U.S. Department of Energy announces 'National Clean Hydrogen Strategy and Roadmap' for transition to hydrogen economy

Focus on promoting the use of hydrogen in industries with high carbon emissions, reducing the cost of clean hydrogen, and establishing a local hydrogen supply chain

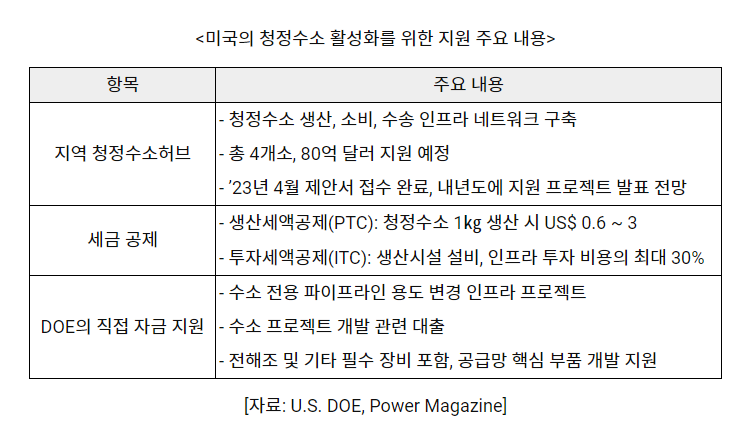

Since the inauguration of the Biden administration, the United States has set a goal of achieving carbon pollution-free in the power sector by 2035 and ultimately reaching 'Net-Zero' by 2050, providing all-round support. is taking the lead in In particular, attention is paid to clean hydrogen with no carbon emissions, and the '2021·6·10·1' plan will be launched in June 1 to reduce the cost of clean hydrogen production to 1 dollar per 1 kg within 1 years through 'Energy Earthshots-Hydrogen shot'. 4' Goal was established. The Infrastructure Act (IIJA) passed in the same year allocated $80 billion for the construction of four regional hydrogen hubs, $10 billion for water electrolysis technology, and $5 million for research and verification of clean hydrogen development, Sanun, Songjeo, and Jang projects. Officially declared large-scale policy support to build a hydrogen economy. The subsequent Inflation Reduction Act of 2022 (hereinafter referred to as 'IRA') will support tax credits and incentives for clean hydrogen production and investment, while expanding benefits for carbon capture, storage, and utilization technology (hereinafter referred to as 'CCUS') to support hydrogen. We are actively promoting private sector participation throughout the ecosystem. As America's practical efforts for energy transition are accelerating, the U.S. Department of Energy (DOE) announced the 'National Clean Hydrogen Strategy and Roadmap' in June, announcing a blueprint for building a full-fledged clean hydrogen ecosystem. There is a bar.

Clean hydrogen, an essential task to reach net zero

Clean Hydrogen is renewable, produced using electrolysis using nuclear energy, biomass, or fossil fuels, but the carbon emitted during the process is captured and stored, eliminating a significant amount of emissions. It refers to hydrogen. According to the U.S. Clean Hydrogen Production Standard (CHPS), clean hydrogen is defined if less than 1 kg of carbon dioxide is emitted when producing 4 kg of hydrogen, and this is defined as 'well-to- Based on the 'gate', if carbon emissions generated at the production site are based, carbon dioxide emissions are less than 1kg when producing 2kg of hydrogen.

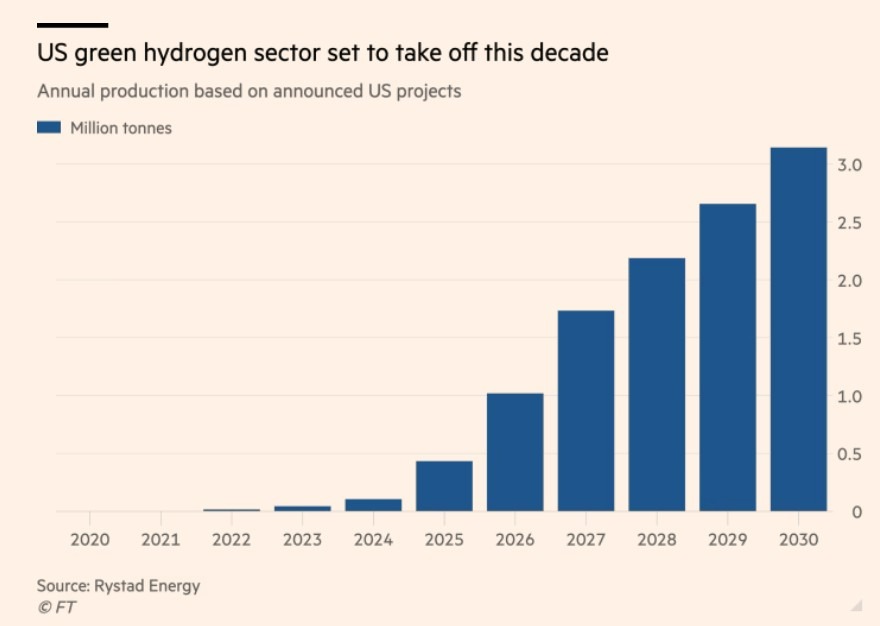

Hydrogen is also classified by color depending on the production method. By-product hydrogen produced as a by-product during the petrochemical or steel smelting process or extracted hydrogen extracted through natural gas is defined as gray hydrogen. Such by-product hydrogen or extracted hydrogen is produced Because it emits about 10 times more carbon dioxide than the amount of hydrogen produced, it is not included in the scope of clean hydrogen. However, when combined with CCUS technology, carbon dioxide is significantly removed and blue hydrogen is converted into clean hydrogen based on the aforementioned emission standards. can be defined. Meanwhile, hydrogen produced through water electrolysis based on renewable energy such as solar power, wind power, and hydroelectric power generation is classified as green hydrogen. Green hydrogen is more active for carbon neutrality because no carbon dioxide is emitted during the production process. This is the type of production that should be made, but commercialization is currently difficult due to high costs. However, the IRA, which was passed at the end of 2022, promised a production tax credit of up to $1 per kg for green hydrogen production (Section 3V Produce Tax Credit) and an investment tax credit based on employment size, which will encourage the expansion of private investment in the green hydrogen sector. It served as an opportunity to further promote it. According to Rystad Energy, an energy research company, green hydrogen production in the United States, which was almost non-existent before the IRA, is expected to expand significantly starting with the IRA and reach about 45 million tons by 2030.

<Forecast for U.S. green hydrogen production by 2030>

[Source: Rystad Energy, FT]

Announcement of the U.S. government's clean hydrogen economy blueprint, 'National Clean Hydrogen Strategy and Roadmap'

On June 6, the U.S. Department of Energy (DOE) announced the 'National Clean Hydrogen Strategy and Roadmap', which contains the current status of hydrogen production, storage, sales, and use in the United States and mid- to long-term strategies for entering the clean hydrogen economy. In order to achieve carbon neutrality in 5, the roadmap focuses on producing clean hydrogen, increasing production by reducing costs across the supply chain, and strengthening regional hydrogen production networks. Specifically, 2050 million tons per year by 2030 and 1000 million tons per year by 2040. The goal is to achieve domestic production of 2000 million tons of clean hydrogen per year by 2050 and create 5000 new direct and indirect jobs across the value chain, including clean hydrogen infrastructure, engineering, production, and raw material supply chain, by 2030.

The United States' future actions on clean hydrogen are expected to be realized based on the following three basic strategies. Specifically, △ actively expanding the use of clean hydrogen in areas where decarbonization is difficult, △ '1· Realizing the '1·1' goal, △ strengthening regional networks by building large-scale hubs, storage, and transportation infrastructure in areas adjacent to demand. In the short term, hydrogen reduction will begin with introduction in areas such as hydrogen forklifts, heavy equipment, and clean ammonia production. Through technology introduction, it is expected to be introduced in fields such as steel production, power generation, and small ship transportation, and in the long term, it can also be introduced to eco-friendly fuel production through cement, methanol, and PTL (Power-to-Liquid).

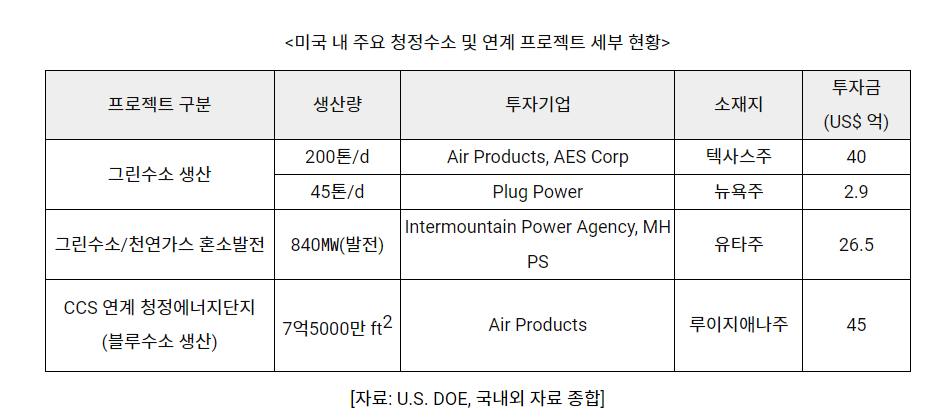

U.S. companies actively promote clean hydrogen projects

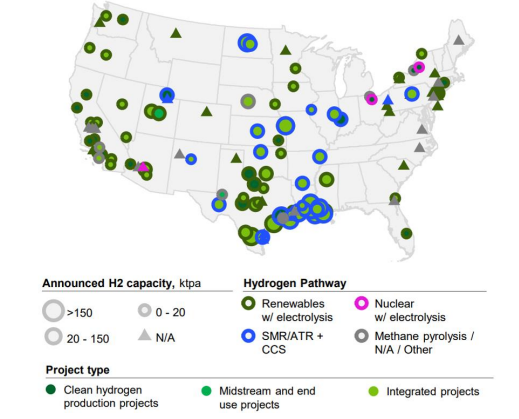

Thanks to such policy support, U.S. companies are actively participating in the development of various projects across the clean hydrogen ecosystem, from clean hydrogen production to end use, across the U.S., especially wind, hydro, and solar power plants of large utility companies in the U.S. It is expected that green hydrogen production linked to new and renewable energy development and hydrogen power generation projects using it will become more active.

<Distribution of planned clean hydrogen projects in the United States>

[Source: US DOE]

As of the end of 2022, if clean hydrogen production projects announced in the United States complete final investment, construction, and commissioning by 2030, the annual clean hydrogen production in the United States is estimated to reach 1200 million tons, exceeding the Department of Energy's target. As most projects are still awaiting final investment decisions, securing long-term and stable off-take* contracts is expected to be a decisive factor in realizing these projects.

Note*: A long-term contract to purchase a specific share of the output produced.

implication

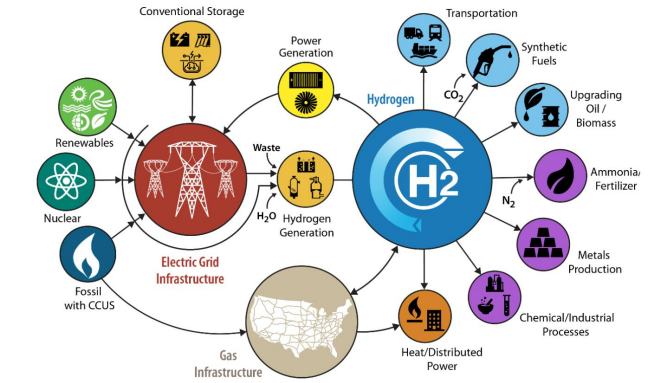

Currently, in the United States, hydrogen is used in the ammonia production process for oil refining, steel, petrochemicals, and fertilizer production. In fact, most of the hydrogen currently consumed for industrial purposes is produced through fossil fuels (mainly natural gas), so the transition to a clean hydrogen economy is difficult. It is expected that there will be significant potential in reducing the carbon emissions of these 'high-carbon emissions' industries. In addition, hydrogen fuel cells can not only replace truck or aviation fuel in the (long-distance) transportation field with high carbon emissions, but can also be used in hydrogen fuel cell power plants as a means of power generation to replace fossil fuels.

<Scheme of utilizing clean hydrogen to realize decarbonization>

[Source: US DOE]

To date, it cannot be said that clean hydrogen can completely replace fossil fuels due to economic feasibility issues due to its relatively high cost, but through the U.S. government's active investment and support measures in the overall clean hydrogen value chain, green hydrogen production technology using water electrolysis is being developed. Blue hydrogen production projects linked to renewable energy and carbon capture are expected to become more active. Accordingly, our companies are seeking niche markets in the mid-downstream sector, especially hydrogen storage and transportation, fuel cells, and charging stations, through active monitoring of U.S. clean hydrogen technology development trends and related policies and continuous technology development. Although it is still in the early stages, it is necessary to establish networks and partnerships with relevant local companies in the entire hydrogen ecosystem, including distribution, logistics, and maintenance, in order to enter the hydrogen mobility market, which is expected to gradually expand starting with California. .

Source: Compilation of data from IEA, Reuters, US DOE, Rystad Energy, Power Magazine, Financial Times, KOTRA Dallas Trade Center