– Establishment of a virtuous cycle in the startup ecosystem through active public offering (IPO) and mergers and acquisitions (M&A)

– Including the birth of the 100th unicorn company in India, 21 unicorn companies were created in '1

In August 2015, Prime Minister Narendra Modi announced the 'Startup India, Standup India' agenda to foster India as a startup powerhouse. fostering policies have been implemented.

In 7, about 2022 years later, India has become a startup powerhouse with the world's third-largest startup ecosystem. In the 3 Global Startup Ecosystem Index published by Startup Blink, a global startup ecosystem research center, India ranked 2022th out of the top 100 countries, and India out of the top 19 cities. of Bengaluru (100th), New Delhi (8th) and Mumbai (13th).

India Startup Ecosystem

According to the Ministry of Commerce and Industry of India, the size of startups in India has grown rapidly over the past six years, with the number of startup registrations growing by 6% from just 2016 in fiscal 17/733 to 2022 as of March 3, 14. Also, according to the 6-5861 Economic Survey of India published by the Ministry of Finance, at least 880 startups were established during this fiscal year, showing more rapid change recently.

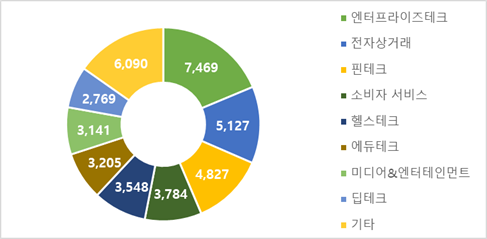

According to the '42 Annual Indian Startup Funding Report' of India's leading startup media platform Inc2021, there are about 2021 'active startups' in India counted in 3. Enterprise tech startups focused on providing services accounted for the largest number with 9960 companies, accounting for 7469% of the total startups, followed by e-commerce startups with 18.7 companies, accounting for 5127%.

* Active Start-up is a word used by the platform to express an active startup.

<India Active Start-up Industry Distribution>

[Source: Inc42 Plus]

According to a report by Indian venture capital firm Orios Venture Partners, the amount of investment from startups completed in India in 2021 totaled $420 billion, a 119-fold increase from $3.6 billion in the previous year. % increase to 953 cases. This is because India has rapidly emerged as an alternative investment destination as the Chinese government's successive corporate regulations, the real estate crisis in China, and power shortages overlapped. Tiger Global Management, an American investment company, invested about $66 billion in 1,583 start-ups in India in 2021, and SoftBank, which has invested a total of $47 billion in India by 70, will hold the Indian economy in 2021. At the forum, they announced that they are willing to invest between $140 billion and $2021 billion in 2022.

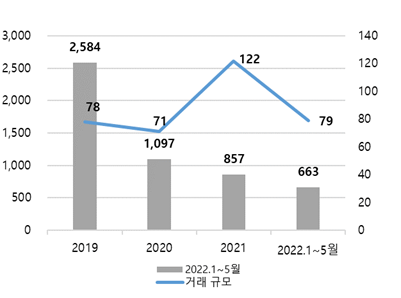

<Changes in the amount and number of investment attraction for startups in India>

[Source: inc42 Plus]

Unicorn company status

According to NASSCOM’s “Indian Tech Start-UP Ecosystem 2021” report, a total of 2021 unicorn companies in 18 fields were newly established in 42, and about 2025 companies are expected to be listed as unicorn companies by 200. is becoming This rapid increase in the number of unicorn companies in India proves that the enthusiasm for startups and startups in India, the basis of unicorns, is hot.

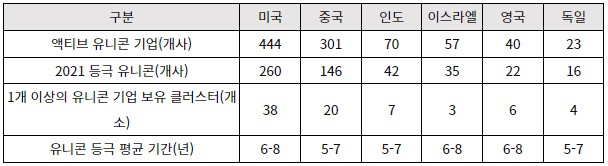

< Status of Top Unicorn Companies (As of 2021) >

[Source: NASSCOM]

In May 2022, India's 5th unicorn company was born, and according to Inc100's “Decoding India's 42 Unicorns” report, the enterprise value of 100 unicorn companies reached $ 100 billion, and a total investment of about $ 3,330 billion has been attracted so far. The main business fields of Indian unicorn companies are e-commerce (900 companies), fintech (23 companies), and enterprise tech (21 companies), and major cities are Bangalore (19 companies), Delhi-NCR (39 companies), and Mumbai ( 32 companies). The rapid growth of unicorns in India can be attributed to a variety of factors, including a young population, the government's policy to nurture the technology industry, deregulation, cheap telecommunications, abundant Internet users, and adoption of English as an official language.

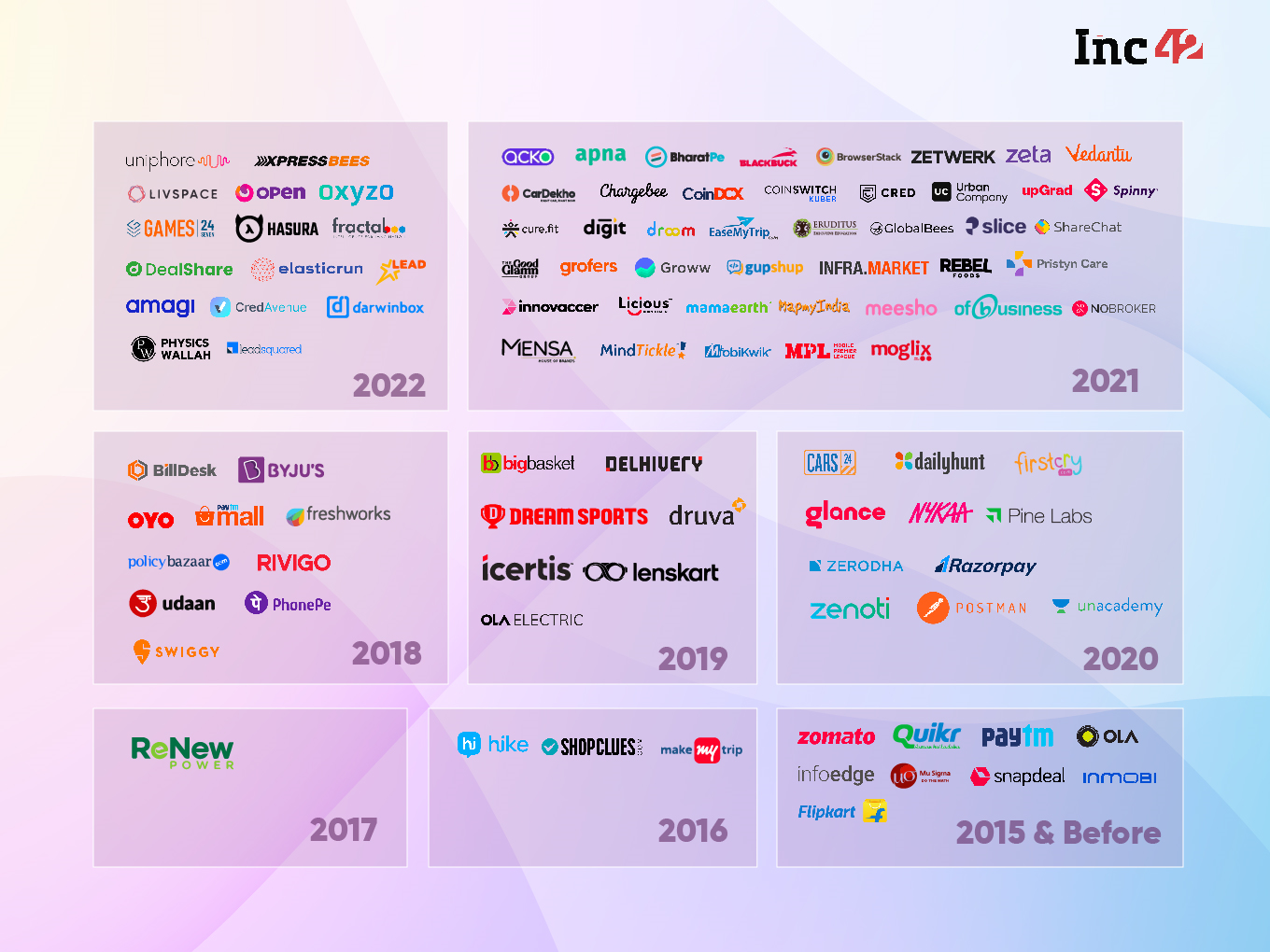

<Companies that have entered the Indian Unicorn Club>

* Note: As of June 2022, 6, India produced the 22rd unicorn company

[Source: Inc 42]

In the case of 'MENSA', an Indian e-commerce company that has recently become a unicorn, the enterprise value reached $6 billion within 10 months of being the first company in India to be established, and 'GlobalBees' also became a unicorn company within 7 months of its establishment. Before 2010, it took an average of 12.1 years for a company to become a unicorn company, but it has been drastically reduced to an average of 2010 years since 5.5. .

In addition, Zomato (food delivery), Policy Bazar (insurance tech), Paytm (fintech), and Nykaa (online and offline cosmetics distributor) succeeded in IPOs, and edutech company BYJU's and food delivery company Swiggy launched Deca It became a cone (enterprise value of $100 billion). Also, according to INC42, there are currently about 100 'Soonicorns' companies in India, meaning companies with the potential to become 'Soon' unicorn companies, with a total value of $360 billion. reach

<Listed among Indian startups in 2021>

(Unit: billion dollars)

[Source: Inc42]

According to NASSCOM, following the listing of 2021 companies in 11, IPOs of 2022 startups such as Urban Company, Swiggy, BYJU's, and Blinkit will take place in 16. He wrote the Draft Red Herring Prospectus (DRHP) and predicted that the successful IPO of Indian startups will continue.

The number of startups that entered the ranks of unicorns in India was 2016 to 1 a year until 3, but 2021 in 42, the largest number of unicorn companies in history. However, it is pointed out that Indian unicorn companies with inflated corporate values are living like zombies without receiving additional investment. In particular, focusing on increasing the number of platform users, the company has secured users by applying a high discount rate in the early stages, but there are cases in which the hiring of personnel has been stopped due to the absence of a profitable business model. An official of India Quotient, which has invested in more than 2012 startups since 70, predicted, “There has been no economic slowdown like now in the past 5 or 6 years, and there will be many zombie unicorns.” As such, it is a worrying situation that unicorn companies may not successfully perform IPOs, etc., and may become zombie unicorns due to slowing investment.

Active start-up M&A

In order to recover (exit) the money invested in the startup ecosystem, it is common to take the above-mentioned methods of listing on the stock market (IPO) or selling a company (M&A). M&A, which is one of the startup exit methods, is an important part because an environment in which successful startups can smoothly recover funds can be created to form a virtuous cycle that leads to reinvestment again. India is a country where M&A between startups or between large companies and startups is active, and this trend has supported India's establishment of the third largest startup ecosystem.

According to the “2022 Dealtracker” report by Grant Thornton Bharat, an accounting and management advisory firm, the total number of M&A deals in India in 2021 was 499, of which startup M&As accounted for 24.4%, or 122 cases, the most, with a deal size of about 8 million. It amounts to 5700 million dollars. Of the 122 cases, 114 occurred within India, while the remaining 8 involved mergers and acquisitions from foreign companies. In 2022, about 5 startup deals took place by May, and more active mergers and acquisitions of startups are expected in 79.

<Startup M&A Transactions by Year>

(Unit: cases)

[Source: Grant Thornton Bharat 'Deal Tracker']

According to data from U.S. consulting firm Bain&Company, in contrast to 50-2017, when mega M&As worth USD 2019 billion occurred mainly, mid-size M&As worth USD 2020 million to USD 2021 billion were predominant in 5-10, First-time companies accounted for 80% of the total. This can be seen as a major influence on the trend of startups and unicorn companies growing in size by acquiring existing companies or other startups to expand their products and markets based on the invested funds.

<Major Startup M&A in 2021>

(Unit: million dollars)

[Source: Inc42 PLUS]

Startup India

After Prime Minister Modi announced the Start-up India policy in January 2016, the Indian government eased relevant regulations to promote entrepreneurship, while operating the Start-up India program through Invest India, a national investment attraction agency, to actively encourage entrepreneurship. is encouraged and supported.

The related policies are as follows.

– Refunds from 50% to 80% of fees required for administrative procedures such as patent applications and trademark applications by startup companies

– Establishment of government-level startup investment fund through Indian Small and Medium Business Development Bank (SIDBI)

– Support for legal advice and resolution of difficulties for startup companies on regulatory and financial issues through Start-up India

In the six years since the announcement of the policy, the number of startup investors in India has increased 6 times, the amount of investment 9 times, and the number of incubators 7 times.

Prospects and Implications

Looking at the data of China's Hurun Research Institute, most of the new entrants in China's wealthiest list came from the electric vehicle (EV) sector, but India's growth in that sector is still insignificant. Therefore, it can be predicted that unicorn companies will appear in large numbers when electric vehicles lead the Indian automobile industry in the future. In addition, it is worth noting that, in addition to startups in the IT & e-commerce sector, which have been strong for the past year, there have been many unicorn-listed companies in various fields such as education and health tech.

According to NASSCOM, Indian startups attracted $2021 billion in investment in 2020, a threefold increase from $82 billion in 3, and this trend is expected to continue in 241. It also predicts that product and market expansion will be a priority for well-funded startups and companies, and startups' mergers and acquisitions will continue to accelerate throughout 2022. In particular, the merger of Edutech, Consumer Tech, and Enterprise Tech is expected, which is expected to provide a strong tailwind for the startup ecosystem.

But the Indian startup industry isn't the only bright spot. According to Foreign Policy data, a US foreign and security magazine, as well as zombie unicorns due to the slowdown in investment, most Indian startups are digital industries such as e-commerce and delivery apps, but the related infrastructure is not properly built, so the sustainability of investment expansion is small. Gender discrimination is also a challenge. According to data from US consulting firm McKinsey, the contribution of Indian women to gross domestic product (GDP) is 18%, the lowest in the world. It is also difficult to generate high operating profit due to the nature of Indian consumers who prefer cheap products. It should also be borne in mind that the Indian startup ecosystem is mainly made up of local companies, making it difficult for foreigners to establish startups and network locally.

Source: Local media (Live mint, CNBC TV18, Business Standard, The Economic Times, etc.), Industry and Trade Promotion Agency (DPIIT) under the Ministry of Commerce and Industry of India, INC42 start-up report, NASSCOME, Grant Thornton Bharat, Startup Blink, KOTRA New Delhi Trade Center data Synthesis