Maintenance of aging infrastructure is an important topic

Increasing demand for technology to complement insufficient manpower and increase efficiency

Japan's aging infrastructure

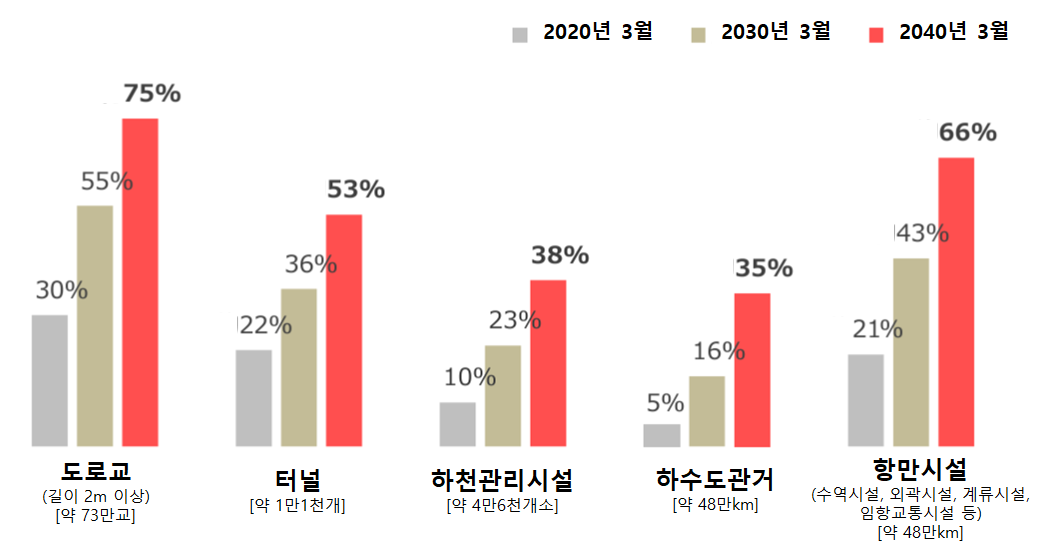

Much of Japan's social infrastructure was built during the period of high growth between the 1950s and 70s, and a significant proportion of the infrastructure is currently constructed more than 50 years ago. The graph below shows the percentage of infrastructure such as road bridges, tunnels, and river management facilities that are over 10 years old in 50-year increments, showing that overall social infrastructure is deteriorating rapidly. According to Japan's Ministry of Land, Infrastructure, Transport and Tourism's forecast of the aging trend of social infrastructure from 2020 to 2040, the proportion of facilities more than 2040 years old after construction as of 50 will decrease from 30% to about 75% for road bridges and from about 22% for tunnels. It is expected to rise to 53%. Due to this aging, the burden of maintenance and repair costs is increasing and there are concerns about the occurrence of serious accidents.

<Proportion of Japanese social infrastructure more than 50 years after construction>

[Source: Ministry of Land, Infrastructure, Transport and Tourism]

The impact of earthquakes is also an important consideration. The impact of large earthquakes such as the Great East Japan Earthquake, Kumamoto Earthquake, and Noto Peninsula Earthquake on infrastructure structures is becoming increasingly difficult to predict. In addition, the civil engineering budget of Japanese local governments (municipalities) decreased by about half (approximately 1993 trillion yen) from its peak in 11 (approximately 5000 trillion yen) to 2011. The reduction rate in the number of employees in the civil engineering sector of local governments (municipalities) was approximately 6%, which was greater than the reduction rate of approximately 14% for all local governments (municipalities).

The problem of Japan's aging infrastructure is difficult to solve due to natural disasters, a decrease in the civil engineering budget of local governments, a shortage of civil engineering employees, and a surge in raw material prices. Recently, digital technology has been attracting attention in Japan to respond to this.

Japanese government's response policy

Japan's Ministry of Land, Infrastructure, Transport and Tourism established the '2013st Basic Plan for Longevity Life of Infrastructure' in November 1 and proposed ways to establish a maintenance and repair cycle to ensure the safety of lifelines and strengthen the competitiveness of the maintenance and repair industry. The second plan announced in 2021 emphasized the importance of preventive maintenance instead of reactive maintenance, and specified that it would aim to improve productivity through unmanned and automated work using technology. As a result of estimating the cost of future maintenance, management, and renewal for infrastructure under the jurisdiction of the Ministry of Land, Infrastructure, Transport and Tourism, it is believed that implementing 'preventive maintenance' can reduce costs by about 2% compared to 'reactive maintenance', 50 It is expected that there will be a total cost reduction of about 30% cumulatively over the years (2019-2048).

<Reduction of infrastructure maintenance costs by switching from reactive maintenance to preventive maintenance>

[Source: Ministry of Land, Infrastructure, Transport and Tourism]

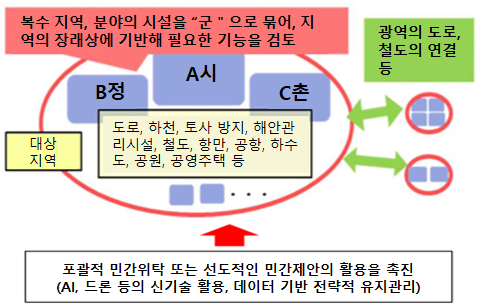

In addition, 'regional infrastructure group regeneration strategy management' is being promoted by grouping multiple regions and fields into 'counties'. In this process, we are utilizing proposals from leading private companies and promoting the maintenance, management, and renewal of infrastructure through comprehensive private consignment or private investment (PFI) methods. In particular, the need for private investment (PFI) projects is increasing due to the reduction in the civil engineering budget of Japanese local governments (municipalities) and the lack of employees in the civil engineering sector, as mentioned earlier.

<Regional infrastructure regeneration strategy management chart>

[Source: Ministry of Land, Infrastructure, Transport and Tourism]

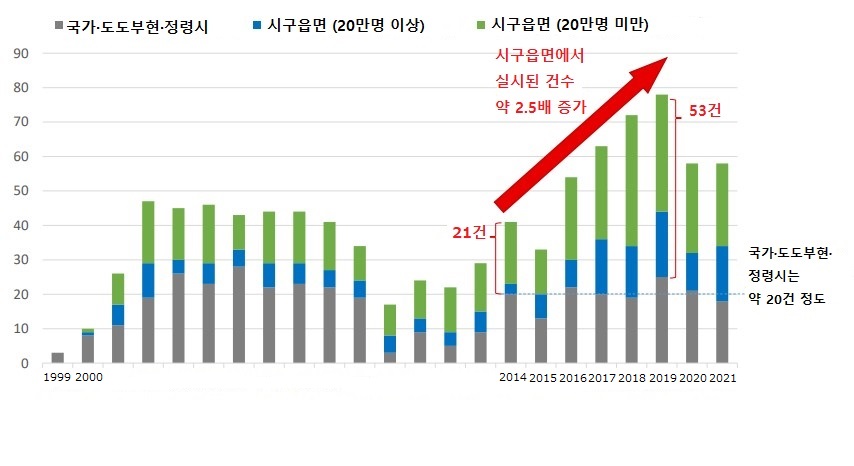

<Trend of number of PFI projects implemented in Japan>

[Source: Cabinet Office]

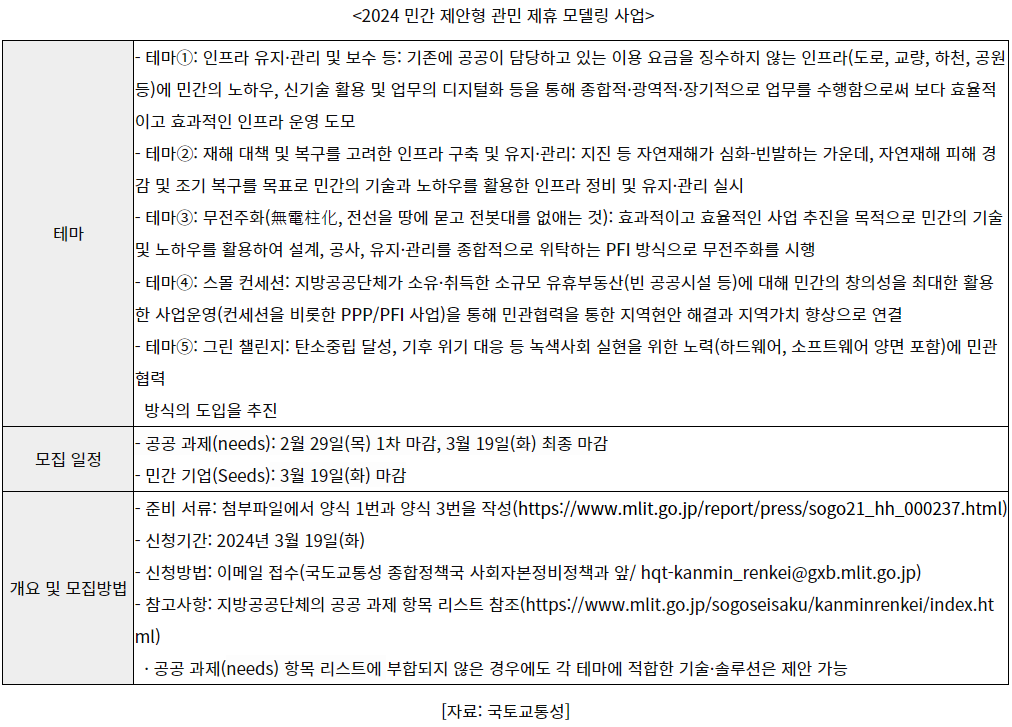

In addition, as part of the private investment (PFI) project, the 'Private Proposal Public-Private Partnership Modeling Project' is being held in 2024 for the second time since last year. This project is conducted in the first half of the year (recruitment from February to March) and matches private companies (Seeds) that provide technology and solutions to tasks (Needs) such as aging infrastructure of local public organizations. Projects and private companies are each recruited according to a specific theme, and any company that can propose technology and solutions that match the task can participate regardless of nationality, location, or industry. Therefore, the opportunity to apply is open to Korean companies as well.

<2024 Private Proposed Public-Private Partnership Modeling Project>

Lastly, the Japanese government recognizes that digital technology is essential for infrastructure maintenance and repair and is actively promoting the development and commercialization of new technologies. Through the operation of the 'New Technology Information System (NETIS)', we are connecting companies that have developed new technologies with companies that want to use the technology. If a new technology is registered in the NETIS system, in principle, it can be posted for 5 years, and the registered new technology information Anyone can search, regardless of whether it is a corporation or an individual. If a positive evaluation is received from a company that uses the service, the posting period can be extended up to 10 years, providing an opportunity for long-term posting. This provides an advantage that can serve as an advantageous condition when bidding for the government or public institutions. Through this process, the reliability of new technologies and services can be objectively proven, and through this, companies can discover new business opportunities.

<Japanese New Technology Information System (NETIS) homepage screen>

[Source: NETIS]

IT market size of Japanese social infrastructure

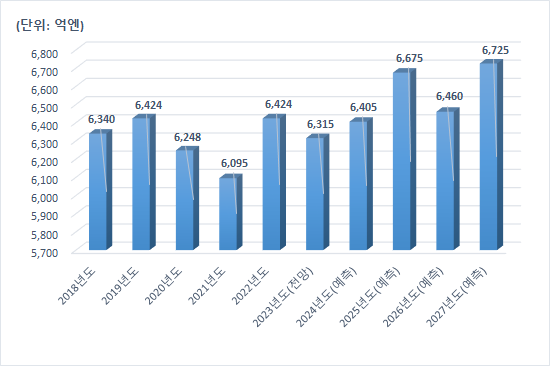

According to Yano Economic Research Institute, a market research agency, the size of Japan's social infrastructure IT market in 2022 is estimated at 5.4 billion yen, up 6424% from the previous year. The reason for this increase is the expansion of social infrastructure IT investment in railways, airports, and water-related fields (water supply, simple water supply, sewerage, water purification plants, drainage treatment, agricultural water, etc.).

Thanks to the government's guidelines and support policies, private companies are accelerating the development of various technologies to respond to aging infrastructure. According to a survey by Yano Economic Research Institute, the size of Japan's domestic social infrastructure IT market in 2022 was estimated at 5.4 billion yen, a 6424% increase from the previous year. It is expected to decrease slightly to 2023 billion yen in 1.7, down 6315% from the previous year, but is expected to grow to about 2024 billion yen in 100, and the infrastructure IT market is expected to enter a period of full-scale diffusion.

<Trend and forecast of social infrastructure IT market size>

[Source: Yano Economic Research Institute]

Japan's infrastructure IT market is gradually expanding after the Ministry of Land, Infrastructure, Transport and Tourism announced its policy to use digital technology for infrastructure preventive maintenance work. Currently, digital technologies such as IoT, cloud, AI (image analysis, voice recognition, data interpretation, etc.), 3D, drones, and robots are being applied in practice. In addition, the emergence of network technologies such as 5G/local 5G, low-power wide area (LPWA), and cellular LPWA, as well as next-generation communication standards such as Wi-Fi HaLow and 6G, predict the creation of new solutions.

<Low-power wide area (LPWA) wireless communication structure>

[Source: Murata Works website]

Infrastructure maintenance and management digital technology use cases

Existing infrastructure management not only requires a lot of time and effort as most of the work is performed directly by people, but there are also concerns about the risk of industrial accidents such as working at high places and working at night. In response to these challenges, services such as facility inspection, remote monitoring, and condition diagnosis of infrastructure using digital technology have been actively developed, especially in large companies.

1) Fujifilm: AI image diagnosis service ‘Hibimitke’ that finds cracks

Fujifilm developed Hibimike, an AI image diagnosis service that utilizes technologies related to photographic film. This service, which means “crack discovery” in Japanese, photographs the surface of concrete structures such as bridges and tunnels and uploads the images to Fujifilm’s cloud. Cracks are automatically detected through AI analysis about an hour later. In addition, four types of data can be extracted, including an integration table of the crack width and length, a composite image, a composite image of the crack line, and a DXF file. With the introduction of this service, structure inspection work time was reduced by 1% from 4 hours to 14.5 hours, greatly increasing work efficiency.

2) Canon

CANON, a video equipment manufacturer, developed a high-performance crack detection AI through joint research with a consultant from Tosetsu Civil Engineering Co., Ltd., which has more than 15 years of experience in video inspection. The characteristic of this technology is to verify the condition and then generate CAD data (DXF format) that classifies cracks by width size. In addition, it is possible to detect cracks as small as 0.05 mm in width, and has the advantage of being able to distinguish and detect contamination that can easily be mistaken for a crack.

3) Softbank: Remote inspection drone ‘Ichimiru’

Softbank has realized automation of visual inspection work with a drone capable of relative positioning (RTK, Real Time Kinematic) using the Global Navigation Satellite System (GNSS). Compared to GNSS (GPS), which provides location information, the positioning error is only a few centimeters, enabling high-level positioning, and is used in places where direct inspection with the naked eye is difficult, such as high places, densely populated areas, and highways. In fact, it has been used in tasks such as inspection of railroad tracks and stations, and inspection of large-scale steel mill facilities.

4) Hitachi

This service is attracting attention as road collapse accidents frequently occur due to natural disasters and structural deterioration. This service was jointly developed by Hitachi Works and Oyo Geological Co., Ltd., which specializes in infrastructure maintenance and repair. The image is analyzed using Lumada's artificial intelligence (AI) interpretation technology based on IoT technology to visualize the underground appearance. The location and dimensions of underground facilities such as water pipes are specified and provided to users as 3D data. This service greatly contributes to cost reduction and manpower efficiency by being able to specify areas requiring construction without digging up the ground.

5) Kubota: ‘AI deterioration evaluation’ to check the deterioration of pipelines

Kubota, a pipe manufacturer, developed a method for evaluating the age of pipes using AI technology through joint research with the University of Tokyo using data on water pipe corrosion surveys and buried environments that it has accumulated over a long period of time. Based on pipeline data, it is possible to calculate the degree of deterioration and renewal priority for each pipeline, and many services are provided, such as predicting the number of annual water leakage accidents and creating maps showing current and future water leakage risks. As water pipes needing renewal beyond their legal useful life of 40 years are becoming more noticeable, attention to this service is increasing, especially among local governments across the country.

6) Solaris: ‘Sooha’, a driving robot for pipe inspection

SoLARIS Co., Ltd. developed Sooha, an earthworm-shaped indoor robot equipped with a camera for inspection inside pipes. Sooha's biggest feature is that it imitates the movement mechanism of an earthworm. There were limitations with existing industrial endoscope cameras when inspecting complicated curved pipes or small-diameter steel pipes. Sooha moves smoothly and flexibly like an earthworm, even in narrow and complicated places with curved pipes, and is capable of inspecting every corner of the depth of the body.

implication

In Japan, where labor is scarce, attempts are being made to apply digital technology to the repair and management of aging infrastructure, and this could be a very good opportunity for Korean companies with strengths in the IT field. These opportunities are especially abundant in rural areas where manpower shortages are prominent.

Korea's Soteria2023, supported by KOTRA, was selected for the demonstration project 'Diagnosis of deterioration conditions of drainage facilities using radar technology, etc.', which was contested by Hamamatsu City in September 9, and will run from October 8 to September 2023. The project is scheduled to proceed until February. This year as well, KOTRA Tokyo IT Support Center is supporting Korean companies' advancement into empirical experiment projects to solve social issues of Japanese local governments.

Additionally, in order to enter the Japanese infrastructure digitalization market, establishing partnerships with local companies can be an effective strategy. Taira Manabu, director of Foval GDX Research Institute, said, “(When Korean companies enter the Japanese market), partnerships with Japanese companies not only enable the creation of new businesses, but also ensure the stability of management by dispersing business risks. . “In addition, in order to build partnerships with Japanese companies, it is important to have transparent and trust-based communication,” he emphasized.

Inquiries regarding the 2024 private-sector proposal public-private partnership modeling project

ㅇ Person in charge: KOTRA Tokyo Trade Center Information Investigation Team Yoshiko Yoshida

ㅇ Email: y.yoshida@kotra.or.jp

ㅇ Note: The viewing period for private companies (Seeds) ends on March 2024, 3, and please understand that response may be limited after that.

Additionally, if you are a Korean company interested in a demonstration project that applies digital technology to solving social problems of Japanese local governments, please contact us using the contact information below.

ㅇ Person in charge: KOTRA Tokyo IT Support Center

ㅇ Phone number: +81-3-5501-2847 (https://www.kotrait.or.jp/kr)

Source: Compilation of data from Ministry of Land, Infrastructure, Transport and Tourism, Cabinet Office, Nikkei Shimbun, Nikkei Lost Trend, Nikkei Business, and KOTRA Tokyo Trade Center