– Expansion of PCB market size due to acceleration of digital transformation

□ Basic information and market status

[Source: tradenavi]

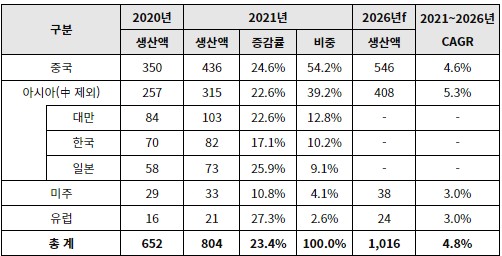

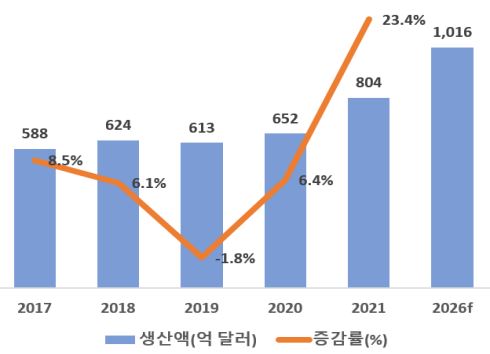

A printed circuit board (PCB) serves to mount a number of electronic components and electrically connect the components to each other, and is also called the mother of electronic products due to its importance. Currently, with the development of digital technologies such as cloud computing, 5G, big data, IoT, and AI, and the increase in demand for the use of the latest IT technologies, the importance of PCB is increasing and industrial development is accelerating. According to Prismark, the total output value of the global PCB market in 2021 recorded $23.4 billion, an increase of 804% from the previous year.

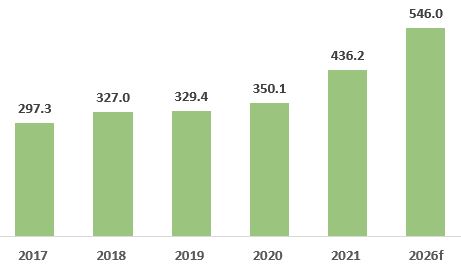

As of 2021, more than 90% of PCB production is concentrated in Asian countries including China and Japan. China has established its own value chain thanks to cheaper labor costs compared to other countries, manufacturing environment, and industrial support policies, and it is found that China occupies more than 50% of the world's PCB production. Among these, the total PCB production by region and country in 2021 showed double-digit growth rates in all regions of the world.

However, Prismark predicted that global PCB production will exceed $2021 billion from 2026 to 4.8, but the average annual growth rate will be XNUMX%, which will slow down slightly.

< Gross production by region in the global PCB market (Unit: billions of dollars) >

[Source: Prismark]

< Trend of Global PCB Total Production >

[Source: Prismark]

< China PCB Total Production Trend >

[Source: Prismark]

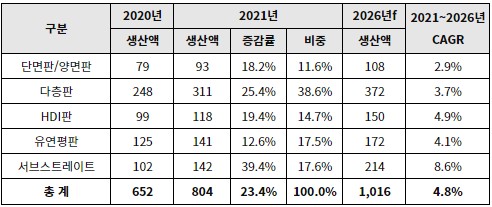

□ Production Trend

With the development of 5G technology, the communication field is the largest demand for PCBs. In particular, the demand for multi-layer boards for communication facilities and HDI boards, flexible distributors and substrates for mobile terminals is high. In addition, the PCB market showed a favorable trend thanks to the expansion of demand for digital electronic devices such as computers, laptops, home appliances, and electronic components, the government and corporations' digital transformation, and the development of the home economy. According to Prismark, each sector showed rapid growth in 2021, and the total production of substrate, multi-layer plate, and HDI plate in 2021 increased by 39.4%, 25.4%, and 19.4%, respectively, compared to the previous year. In addition, companies are making investments to expand production plants in accordance with the increase in demand by sector, and it is predicted that Substrate will grow the fastest by 2026, recording a CAGR of 8.6%.

< Trend of global total production by PCB type (Unit: XNUMX million USD) >

[Source: Prismark]

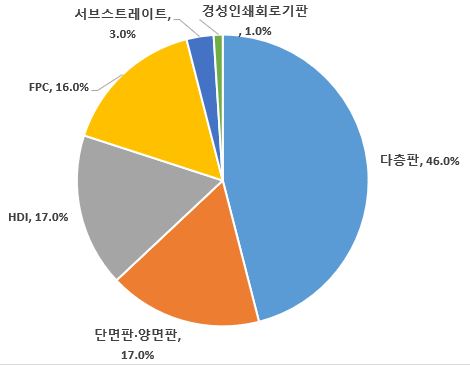

China is the world's largest PCB manufacturing country in terms of industrial scale, but looking at the product composition, it is mainly concentrated on single-sided, double-sided, and multi-layered plates, and the proportion of HDI, FPC, and substrate with higher added value is still low. According to WECC data, multi-layer board accounts for 46% of Chinese PCB products, followed by single-sided, double-sided, and HDI plates with 17% each, FPC with 16%, and substrate with only 3%. Looking at the production composition of PCB products in Taiwan, FPC is 26%, substrate 25%, multi-layer plate and HDI are 19% each, and single-sided plate and double-sided plate are 8%, showing a difference from China.

< Proportion by PCB Product in China >

[Source: WECC]

Looking at the major fields of use of PCBs, the global standard communication sector accounted for the largest share at 33%, followed by computers at 29%, home appliances at 15%, automobiles at 11%, and industrial/military engineering/medical machinery at 4% each. appeared to be The Chinese market was concentrated in these four areas with telecommunications 33%, computers 22%, automobiles 16%, and home appliances 15%, with a relatively low proportion with 4% for medical equipment and 4% for military aviation.

In the telecommunication field, it is mainly used for mobile phones, base stations, routers, and exchanges. In particular, with the commercialization of 5G, replacement and upgrade to the latest products, such as mobile phones and base stations, are necessary, and the development of industries such as IoT, where connection to the Internet is important, is creating a large demand for PCBs.

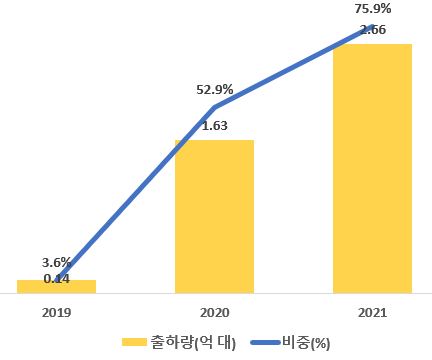

According to the Ministry of Industry and Information Technology (Ministry of Industry and Information Technology), as of 2021, 5G mobile phone users exceeded 4.5 million, and shipments of 5G mobile phones in China recorded 63.5 million units, an increase of 2.66% from the previous year. In 2019, 5G mobile phone shipments were only about 1,400 million units, and 5G phones accounted for only 3.6% of shipments. In addition, there are 2021 million 19G base stations in China, and 5G networks reach 115% of large cities, Jeonbuk and prefectures nationwide, and 97% of rural areas. expected to be installed.

< China 5G mobile phone shipments and 5G mobile phone share >

[Source: China Information and Communication Research Institute (信通院), Zhongsang Industrial Research Institute (中商产业研究院)]

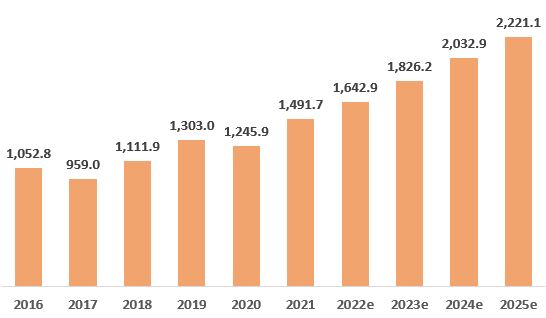

In addition, the demand for PCBs in the automobile sector is also showing a rapid increase, with single-sided plates and multi-layer plates taking up the mainstream at 73.5%, FPC 14.6%, HDI 9.6%, etc. China has been the world's largest automobile producer for more than 10 years, and the production and sales of new and renewable energy vehicles in 2021 recorded 330.8 million units and 298.9 million units, respectively. In particular, FPC is widely used in automotive displays, electronic equipment, engine systems, and automatic safety systems such as sensors, and the market is gradually expanding. Although there have been some ups and downs due to COVID-19, the market is expected to grow to about 2021 billion yuan in 1,500 and record a compound annual growth rate (CAGR) of 2025% until 10.5.

< Trend of FPC market size in China (Unit: XNUMX million yuan) >

[Source: Huajing Market Research Center]

□ Competitive trends

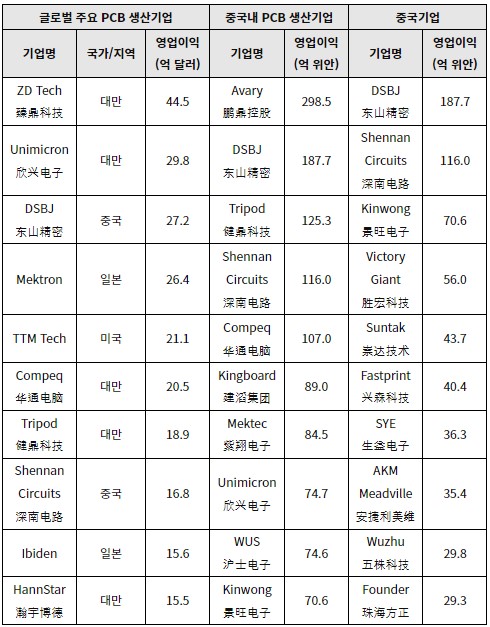

Looking at the list of the top 100 global PCB producers selected by NTI, Taiwanese companies ranked first and second in terms of operating profit, with ZD Tech (臻鼎科技) and Unimicron (欣兴电子), and there are 1 Taiwanese companies in the top 2. it was exhausted Two Chinese companies in the top 10 were DSBJ (东山精密) and Shennan Circuits (深南电路) in 5th place. In addition, two Japanese companies such as Mektron and Ibiden and one American company such as TTM Tech were included in the top 10 companies.

Meanwhile, Avary Holding (鹏鼎控股) occupied the largest proportion of production companies in China, and DSBJ (东山精密), China's largest production company, ranked second. Meanwhile, according to Prismark's data, the proportion of the top 2 Chinese manufacturing companies in terms of operating profit was 10%, indicating a high concentration of conglomerates.

< Major PCB producers >

[Source: NTI]

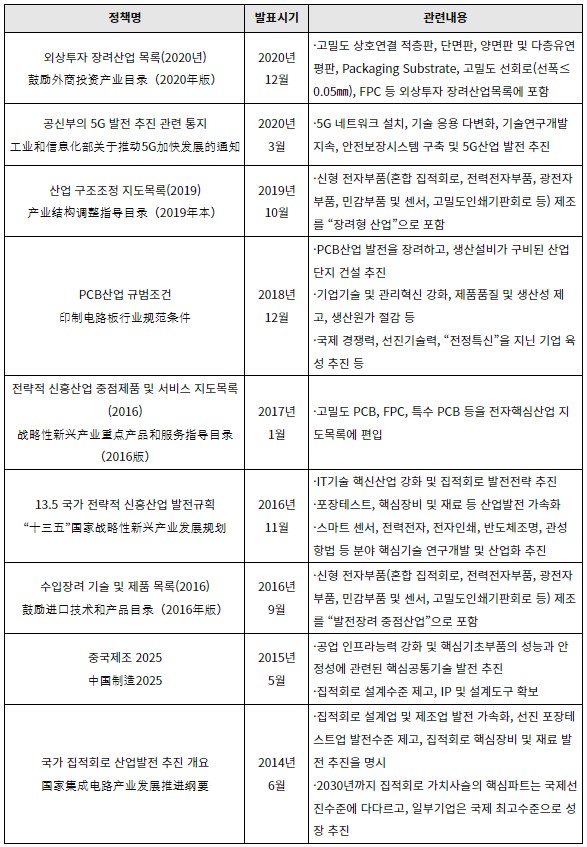

□ Government Policy

Although China's PCB market is already the largest in the world, PCBs are important as parts used in various industries in addition to the high-tech IT industry. It supports industrial development.

< China PCB industry related laws and policies >

[Source: Guangzhou Trade Center Organized]

□ Import trend, certification system and distribution structure

China has steadily expanded its production capacity, and since 2013 PCB exports surpassed imports, it has maintained its status as a net exporter. In particular, exports in 2021 recorded $38 billion, up 208% from the previous year, and exports to the top 10 exporting countries all recorded an increase of more than 30%. It is analyzed that this is due to the investment of foreign companies for production in China and the improvement of technology of Chinese companies.

As a result, imports continued to decline, but in 2021, it recorded $13 billion, an increase of 123% compared to the previous year. In particular, it is analyzed that this is because high-tech products are still more dependent on imports due to technological differences. As of 2021, the largest import target country was Taiwan, which recorded $34 billion, followed by Japan, South Korea, Vietnam, and Thailand.Excluding 19, when Corona 2020 broke out, imports from Korea were about $16.8 billion, and the proportion was maintained at 13-14%.

< China PCB Import Status (Unit: USD million, %) >

[Source: Korea International Trade Association]

< China PCB Export Status (Unit: USD million, %) >

[Source: Korea International Trade Association]

In addition, there is no certification that must be obtained when exporting to China. In addition, since PCBs are not final products, they are delivered directly or through agents to end-product manufacturers such as telecommunications, computers, automobiles, and electronic consumer goods, and online B2B transactions are being actively conducted.

□ Prospect

The digital transformation around the world has been accelerating due to COVID-19, and the demand for PCBs for digital devices has increased significantly. In addition, as supply chain uncertainty increases, the production method of companies has changed from JIT (Just-in-Time) to JIC (Just-in-Case), and as more inventories are accumulated, an opportunity for further growth of the PCB market has been prepared. Thanks to this, the growth rate of total PCB production in 2021 recorded 13~14%, and the price is also showing an upward trend according to the demand. In addition, China is already the largest PCB producer in the world, recording the largest scale in both supply and demand.

As a result of an interview with the supply chain manager of a Chinese PCB company, the PCB industry has become very important due to the digital transformation, but in particular, thanks to the “carbon peak and carbon neutral” policy of the Chinese government, the demand in the automobile sector has greatly increased and developed. This is expected to accelerate. It is expected that the demand for PCBs will increase according to the demand for automobile safety, smartization, and eco-friendliness.

On the other hand, China is currently the largest producer, with many producers and a large market size, but it is predicted that dependence on high-end imported products will continue due to the technological gap with foreign producers. It seems necessary to carefully monitor business opportunities and power generation demand based on a large market size and seek opportunities for market entry.

Source: China Printed Circuit Association (CPCA), International Data Center (IDC), Prismark, China Chain Management Association (CCFA), Guo New Securities and Economic Research Institute , vzkoo.com(未来智库), WECC(World Electronic Circuits Council), NTI, Canalys, Guangzhou Trade Center