2nd largest smart city market in Latin America after Mexico and Brazil

Mexico's smart city market is expected to grow by an average of 5% over the next five years.

2024 Central and South America Smart City Roadshow Overview

-Event name: 2024 Central and South America Smart City Roadshow

-Duration and location: March 2024-3, 4 / Bogota, Mexico

-Contents: Business consultations, market briefings, on-site visits, meetings, etc.

-Field: Smart city, overall ICT field

-Participation scale: 7 domestic companies, 39 buyers (14 in Mexico City)

From March 2024 to 3, 4, at the KOTRA Mexico City Trade Center, seven domestic companies in the information and communication technology field hoping to enter Latin America and local clients held networking sessions, one-on-one business consultations, and market briefing sessions. On the 8th, a seminar was held by inviting Alfredo Molina Ledesma, a smart city & infrastructure partner at Deloitte, to introduce Mexico's smart city market to Korean companies.

<Deloitte speaker invitation seminar site during the 2024 Central and South America Smart City Roadshow>

[Source: KOTRA Mexico City Trade Center’s own photo]

Mexico smart city market entry strategy

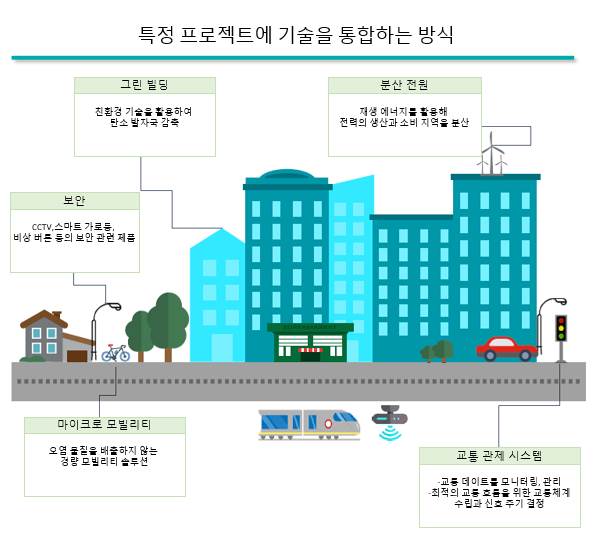

According to Deloitte, there are two strategies for entering the smart city market: 1) providing technology and equipment to specific projects, and 2) participating in comprehensive smart city projects. Providing technology and equipment to specific projects is mainly linked to public services. For example, this applies to distributing products such as CCTV, smart street lights, smart lighting, smart traffic lights, and digital shine, or introducing traffic flow control systems, digital government systems, and smart civil service services.

Currently, several administrative agencies in Mexico are focusing on digitalization and purchasing equipment and software, and attempts are also being made at the municipal level to integrate cutting-edge equipment into their infrastructure. The characteristic of this entry strategy model is that competition is fierce because multiple projects can be carried out simultaneously. In particular, in the case of CCTV and Wi-Fi, installation is quick, so project development progresses quickly.

First, it is important for companies seeking business opportunities to immediately seize these government projects through collaboration with local partners. For example, Mexico City recently launched a 119-hour security surveillance system called 'C112', which integrates the concepts of Korea's 5 and 24. C5 (Centro de Control, Comando, Comunicacion, Computo, y Calidad), which stands for the first Spanish letters of command, control, statistics, communication, and citizen support, monitors CCTV in each local government center to check the safety of the floating population in the metropolitan area. It is a control tower that integrates functions, and when a project like this occurs, the demand for related equipment and systems naturally increases, so it is important to keep an eye on government trends.

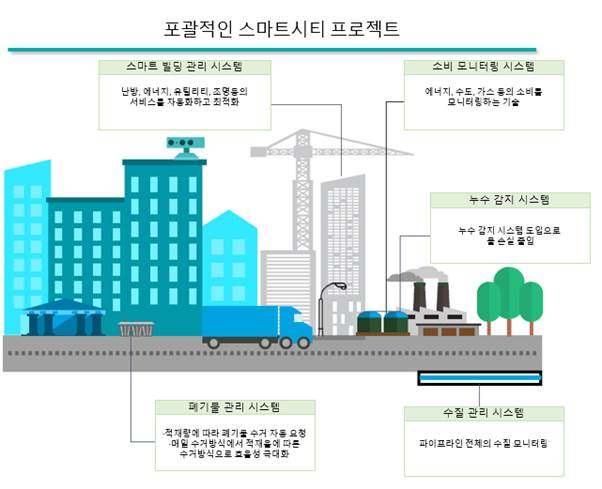

Second, participating in a 'comprehensive smart city project' refers to integrating and providing complex solutions to develop industrial complexes, residential complexes, and urban core areas. For example, this includes providing solutions for the entire process from manufacturing to monitoring in the Polygon industrial complex, or providing solutions that control everything from lighting to mobility, security, and communication in residential complexes. Representative comprehensive smart city projects include the smart tourism city 'Smart Tequila (Tequila Destino Turistico Inteligente)', which was a public-private joint project, 'Digital Creative City Jalisco (Ciudad Creativa Digital)' to foster an educational innovation research center, and an automobile manufacturing center. There is a ‘model city of Puebla (Ciudad Modelo)’ for the development of surrounding future cities.

However, in many cases of this type, it is conducted through private bidding, and the development time is long due to the complexity of the project, and the number of projects is small, so the barrier to entry is high. In order to increase the possibility of receiving orders, an accurate understanding of the business is required through sufficient communication with relevant project stakeholders, and attempts to provide solutions that can meet all possible requirements through consortia, etc. are necessary.

No matter which model you use, the entry process goes through the following processes: 1) market research, 2) strategy establishment, 3) project, and 4) implementation. According to Deloitte's Alfredo Molina, the following must be kept in mind at each stage to successfully enter the market.

<Deloitte’s 4 tips for successfully entering the Mexican smart city market>

- market research :

– Determine whether your company is a technology company or a comprehensive solutions provider

– Review whether the company’s capabilities are suitable for participation in potential projects

– Check permits, government registrations, major events such as elections in Mexico, etc.

- Establish a strategy:

– Identify the market and develop a market entry strategy

– Build partnerships with local partners

- project :

– Identify the projects to participate in and decide the appropriate time to participate.

– Establish a proposal submission strategy for projects you wish to participate in

– Consider the characteristics of each project (select a project with a narrow market but high profitability, or vice versa)

- Enforcement:

– Establish strategies on how to invest in cities, projects, total amounts, etc.

– Plan how to participate in relevant bids and meet bid requirements

– It is important to work with local partners for information about the bidding process

– Familiarization with the Mexican market, key players and processes and related timelines

[Source: Deloitte, '24.3.]

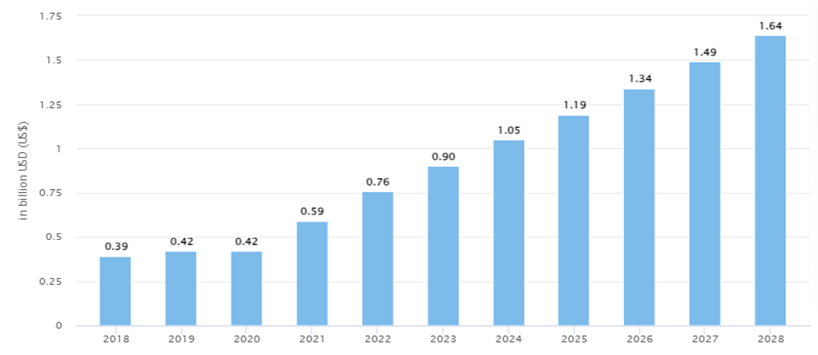

Mexico is the second largest smart city market in Latin America after Brazil, and the need for smart cities is emerging as a solution to rapid urbanization. According to Statista, Mexico's smart city market is expected to grow by an average of 2% over the next five years to $2023 million in 9, reaching $5 billion in 15.

<Mexico Smart City Market Outlook>

(Unit: US$ billion)

[Source: Statista, '23.09.]

As of 2023, the proportion of Mexico's urban population is 81.6%, and problems are arising due to rapid urbanization. Demand for urban public services exceeds supply in areas such as transportation, health, security, water treatment, energy, and waste management. One of the emerging measures to solve public service problems is a smart city incorporating technology. Smart cities can improve the quality of life for residents by collecting data through various technologies and sensors and optimizing city operations based on that data.

In Mexico, smart city projects are being implemented mainly in industrial cities in the north and central regions, and each state government is mainly in charge of the project. Ongoing projects include Querétaro (Maderas Project), the City of Tequila (Smart Tourism Zone), the City of Jalisco (Digital Creative City), Puebla (Smart City), and Mexico City (overall smart infrastructure), and the Federation of Chambers of Industry and Commerce. According to (CONCAMIN, La Conferencia de Camaras Industriales de los Estados Unidos Mexicanos), 13 cities, including Monterrey (sustainable ecosystem) and Leon (traffic detection sensors), are considered promising regions.

Promising areas related to smart cities

Smart cities are created by combining complex fields such as environmentally friendly solutions, safer security solutions, quality education solutions, and efficient energy distribution. Among them, smart security and cybersecurity are considered promising fields in Mexico. Mexico's security is still unstable to the extent that the top five cities in the world for murders per 10 people are all located in Mexico, and as a result, the size of the private security industry amounts to 5% of GDP. Additionally, Mexico ranks 2nd among 182 countries in cyber attack vulnerability, and its cybersecurity market is expected to grow by an average of 52% over the next five years, reaching $5 billion in 12.

If we divide promising items in conjunction with the entry strategy, green buildings, distributed power, security, micro-mobility, and traffic control systems are promising in terms of providing technological equipment, and smart building management systems, consumption monitoring systems, and water leak detection systems are promising in terms of providing integrated solutions. , waste management system, and water quality management system are promising.

<Promising fields by entry strategy>

[Source: Deloitte, '23.03.]

Outlook and Implications

There are political and economic prerequisites for the spread of smart cities in Mexico. First of all, Mexico has problems such as water shortages and unpaved roads due to a lack of basic infrastructure, and there is a possibility that smart cities will be pushed down the priority list of government-led projects. Also, in terms of budget, smart cities are difficult to develop under the leadership of private companies, so there are difficulties in raising funds to prepare a budget at the government level. Nevertheless, Mexico's smart city market is a market that should not be missed considering its future growth potential. The Mexican federal government is working to expand communications and the Internet, which are key elements in building a smart city. According to the Federal Communications Agency IFT, through projects such as 'Internet for All', the number of Wi-Fi spots nationwide will reach 8, 2000G will be distributed to about 2025% of the country by 14, and the proportion of the population using wide area communication networks will reach 5% by 2026. It is expected to expand to . Accordingly, the smart city-related market is expected to gradually grow.