– The Japanese drone industry has a growth opportunity due to the exclusion of Chinese drones

– The Japanese government is spurring the revision of laws for the practical use of drones

As one of the key growth industries for the next generation, the mobility industry including autonomous driving, robotics, and electric vehicles is attracting attention, and one of them is drones. Drones, which have been evaluated to bring about the 'industrial revolution in the sky', came into the spotlight in Japan in 2015, and a drone accident occurred at an important facility or downtown area, such as the residence of the then prime minister of Japan. . In the wake of the drone crash at the Prime Minister's office, the amendment to the Aviation Act, which legally punishes the use of unauthorized drones, was made in just 7 months. In 2015, 'drone' was included in the top 10 Japanese new words and buzzwords. And the year 2022 is expected to be the year when the Japanese drone industry enters a full-fledged growth phase. In this paper, we would like to discuss the recent status of the Japanese drone industry.

<Drone useful in agriculture>

[Source: JAVOA (National Unmanned Aircraft Flight Function Appropriate Assessment Monitoring Organization)]

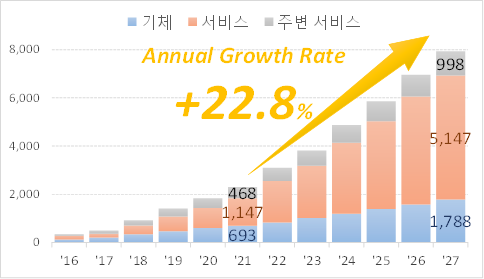

Japanese drone market size

According to a survey conducted by Impress Research Institute, a Japanese market research institute, the size of the domestic drone market in Japan was about 2021 billion yen in FY2,308, an increase of about 1,841% from the previous year (25.4 billion yen). The detailed breakdown is 693 billion yen for drone aircraft, 1,147 billion yen for service, and 468 billion yen for surrounding services. In 2027, the market size is expected to reach about 7,933 billion yen (gas 1,788 billion yen, service 5,147 billion yen, peripheral service 998 billion yen), which is 2021% when converted at an annual average growth rate (CAGR of 2027-22.8). A continuous high level of growth is expected, and the field that is expected to grow the most is the drone service market.

<Trends in the size of the domestic drone market in Japan>

[Source: Prepared by KOTRA Tokyo Trade Center based on data from Impress Research Institute]

Japan's drone industry faces growth opportunities by excluding Chinese-made drones

Until the mid-2010s, the Japanese drone market was dominated by China's DJI, the world's No. 1 drone market share, and many Japanese drone companies gave up hardware development and shifted to the service sector. However, the situation changed drastically in 2017 when the Chinese government enacted the National Intelligence Law, which significantly strengthened the authority and information collection power of the national intelligence agency. As concerns over Chinese-made drones grow globally, government agencies in Europe, including the United States, have rapidly spread the movement to restrict the use of Chinese-made drones to ensure their national security. In September 2020, the Japanese government also announced the <Policy on the Procurement of Unmanned Aerial Vehicles from Government Agencies, etc.>, and delivered guidelines to each government agency to replace risky products in order to strengthen cyber security. As a result, Chinese drones, including DJI, were excluded from government procurement, and even in the case of private drones that are expected to have a certain level of public use, such as infrastructure inspection, Chinese drones were excluded from the options.

As Chinese-made drones are being excluded from the market, Japanese drone manufacturers have a chance to grow. First of all, prior to the announcement of the Japanese government policy in September 2020, the NEDO (National Research and Development Corporation New Energy Industrial Technology Development Organization)'s "Safe and Secure Drone-Based Technology Development" project (April 9 to November 2020) was launched, and the development of high-performance small drones focused on data leakage prevention and drone hacking defense was promoted. This project was led by ACSL, a domestic drone maker in Japan, and five companies, including Japan's NTT Docomo and Yamaha Motor, participated, and standards-based design and development, including flight controllers, were carried out. And in December 4, the result is a small security aerial photography drone. this was announced In addition to complying with ISO 2021, the international standard for security products, it also has a function to encrypt and transmit shooting data and flight route data secured by drones. The data collected through the telecommunications network is also equipped with a system to accumulate and store data in the cloud in Japan. In addition, main parts of the airframe were domestically produced in Japan or procured from overseas with reliability.

<Japanese industrial small drone 'SOTEN'>

Note: Flight controller API and main parts connection specifications are being released on the website

[Source: Japan Ministry of Economy, Trade and Industry]

With the NEDO project in the lead, Japanese companies have been actively participating in the drone market since 2021. In November 2021, Sony Group launched a medium-sized drone 'Airpeak' equipped with its full-size mirrorless single-lens camera 'α'. Although this product was produced for video production such as advertisements and film shooting, it is sufficient for industrial purposes such as surveying and inspection according to the aircraft specifications. NTT Group co-founded 'NTT e-Drone Technology', a joint venture for domestic drone development with software company OPTiM and drone maker WorldLink & Company with its subsidiary NTT East Japan as its axis. It is trying to expand its entry into various industrial fields, mainly in the agricultural sector, where it has had business performance, and aims to sell 2022 units in 3, which is three times the sales volume of the previous year. In addition, in the Japanese drone market, not only venture companies specializing in drones, but also companies in other industries that can link their business development or core technologies are participating in the market from various angles, so a rapid market expansion is expected in the future.

<Sony Group's first drone product 'Airpeak' (left) and NTT e-Drone Technology's agricultural drone 'AC 101' (right)>

[Source: NIKKEI newspaper]

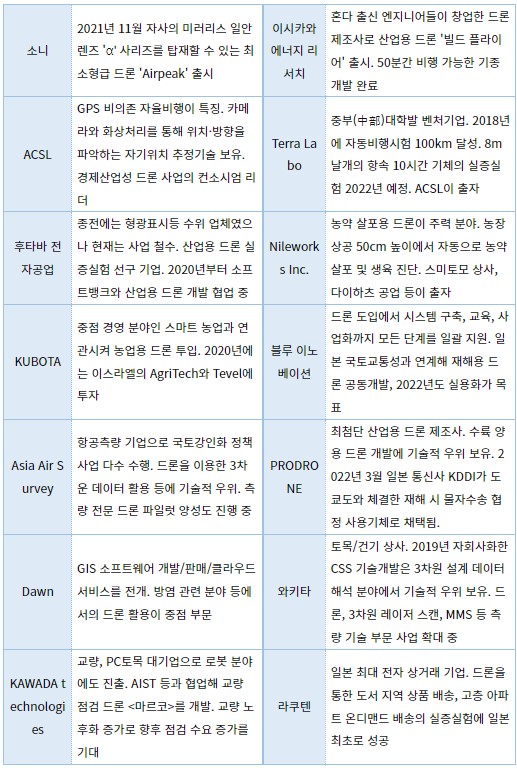

<List of major drone-related companies in Japan>

Note: 1) NEDO: National R&D Corporation New Energy/Industrial Technology Development Organization. GIS: Geographic Information System. PC: Prestressed Concrete. AIST: Industrial Technology Research Institute. MMS: Mobile Mapping System

2) The ACSL item <Ministry of Economy, Trade and Industry Drone Project> refers to NEDO's <Safety and Safety Drone-based Technology Development> project.

[Source: Prepared by KOTRA Tokyo Trade Center based on media reports and company data]

<The latest drone technology trends in Japan>

[Source: Prepared by KOTRA Tokyo Trade Center based on PR materials of each company]

The Japanese government spurs the revision of laws for the practical use of drones

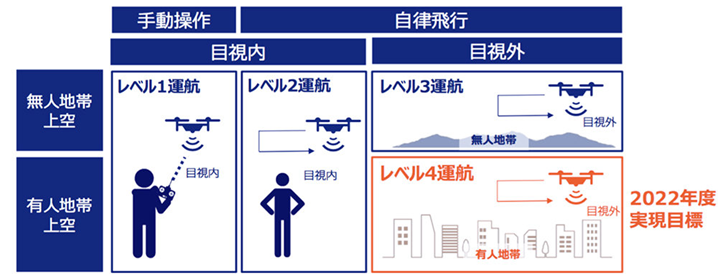

In line with the growth of the Japanese drone market, the government is actively promoting the revision of related laws. The goal of the Japanese drone industry is to develop a fully autonomous drone that responds to the drone 'Level 2022' (a level that allows drones to fly while avoiding obstacles on their own in a space where the human eye cannot reach), which is scheduled to be overhauled by the year 4. will do Japan's Ministry of Land, Infrastructure, Transport and Tourism classifies drone flight as Level 1 to Level 4, and it is expected that Level 2022 flight will be possible within the year 4 according to the revision of the Aviation Act. It is expected that the scope of use of drones will be further expanded as it becomes possible to fly in areas beyond the pilot's field of vision.

<Flying level of drones regulated by the Ministry of Land, Infrastructure and Transport of Japan>

[Source: KDDI]

As a preliminary step for the introduction of Level 4, Japan's Ministry of Land, Infrastructure, Transport and Tourism will make it mandatory to register drones of a certain size or larger as of June 2022. The mandatory registration of drones is in accordance with the enforcement of the revised Aviation Act in 6, and the newly established Article 2020, Articles 131 to 3 are the legal basis. The intention is to create an accident cause identification and safe operation regulation system under the premise that the aircraft's performance information and owner information are known. The scope of application of the mandatory registration is all drones with a weight of 14g or more that fly outdoors. The cost of the registration process varies depending on the application method, but is approximately 100 to 1,000 yen. It is also mandatory to display the registration number of the aircraft and install the remote ID function. The application is valid for 2,500 years, and more information can be found at the link below.

Note: Available in Japanese and English

Comments from experts in the Japanese drone industry

We asked Japanese drone manufacturer T, which is operating in more than 10 countries around the world, about the trends in the Japanese drone industry.

Q1: What are the main uses of drones manufactured by your company?

A1: It is mainly used for infrastructure inspection and surveying of power facilities located in places that are difficult for people to access, such as inspection of transmission lines located in mountainous areas.

Q2: Last June, the Japanese government lowered the weight of drones, which are required to be registered with the Ministry of Land, Infrastructure, Transport and Tourism, from 6g to 200g. In the future, even when operating small drones weighing more than 100g, there will be many areas to pay attention to in terms of safety. Are there any restrictions?

A2: Since the small industrial drones we are dealing with are mainly used in places where there are no people, it is expected that there will be little impact. However, it is thought that the use of small drones used for general hobby rather than industrial use may be more limited than before.

Q: What is the current safety of drones?

A: In recent years, the software technology that controls the operation of drones has grown dramatically, and the safety of drones has greatly improved compared to the past. Drones currently used in Japan have excellent software functions, so if a person is nearby, a sensor can operate to avoid it.

Q: I know that technology development to replace Chinese drones is being actively developed in Japan. Is it possible to completely replace Chinese drones?

A: As the Chinese government enacted the National Intelligence Act in 2017, Japan is also accelerating its own development to replace Chinese-made drones, but it is still not easy to replace them with the same performance as DJI at the same price. Even now, in the Japanese drone industry, China's DJI occupies the first place in the market share. However, with the support of the Japanese government, which is actively promoting the drone industry, major conglomerates are spurring their own development of drones. The future looks bright.

implication

The Japanese drone market began to grow on a full-fledged growth trajectory since the late 2010s as domestic drones were developed actively for national security. Under the active policy support of the Japanese government, major Japanese companies are spurring the development of drones and the market is expanding. The global supply chain risk is increasing as the unstable international situation continues, such as the recent COVID-2022 crisis, the US-China trade war, and Russia's invasion of Ukraine. Japan's export restrictions in 4 or the shortage of urea in the second half of 19 are examples of how dangerous it is to excessively depend on foreign countries for key items important to national security. Drones, which are widely used not only for agricultural and infrastructure inspections but also for military purposes, are one of the key items that require localization in terms of national security along with semiconductors and lithium-ion batteries. Referring to the case of Japan, where public and private cooperation is spurring drone localization, Korea also needs to focus on nurturing the drone industry and localizing core parts for drones at the national level.

Source: Japan Ministry of Land, Infrastructure and Transport, Ministry of Economy, Trade and Industry, Impress Research Institute, NEDO, KDDI, Nikkei Shimbun, website of each company and KOTRA Tokyo Trade Center