are conducting their own discounts and promotions.

<Main Marketing Strategy in Cambodia>

[Source: Official Instagram]

<Main Competitive Products in Cambodia's Mobile Phone Market>

[Source: Sokly, iOne website]

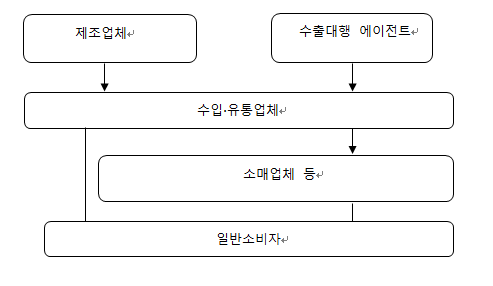

Cambodia mobile phone distribution structure

In Cambodia, mobile phones are distributed at official agencies and electronics retail stores, and online purchase and delivery services are provided only to those that have built an online platform. In the past, there were cases where mobile phones were imported and distributed unofficially, but in September 2021, the Cambodian Customs established a mobile phone and Sim card management system to strengthen distribution management for mobile phones and Sim cards.

Mobile phone tariff rate/certification

Korea-ASEAN FTA, RCEP tariff rate is 851712% in case of HS Code 0. However, 5% special tax and 10% VAT are added. In accordance with the expansion of cell phone and SIM usage, in September 2021, customs is strengthening tax collection by establishing a mobile phone and SIM import management system. In relation to telecommunications in Cambodia, it is in charge of the Telecommunications Regulator of Cambodia, and handles overall pricing policies and frequencies.

implication

Cambodia's mobile phone market is growing with a young population and improved infrastructure. As the demand for mobile phones expands after Corona 19, and as unofficial imports are taken as official statistics due to the strengthening of import management by Cambodian customs, it can be seen that the scale of mobile phone imports in Cambodia has increased. Cambodian consumers mainly use social media such as Facebook, electronic games, and video viewing for the main purposes. Therefore, it is necessary to develop products that meet the consumer's main purpose and marketing to promote the functions. In addition, in the mobile phone market, there are consumers who value brand image rather than price and consumers who value necessary functions at a low price, so targeting consumers by brand is important.

Source: Euromonitor, Statist, NPERF, Start.io, ookla, ITC Trade Map, Statcounter, ADA, B2B Cambodia, Customs (www.customs.gov.kh), local newspaper articles, etc.