– Germany’s charger market is growing due to increased demand for electric vehicles

– In order to establish a strategy for entering Germany, we need to pay attention to the increase in demand for home wall-mounted chargers.

Product name and HS CODE

Product Name: Electric Vehicle Charger

HS Code: 850440 (Static converter – including rectifier, inverter, AC converter, DC converter, etc.)

The German federal government has set a plan to reduce Germany's greenhouse gas emissions by 2030-1990% compared to 55 by 56, and in the transport sector, it aims to reduce 40-42%. Since electrification of road transport is particularly essential to meeting the transport sector's carbon reduction targets, the federal government set a plan to supply 2019 million electric vehicle charging stations in the 2030 Climate Protection Program announced in 100. With the active support of the federal government, the German electric vehicle charging facility and charger-related market is positioned as a market with great potential.

Electric Vehicle Market Trend

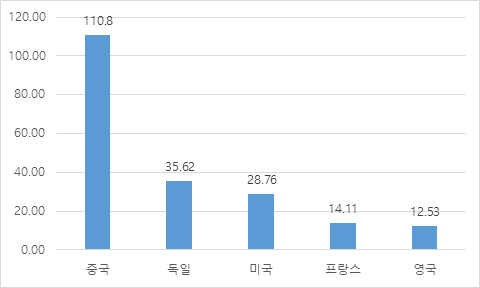

According to Statista, a statistical information provider, the total sales of electric vehicles in Germany in 2022 is expected to be about 356 billion euros. This is the second largest market in the world after China (6000 billion euros) and the number one market in Europe.

<Top 2022 countries based on estimated sales of electric vehicles in 5>

(Unit: billion dollars)

[Source: Statista]

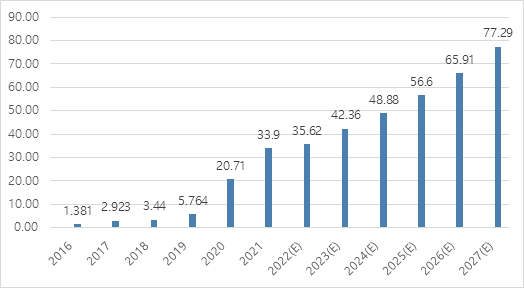

The German electric vehicle market is also growing significantly thanks to the federal government's eco-friendly vehicle expansion policy and electric vehicle subsidy support. According to Statista, Germany's electric vehicle market sales in 2021 will reach 339 billion euros, up 63.6% from the previous year. Statista forecasts that the electric vehicle market in Germany will grow at a CAGR of 2022% from 2027 to 16.7, reaching a market size of about 2027 billion euros in 772.

<Germany Electric Vehicle Sales Trend>

(Unit: billion dollars)

[Source: Statista]

German electric vehicle charger market trends

As electric vehicle sales increase, electric vehicle charger sales are also rapidly increasing. Total sales of electric vehicle chargers in Germany in 2021 were 1 million euros, an increase of 2970% from 2020, and this rapid growth is expected to continue. The market is expected to grow at a CAGR of 116.2% over the next five years from 2022 to form a market size of 5 billion euros by 39.8.

<Germany Electric Vehicle Charger Sales Trend>

(Unit: million dollars)

[Source: Statista]

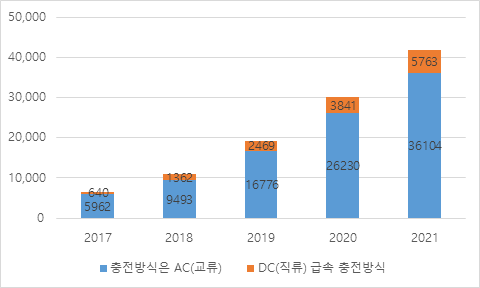

As of 2021, as of 36,104, there are 5,763 AC (alternating current) slow charging stations and 41,867 DC (direct current) fast charging stations, a total of 5 charging stations in Germany. According to the Federal Network Agency (Bundesnetzagentur), the number of slow charging stations has increased significantly over the past five years, while DC (direct current) fast charging stations have shown a modest increase. Therefore, it can be judged that Germany is expanding its EV charger infrastructure with a focus on slow chargers.

<Trend of charging stations by charging method in Germany>

(Unit: Pieces)

[Source: Statista]

Although the EV charging infrastructure is being expanded, the supply of EV charging stations in Germany still does not meet the demand. According to statistics from the Federal Ministry of Motor Vehicles and Transport (Kraftfahrt-Bundesamt) and the Federal Network Agency (Bundesnetzagentur), between 2020 and 2021, the number of electric vehicles has increased about threefold, while charging stations have only doubled.

In addition, when looking at the distribution of public charging stations by region (as of June 2022), there is a large regional variation in the number of charging stations. Mainly, there are more charging stations in southern Germany than in northern Germany, and more charging stations are distributed in West Germany than in former East Germany. For example, the number of EV charging stations in Bavaria in southern Germany is the sum of the charging stations in the northern German states of Schleswig-Holstein, Mecklenburg-Vorpommern and Brandenburg. about three times more than

<Status of EV charging stations in Germany as of June 2022>

(Unit: Pieces)

Note: slow charging station (blue), fast charging station (orange)

[Source: Bundesnetzagentur]

Meanwhile, with the increase in electric vehicles, the charging infrastructure for home use is also increasing. According to the Federal Department of Transportation (Bundesverkehrsministerium), since the start of subsidies for wall-mounted electric vehicle chargers, more than 2020 applications have already been submitted by the end of November 30, with 10 out of 9 being used at home or at work.

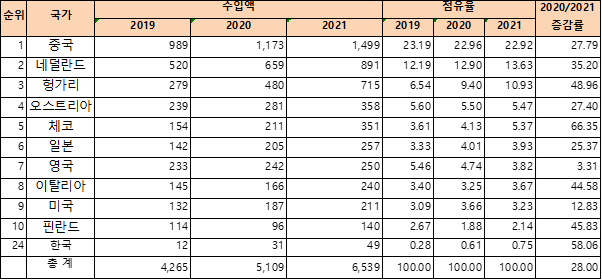

German electric vehicle charger import trend

HS code 850440 refers to various converters including stationary converters. As of 2021, Germany's total imports of stationary converters amounted to approximately $65 billion, an increase of 3900% compared to last year. As of 28, China, the Netherlands, Hungary, Austria and the Czech Republic form the top five countries in the static converter import market, with a market share of about 2021%. As of 5, Germany's imports to Korea amounted to 58.3 million dollars, an increase of 2021% from the previous year. Although the share of imports is not high at 4900th, the amount of imports is increasing significantly every year.

(Unit: million dollars)

[Source: Global Trade Atlas]

Competitive trends and distribution structure

As of June 2022, 6, a total of 1 companies are operating charging stations in Germany, and representative companies include EnBW mobility+ AG und Co. KG, Charge-ON GmbH, Allego GmbH, EWE Go and Westenergie Metering GmbH. The largest charging station operator is EnBW mobility+ AG und Co. KG operates a total of 3,950 charging stations, followed by Charge-ON GmbH with 5, Allego GmbH with 3,777, EWE Go with 2,172 and Westenergie Metering GmbH with 2,128.

<The number of charging stations of major German electric vehicle public charging station operators in 2022>

(Unit: Pieces)

[Source: Statista]

German household electric vehicle charger products

Most charging station operators also offer home wallbox charger models. EnBW and EWE Go provide chargers for individual customers or in cooperation with partners (Heidelberg and EnBW).

<Home electric vehicle charger products>

[Source: each company website]

tariff rate

After the announcement of the Korea-EU FTA, the tariff rate for Korean stationary converters (HS code 850440) is 0%. However, when exporting more than 6000 euros per export to the EU, you must apply for a certified exporter through the Korea Customs Service as you must be designated as a certified exporter of origin by Korean customs to receive the preferential FTA tax rate in trade transactions with EU member states.

Regulation and Certification

The required certification is CE, and other connector standards (IEC 62196 or IEC 62752, etc.) and charging interface standards (DIN EN 61851) must be met.

All publicly accessible charging stations installed after 2016 June 6 must provide integrated connectors after the charging station adjustment (Ladestationverordnung).

- For DC (direct current) fast charging, each charging station must be equipped with at least one type 2 socket or type 2 vehicle connector.

- In addition, each charging station must be equipped with at least one combo type 2-CCS vehicle connector.

- For alternating and direct current charging, each charging point must be equipped with at least one combo type 2-CCS vehicle linkage.

Combo Type 2–CCS CHA Demo (a rapid charger standard developed by Tokyo Electric Power Corporation)

[Source: Bundesnetzagentur]

Prospects and Implications

Germany's electric mobility market is one of the largest in the world. However, the infrastructure of public electric vehicle charging stations, the core of electric mobility, is not keeping up with demand despite the German government's efforts. Currently, 90% of car chargers in Germany are home chargers installed at home or at work. However, this situation in Germany, which lacks public infrastructure, can provide several opportunities for Korean companies to enter the German market. This is because Korean electric vehicle charger manufacturers are showing strength in the home charger field. In addition, cooperation with public charging station construction companies can be one way to advance into Germany.

Source: Statista, Global Trade Atlas, Bundesnetzagentur, Bundesverkehrsministerium, Bundesverband der Energie- und Wasserwirtschaft, VDA, AutoBild, Pixabay and KOTRA Hamburg Trade Center