China accelerates the growth of related companies through various hydrogen industry development policies

Seeking opportunities for Korean companies to enter the market following the formation of China’s hydrogen industry value chain

Status of hydrogen energy in China

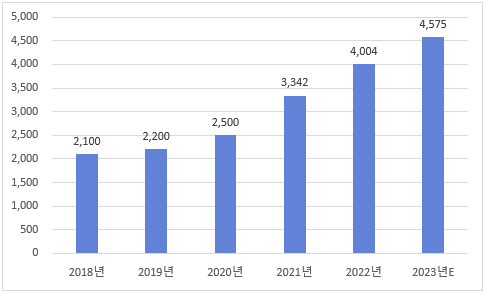

Hydrogen energy is one of the representative clean energies. The main by-product after power generation is water, and it is considered the least polluting energy source among existing power generation methods. China is also intensively fostering the hydrogen energy industry, focusing on the central government's zero-carbon emissions policy. In particular, China has become the world's largest hydrogen producer as of 2022, and according to data from the China Coal Industry Association, China's hydrogen production in 2022 is 4004 million tons, a 32% increase from the previous year.

<China’s hydrogen energy production trend from 2018 to 2023>

(Unit: XNUMX tons)

[Source: China Coal Industry Association]

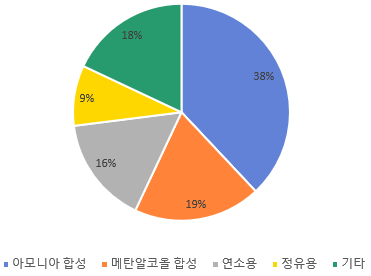

Looking at the current hydrogen demand structure in China, about 38% of hydrogen energy is used for ammonia synthesis, 19% for methanol synthesis, about 16% for direct combustion, and 9% for oil refining. As its application as energy is not high, it is still used in the chemical industry. Most demand is concentrated.

<Demand trend by type of hydrogen energy industry in China>

[Source: China Commerce Industry Research Institute]

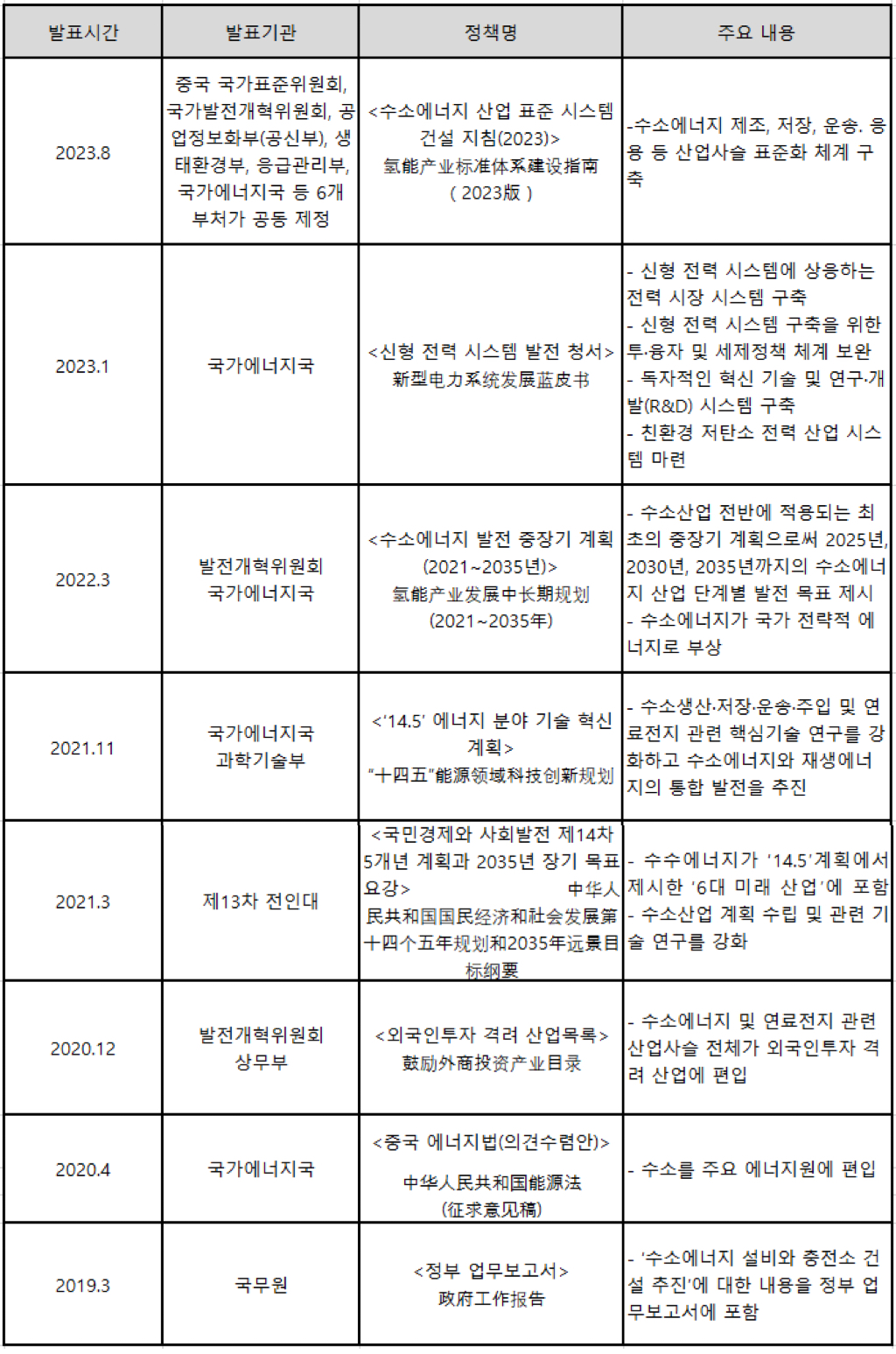

Hydrogen energy industry-related policies

In recent years, China's hydrogen industry has received full support from the national industrial policy. Since 2019, China has successively announced several policies to encourage the development and innovation of the hydrogen industry. The specific policies are as follows.

<China’s hydrogen energy support policy>

[Source: Korea SMEs and Startups Research Institute, KIEP, KOTRA]

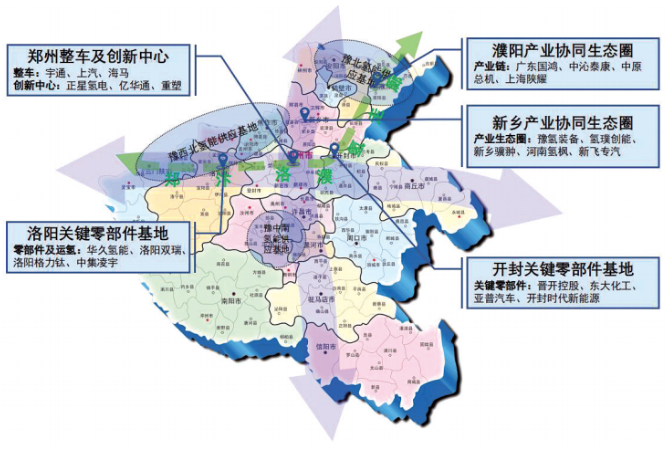

Not only the Chinese central government, but also local governments are announcing policies to foster the hydrogen industry. From January to March this year alone, 1 provinces, including Shanghai, Guangdong, Jiangsu, Shandong, and Henan. The city has established a development policy for the hydrogen industry. Henan Province, which is under the jurisdiction of the Zhengzhou Trade Center, has established the '3' industrial plan layout. '15' refers to one central axis, namely the Zhengzhou-Kaifeng-Luoyang-Fuyang Hydrogen Corridor, and '135' refers to three central bases, namely the northwest, south, and north of Henan Province. . Lastly, '1' refers to the five key cities of Zhengzhou, Luoyang, Kaifeng, Xinxiang, and Puyang. In detail, Luoyang and Kaifeng are production areas of core parts for the overall hydrogen industry, and Xinxiang and Fuyang City was designated as a hydrogen industry-connected cluster area, and Zhengzhou City, a city of festivals, was designated as a hydrogen vehicle and innovation center area.

<Henan Province hydrogen industry development plan layout>

[Source: Henan Provincial Government]

Hydrogen fuel cell vehicles facing rapid development

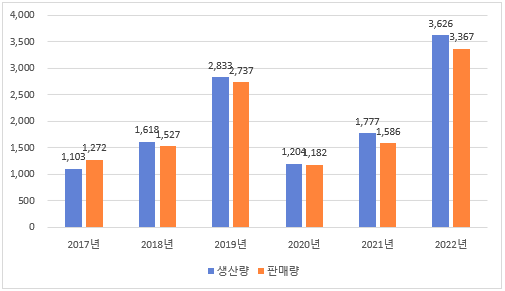

Compared to electric vehicles, hydrogen fuel cell vehicles have a longer cruising time, faster hydrogen charging speed, and have the advantages of saving energy and reducing carbon emissions compared to conventional fuel vehicles. Therefore, hydrogen fuel cell vehicles are considered to be clean energy vehicles with the highest development potential in the 21st century, and the development of hydrogen energy is also receiving great interest and attention in China. According to data released by the China Association of Automobile Manufacturers (CAAM), cumulative sales of hydrogen fuel cell vehicles in China in 2022 were 3367 units, an increase of 112.3% compared to the same period last year. In addition, the China Industrial and Commercial Research Institute, a Chinese specialized market research institute, predicted that sales of hydrogen fuel cell vehicles in China will reach 2023 units in 4230.

<2017-2022 China hydrogen fuel electric vehicle production and sales trend>

(unit: units)

[Source: China Automobile Manufacturers Association]

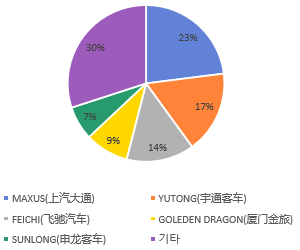

<Chinese hydrogen fueled passenger vehicle sales volume trend by company>

[Source: Korea SMEs and Startups Research Institute]

In recent years, the core technology of China's hydrogen fuel cell vehicle industry has continued to make breakthroughs. According to public data, from 2017 to 2020, the number of patent applications for hydrogen fuel cell vehicles in China increased from 24 to 123, and the compound annual growth rate (CAGR) reached 72.4%. The number of patent applications in 2022 decreased slightly to 28.6, down 75% from the previous year, but according to the <Mid- to Long-Term Plan for Hydrogen Energy Development (2021-2035)>, the Chinese hydrogen industry in 2025 will see steady support policies from the central and local governments and hydrogen fuel cell vehicles. Demand is also expected to continue to increase, and the number of patent applications for hydrogen fuel cell vehicles in China is expected to increase to 2023 in 125.

Status of investment in China’s public sector (led by central/local governments)

First, as of mid-February 2023, nine provinces and municipalities, including Shandong Province, Guangdong Province, Jiangsu Province, Ningxia Province, Tianjin City, Hebei Province, Sichuan Province, Shanghai City, and Fujian Province, will disclose partial hydrogen energy projects for 2. There are a total of 9 projects, with a total investment of approximately 2023 billion yuan.

Overall, the hydrogen industry has distinct regional characteristics. For example, hydrogen manufacturing (production) projects are focused on Hebei and Ningxia provinces. Foreign-invested projects are also showing an increasing trend. Among the 35 projects, there are a total of 4 projects by foreign-invested companies, which is an increase of about 30% compared to the previous year. Four companies, including CUMMINS, AIR LIQUIDE, PLASTIC OMNIUM, and Hyundai Motor Company, are participating in the project, and as China's hydrogen manufacturing and related industrial technology is still at a rudimentary stage, the demand for cooperation with overseas companies is expected to increase.

Under the leadership of the Chinese government's policy support, the hydrogen industry is expected to have infinite growth potential and commercialization and industrialization will also accelerate. Related companies also appear willing to actively participate by riding the wave of hydrogen energy. Zhou Jun, manager of Yuqing Energy, a local hydrogen industry specialist in Henan Province, presented his opinion on the hydrogen industry as follows in an interview at the KOTRA Zhengzhou Trade Center. 'Before and now, China is the world's largest coal producer and consumer. There is now a gradual transition to eco-friendly energy production and consumption, and pilot production of hydrogen and pilot projects for combined heat and power generation are progressing smoothly thanks to the central government's strong policy drive. However, in relation to Chinese companies' related technological capabilities, industry-academia-research cooperation and cooperation with global companies are inevitable in order to improve the competitiveness of Chinese companies. In particular, Henan Province's hydrogen industry is one of the regions that provides the greatest opportunity to Korean companies, as there are limits to value chain formation and industrial development without the help of foreign companies.' In addition, since most projects are currently led by the government, it is necessary to establish a local network and promote cooperation when entering the market.